Big Bazaar is a large retail chain store in India operated by Pantaloon Retail (India) Limited. It provides a wide range of products across various categories at affordable prices under one roof. Big Bazaar aims to be the most customer-centric retailer by offering low prices, various promotional offers and discounts. It has over 170 stores across India and plans to expand further to reach more customers.

![VISION

The variety of product range in Big Bazar. This large format store comprise of almost everything required by people from

income groups. It varies from clothing and accessories for all genders like men, women and children, playthings, stationary

footwear, plastics, home utility products,cosmetics, crockery,home textiles, luggage gift items, other novelties, and

products and grocery.The added advantage for the customers shopping in Big Bazar is that there are all time disc

promotional offers going on in the Big Bazar on its salable product. The significant features of Big Bazar: Shopping in the B

a great experience as one can find almost everything under the same roof. It has different features which caters all the ne

shoppers. Some of the significant features of Big Bazar are:The Food Bazar or the grocery store with the department se

and vegetablesThere is a zone specially meant for the amusement of the kids. Furniture Bazar or a large section de

furnitures. Electronics Bazar or the section concerned with electronic goods and cellular phones. [FutureBazaar.com] or

shopping portal which makes shopping easier as one can shop many products of Big Bazar at the same price from h

regulated customer care telecalling services.

The following are few of the sections at Big Bazar: 1. Books 2. Cameras 3. Computers & Peripherals 4. Electronics 5. Gift V

Health and Fitness 7. Home & Kitchen 8. Jewelery 9. Memory & Storage 10. Mobiles & Phones 11. Movies & Videos 12. W

Womens wear 14. Mens wear 15. Childrens wear 16. Others

NEW DELHI: Kishore Biyani-promoted Future Group company Pantaloon Retail is hiving off four of its business divisions, inc

Bazaar and Food Bazaar, into independent subsidiaries, keeping the option open for listing them in future.The Board of

Retail today approved setting up of wholly-owned subsidiary companies for Big Bazaar, Food Bazaar, Speciality Reta

Activities and Property and Mall Management Division. When contacted, a company official told reporters from Mumba

hiving off the different business divisions were done keeping in mind the independent growth each division had achieve

gives us the option of listing them in future at an appropriate time the official added The company said the respective

would be transferred on a going concern basis to the respective subsidiaries, subject to receipt of all requisite statutory

necessary approvals. Big Bazaar is Future Groups flagship hypermarket format, while Food Bazaar is a chain of sup

focussing on eatable items. Pantaloons speciality retail business activities take care of its various joint ventures such as the

with Lee Cooper and also with French innerwear major, Etam. Under the Property and Mall Management Division, the Fut

already has two malls in Mumbai and had recently opened one in Siliguri .

