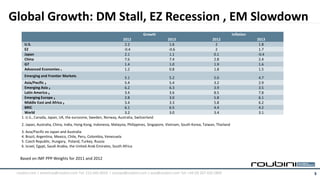

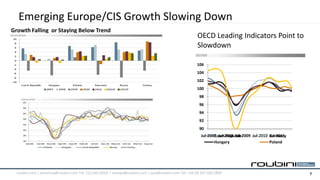

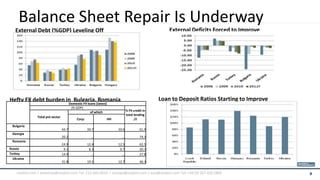

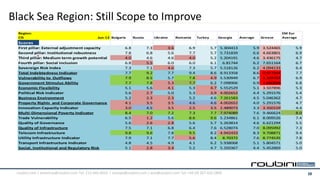

The document discusses the slowing economic growth in the Black Sea region due to global headwinds, particularly weak growth in Europe. It notes that while policy responses have helped, growth has sharply slowed across the Black Sea countries in 2012 and long-term growth remains uncertain. The region faces risks from balance sheet vulnerabilities, currency pressures, and constrained policy space compared to other emerging markets.