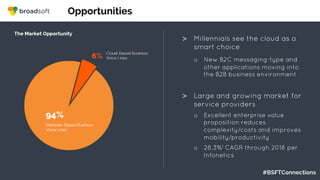

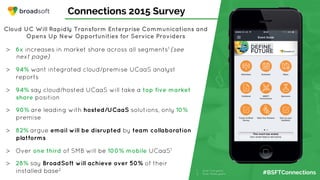

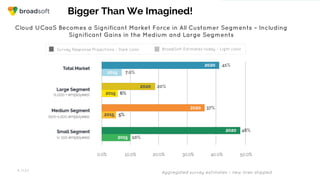

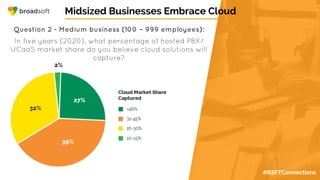

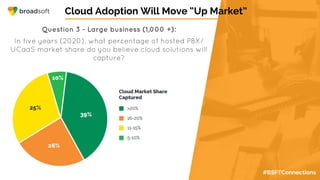

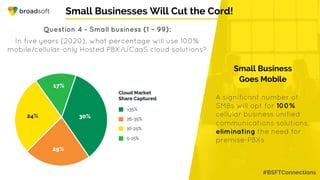

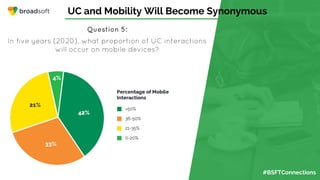

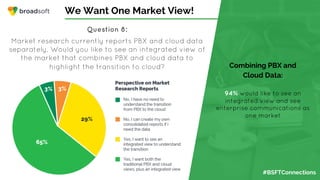

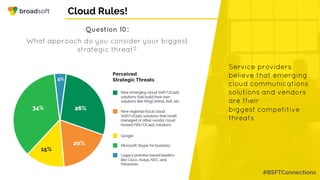

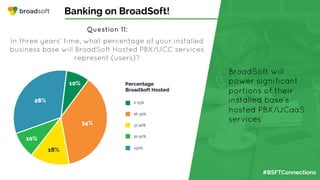

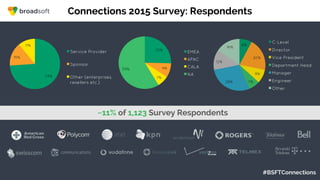

The document summarizes key findings from BroadSoft Connections' 2015 survey of over 1,000 industry professionals. The survey found that cloud-based UCaaS solutions will rapidly gain market share over the next 5 years across small, medium, and large businesses. Respondents believed BroadSoft will achieve over 50% market share for some service providers within 3 years. The survey also indicated email will be displaced by new messaging platforms, and that 90% of service providers are leading with cloud-based UCaaS solutions.