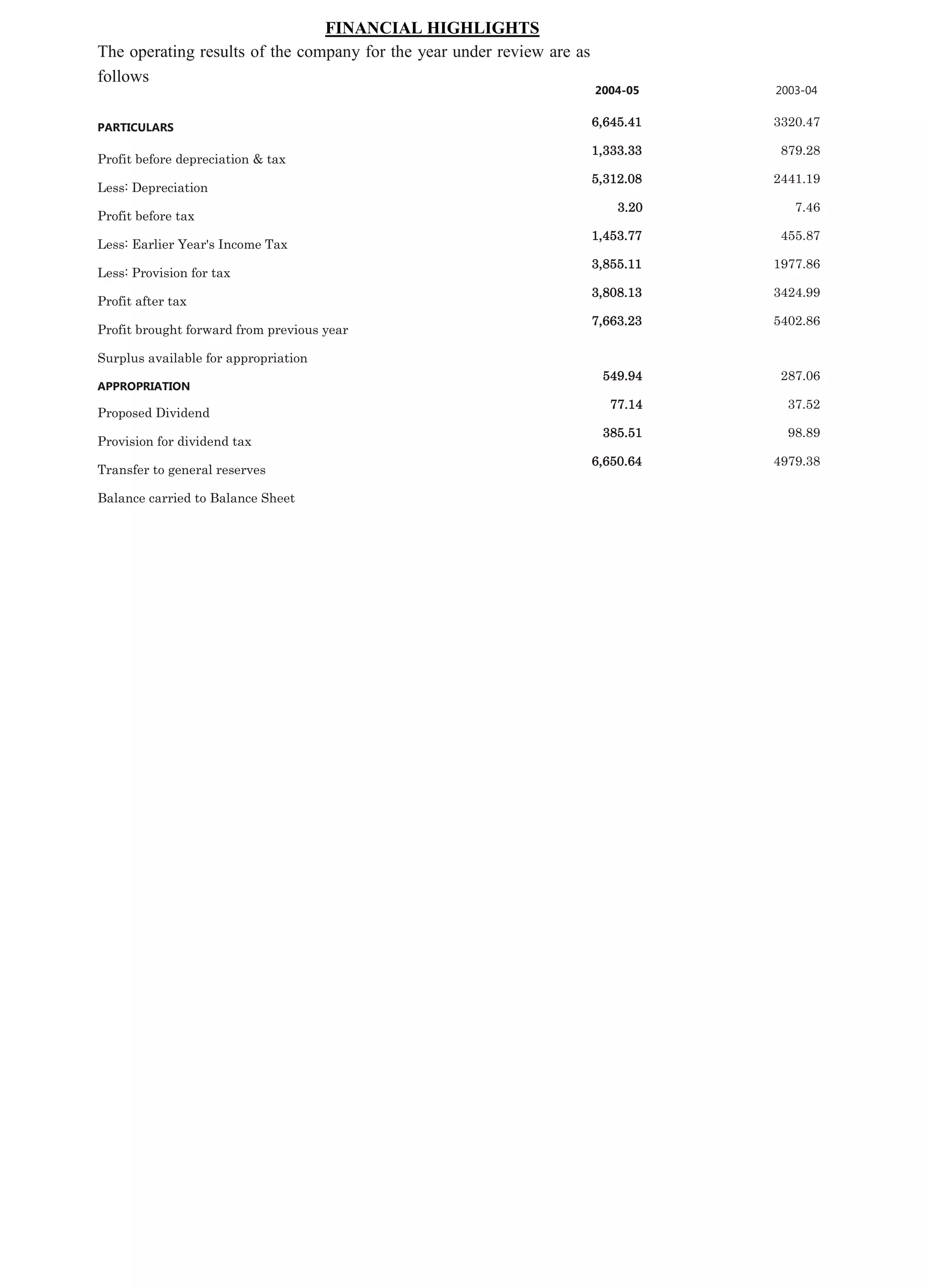

Executive Summary

Retailing is emerging as a sunrise industry in India and is presently the largest employer after agriculture. In the year 200

of Indian organized retail industry was Rs 28,000 Crores, which was only 3% of the total retailing market. Retailing in its pre

started in the latter half of 20th Century in USA and Europe and today constitutes 20% of US GDP. It is the 3rd largest

segment in USA. Organized retailing in India is projected to grow at the rate of 25%- 30% p.a. and is estimated to

astounding Rs 1,00,000 Crores by 2010. The contribution of organized retail is expected to rise from 3% to 9% by the e

decade. The projection for the current year ie 2005 is Rs 35,000 Crores. In India, it has been found out that the top 6 cities

for 66% of total organized retailing. With the metros already been exploited, the focus has now been shifted towards

cities. The 'retail boom', 85% of which has so far been concentrated in the metros is beginning to percolate down to these

smaller cities and towns. The contribution of these tier-II cities to total organized retailing sales is expected to grow to

the year 2004, Rs 28,000 Crores organized retail industry had Clothing, Textiles & fashion accessories as the highest c

(39%), where as health & beauty had a contribution of 2%. Food & Grocery contributed to 18% whereas Pharma Re

contribution of 2%. Pantaloon Retail (India) Limited, is India leading retailer that operates multiple retail formats, the

operates over 5 million square feet of retail space, has over 450 stores across 40 cities in India and employs over 18,000 pe

