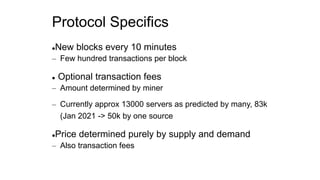

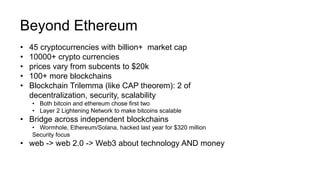

Blockchain and cryptocurrency applications can be summarized in 3 sentences:

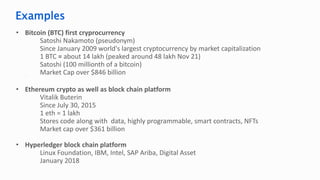

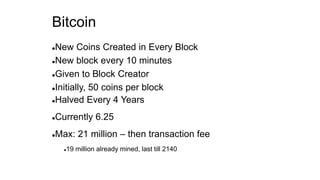

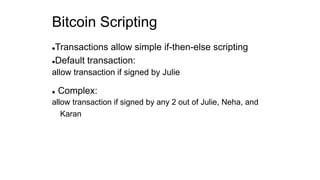

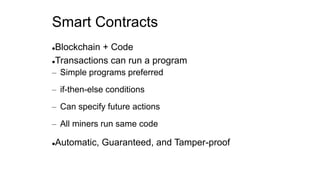

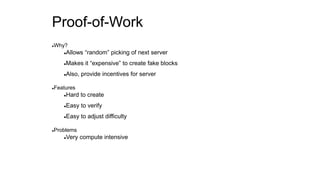

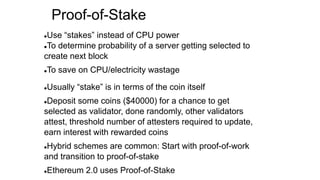

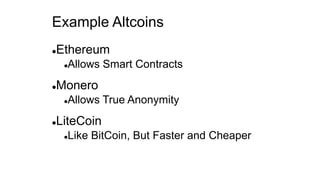

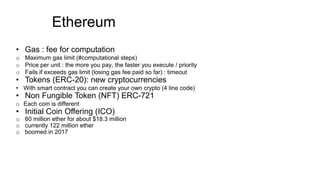

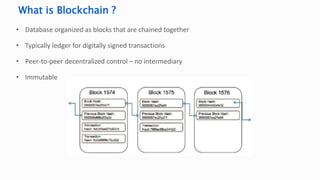

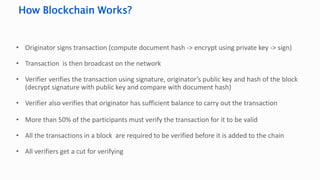

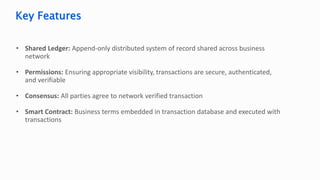

Blockchain is a distributed ledger technology that allows for the decentralized recording of transactions and smart contracts without a central authority. Bitcoin was the first cryptocurrency to use blockchain technology for tracking ownership and transfers of digital currency. Ethereum later introduced programmable smart contracts and decentralized applications to blockchain.