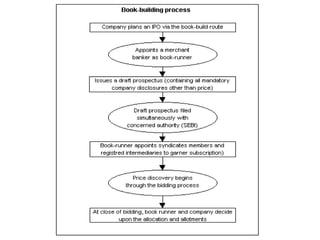

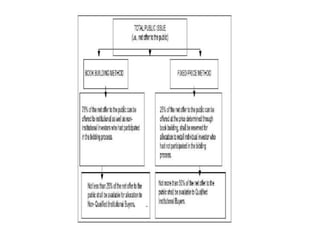

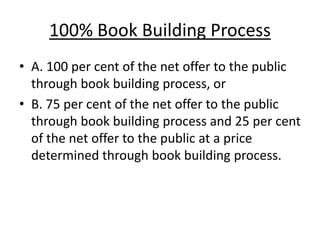

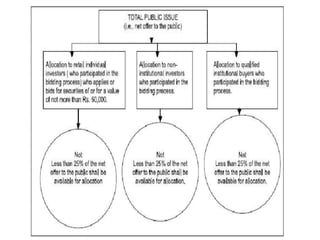

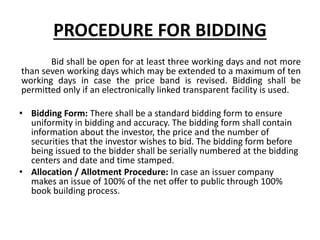

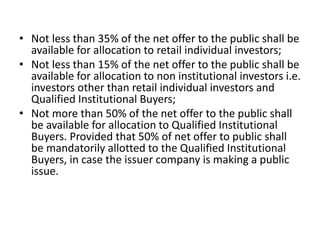

The document discusses book building, which is the process used to determine the price of shares being offered in an initial public offering (IPO). Book building involves generating demand for shares from investors and determining the appropriate price based on bids submitted. It allows companies to assess market demand at different price levels to set the final issue price. The key aspects covered include how the price band is set by the issuer, how bidding occurs over a period of days, and SEBI guidelines regarding allocation of shares to different investor types in a book building IPO.