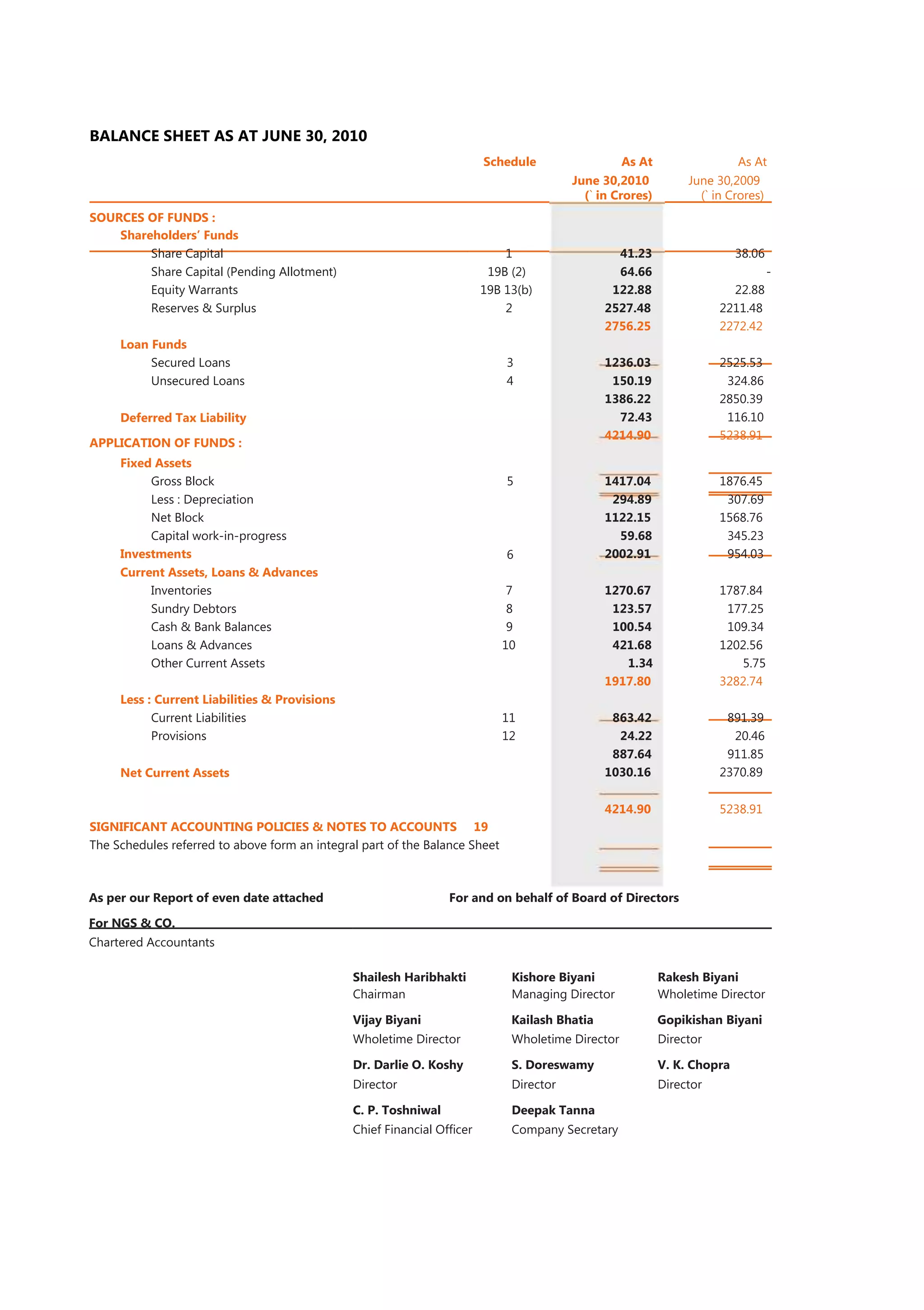

Company Profile:-

Pantaloon Retail (India) Limited, is Indias leading retailer that operates multiple retail formats in both the value and lifestyl

of the Indian consumer marker. Headquartered in Mumbai (Bombay), the company operates over 5 million square fee

space, has over 450 stores across 40 cities in India and employs over 18,000 people. The companys leading forma

Pantaloons, a chain of fashion outlets, Big Bazaar, a uniquely Indian hypermarket chain, Food Bazaar, a supermarket cha

the look, touch and feel of Indian bazaars with aspects of modern retail like choice, convenience and quality and Central,

seamless destination malls. Some of its other formats include, Depot, Shoe Factory, Brand Factory, Blue Sky, Fashion Statio

10, Bazaar and Star and Sitara. The company also operates an online portal, futurebazaar.com. A subsidiary company, Hom](https://image.slidesharecdn.com/bigbazaar-120113084639-phpapp02/75/Big-bazaar-3-2048.jpg)

![way, Big Bazaar make full use of the marketing mix for a new venture which earlier belongs to the unorganized retail

kirana stores. Application of the best marketing practices helps Big Bazaar in a great way.

