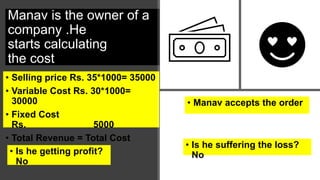

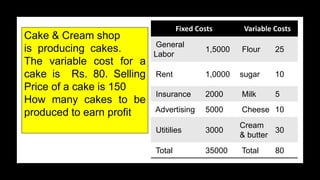

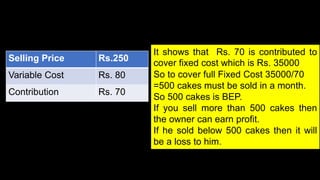

This document discusses break even analysis for a toy manufacturing company. It provides an example where the company has fixed costs of Rs. 5000 and variable costs of Rs. 30 per toy. The company received an order for 1000 toys at a selling price of Rs. 35 per toy.

The document calculates that at this selling price, the total revenue of Rs. 35,000 equals the total costs of Rs. 30,000 in variable costs plus Rs. 5000 in fixed costs. Therefore, the company would break even but make no profit by accepting this order.

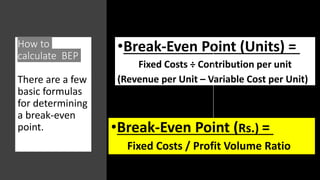

The document then provides general explanations of what a break even point is and formulas for calculating break even points based on either units sold or total revenue. It gives another