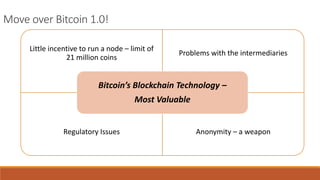

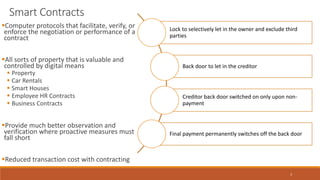

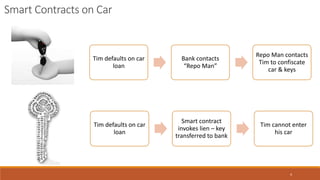

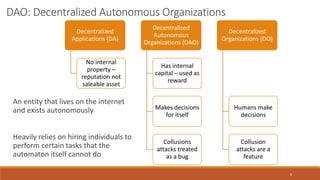

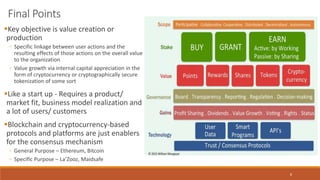

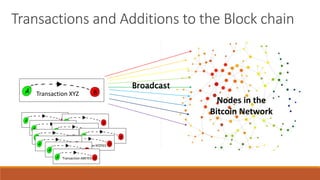

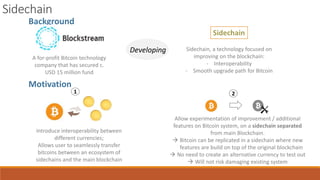

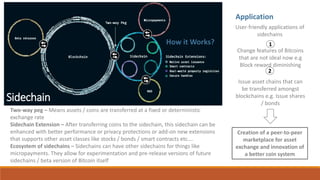

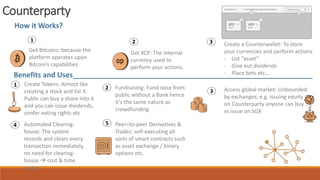

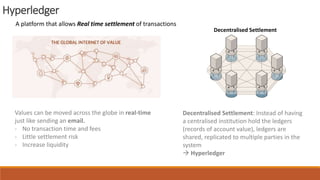

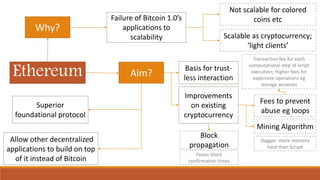

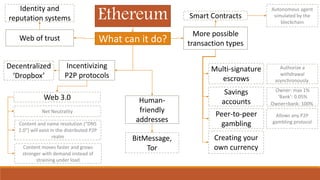

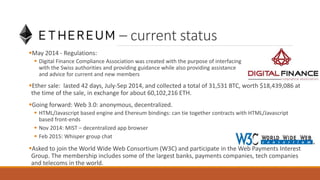

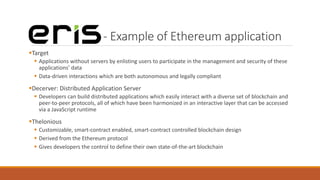

The document discusses various applications and improvements of blockchain technology beyond Bitcoin 1.0, including smart contracts, decentralized autonomous organizations, sidechains and counterparty. Ethereum is presented as a platform to build decentralized applications that allows for more transaction types beyond currency, including multi-signature transactions and creating your own currencies. It aims to be a scalable foundational protocol for other applications to utilize improved features like faster block confirmation times.