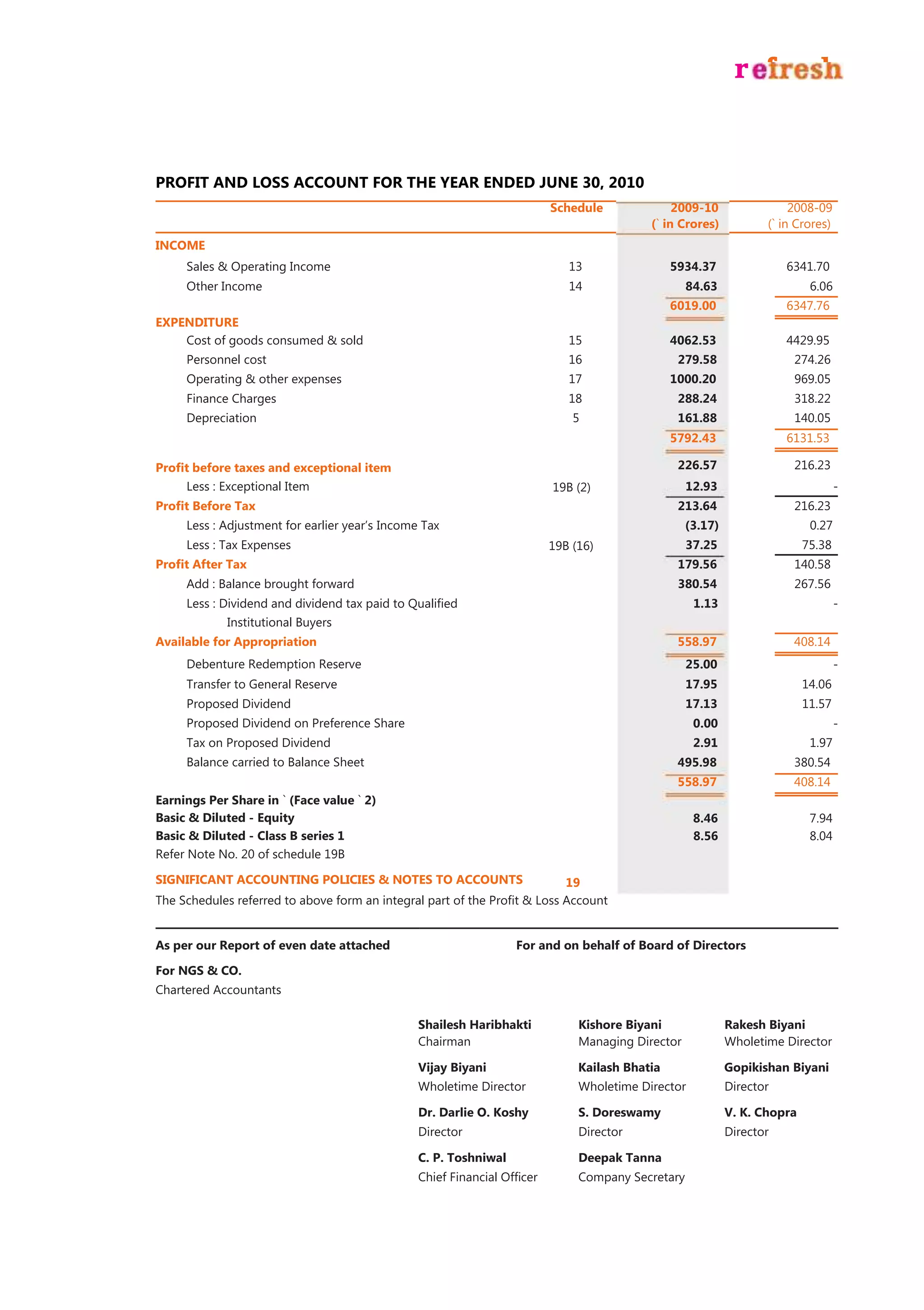

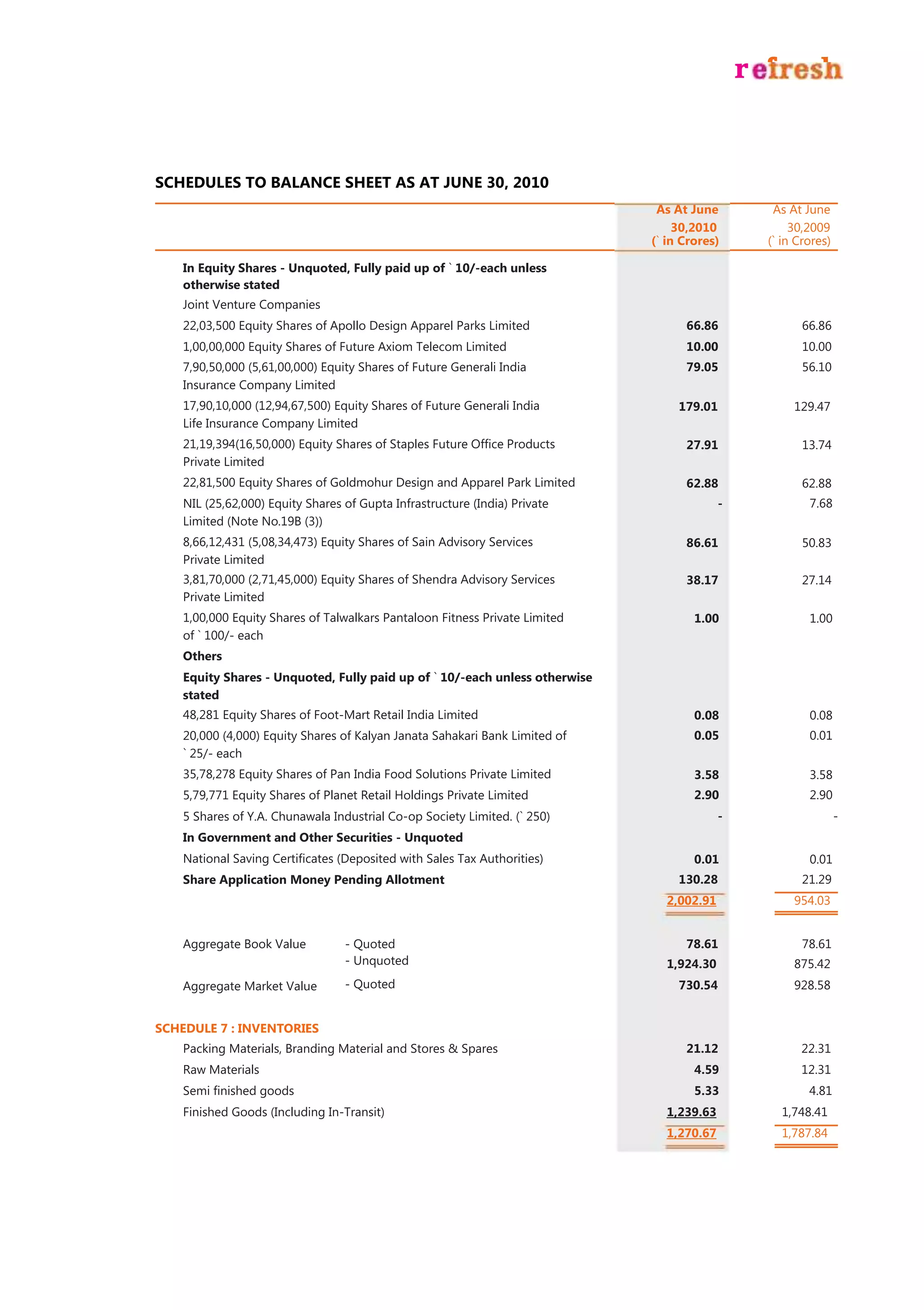

MANAGEMENT TEAM

Mr.KishoreBiyani,(ManagingDirector)

Mr.GopikishanBiyani,(WholetimeDirector)

Mr.RakeshBiyani,(WholetimeDirector)

Mr.VedPrakashArya,(Director)

Mr.ShaileshHaribhakti,(IndependentDirector)

Mr. S Doreswamy, (Independent Director)

Dr.DOKoshy,(IndependentDirector)

Ms.AnjuPoddar,(IndependentDirector)

Ms.BalaDeshpande,(IndependentDirector)

Mr. Anil Harish, (Independent Director)

Rakesh Biyani ,CEO - ( Retail )

Anshuman Singh, CEO - (Value Fashion )

Damodar Mall, CEO - (Incubation & Innovation)

Hans Udesh ,CEO - ( General Merchandising )

Hemchandra Javeri ,CEO – (Home Solutions Retail (India) Ltd. )

Kailash Bhatia ,CEO - ( Integrated Merchandising Group )

Madhumati Lele ,CEO - (Services )

Rajan Malhotra ,CEO - (Big Bazaar )

Sadashiv Nayak CEO - (Food Bazaar)

Sanjeev Aggarwal ,CEO –( Pantaloons)

Vishnu Prasad ,CEO - (Central & Brand FactorykurbenMoodliar )

President- Operations (Value Retailing)

Mayur Toshniwal

[Head - Operations (North Zone)]

Rajesh Joshi

[Head - Operations (West Zone)]

Rohit Malhotra

[Head - Operations (South Zone)]

Sandeep Marwaha

[Head - Operations (East Zone)]

Sanjay Jog

(Head - Human Resources)](https://image.slidesharecdn.com/bigbazaar-120113084639-phpapp02/75/Big-bazaar-9-2048.jpg)

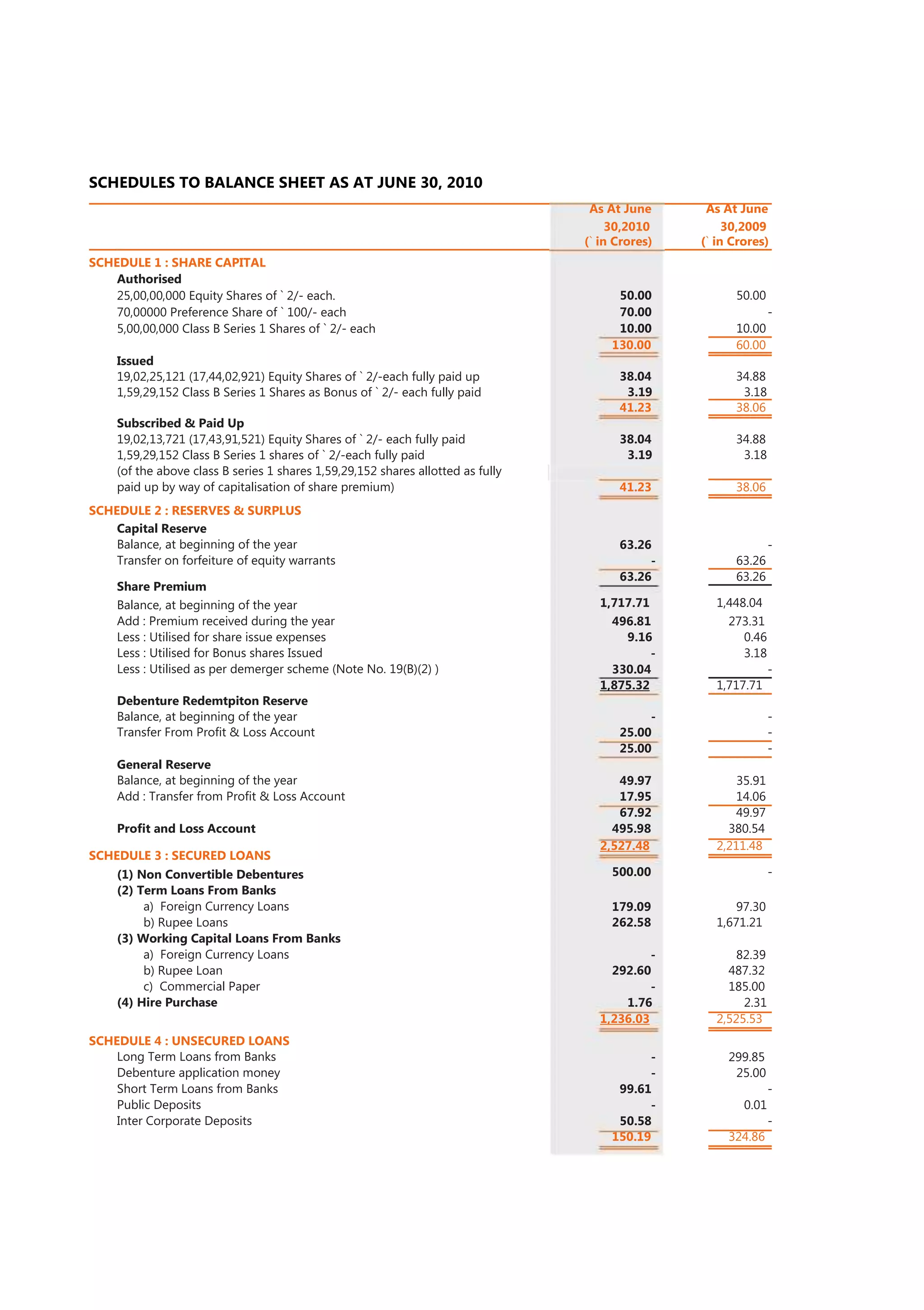

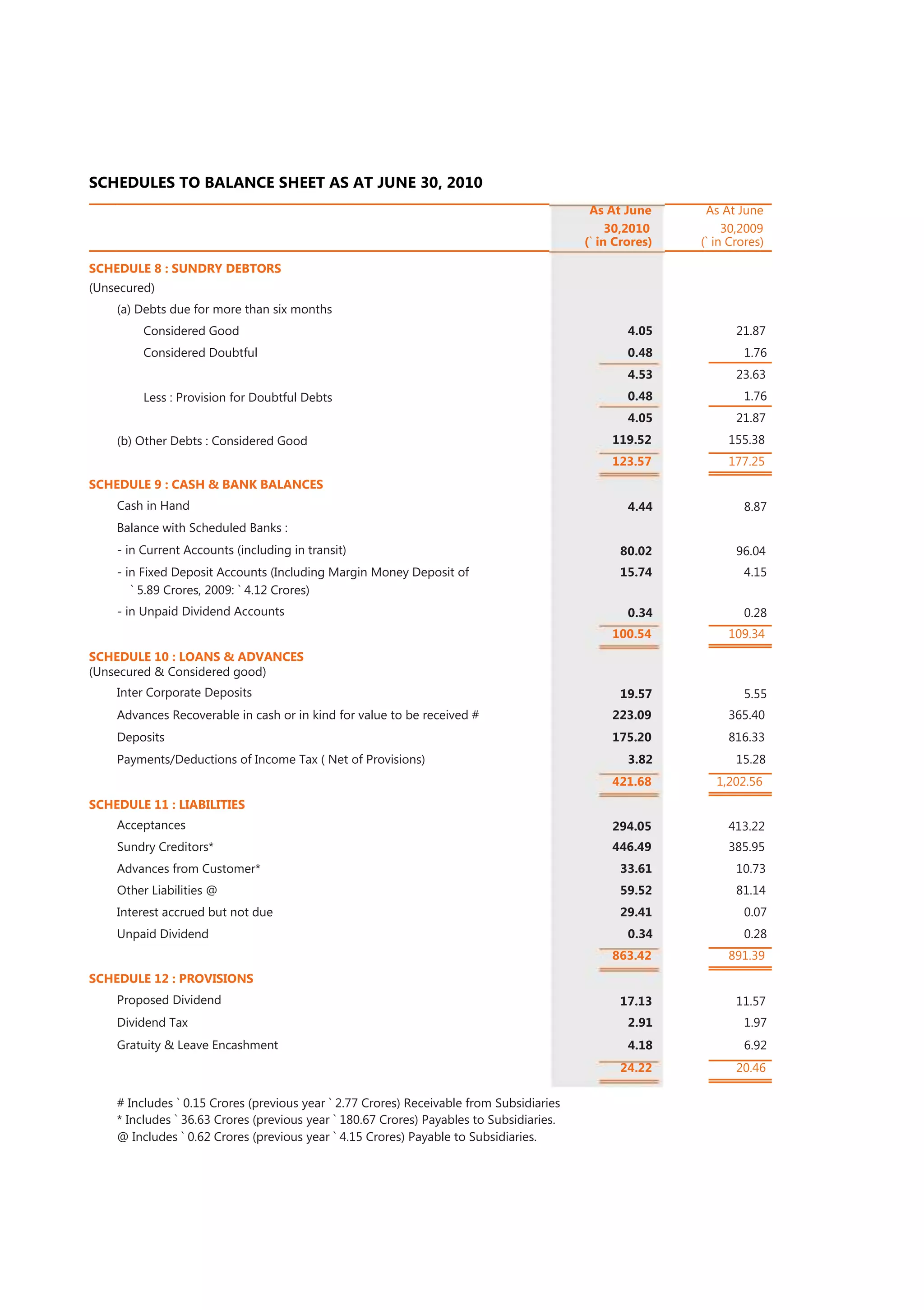

![Ushir Bhatt

(Executive Board Member)

Atul Takle

(Head - Corporate Communications)

Prashant Desai

[Head - Group IR & New Ventures (PE)]

Vinay Shroff

(Head - Supply Chain Management)

PRODUCTS

Big Bazaar is based on 3-C theory of Kishore Biyani. The 3-C symbolize Change, Confidence and Consumption, and accord

theory, "Change and confidence is leading to rise in Cons

They divided Indian customers in three categories: -

India One

Consuming class, constitutes only 14% of Indian population. They are upper middle class and most of customers have

disposable income. Initial focus of Big Bazaar.

India Two

Serving class which includes people like drivers, house-hold helps, office peons, washer-men, etc. For every India One, there a

India Two and have around 55% of Indian population.

India Three

Struggling class, remaining population of India,Cannot afford to inspire for better living, have hand-to-mouth existen

cannot be addressed by current business models.The potential customers of Big Bazaar are India One and India Two. The

insights were developed by close observation of the target set. The insights that came out were: - The clean and shiny envir

modern retail stores creates the perception that such store are tooexpensive and exclusive, and are not meant for India Two.

finds moves and find a lot of comfort in crowds, they are not individualistic. They prefer to bein queues. Indian-ness is no

ades hi, its about believing in Indian ways of doing things. Indian customers prefer to purchase grains, grams, etc., after touc

so its better not to sell inpolythene packs. Big Bazaar has counters where you can touch wheat, rice, sugar, etc., before p

Advertisements about schemes and offers through local newspapers, radio in local languages, inspirescustomer more

traditional ways. The guards, salesman at the Big Bazaar outlets should not look smarter than customer, so they prefern

tie, etc., in their uniform. Hypermarkets in India should be situated in city unlike western countries where they are loc

from city India Two finds moves and find a lot of comfort in crowds, they are not individualistic. They prefer to bein queu

ness is not abouts w ades hi, its about believing in Indian ways of doing things.Indian customers prefer to purchase grains,

after touching them, so its better not to sell inpolythene packs. Big Bazaar has counters where you can touch wheat, rice, s

before purchasing. Advertisements about schemes and offers through local newspapers, radio in local languages, inspire

more than the traditional ways. The guards, salesman at the Big Bazaar outlets should not look smarter than custome

prefernot to have tie, etc., in their uniform. Hypermarkets in India should be situated in city unlike western countries w

are located awayfrom city. Purchased bags / goods should be sealed at check-out as customer can enter and exit multiple

Indians, shopping is an entertainment; they come in groups, with families so Big Bazaar shouldoffer something for every

family. That also led separate section for clothes, vegetables, food, etc., that is multiple clusters within a bazaar. De

diversity tracing cell to cater local patterns, demands, festivals, as every region of customers has unique demands.

advertising: The Essential of Brand Building Process

Advertising is an essential component of brand building. The advertisement and brand building is done through various

techniques used are: - Tag-line: Big Bazaar tag-lines are the key components of advertising. These tag-lines are modified

to demographic profile of customers. These catch-phrases appeared on hoardings and newspapers in every city where Big B

launched. Everybody understood and connected easily with these simple one-liners. The catch-liners include "Hindi - Chane k](https://image.slidesharecdn.com/bigbazaar-120113084639-phpapp02/75/Big-bazaar-10-2048.jpg)