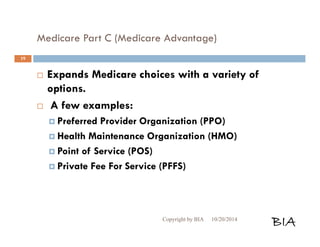

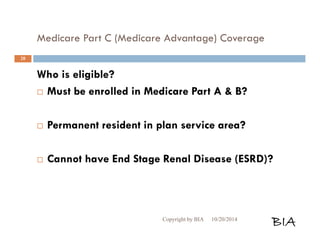

This document provides an overview and summary of Medicare and supplemental insurance options. It begins with introducing Boone Insurance Associates, which provides various health and life insurance products. The bulk of the document then summarizes Medicare Parts A, B, C, and D - including what they cover, who qualifies, premium and cost-sharing details. It also discusses options for covering gaps in Medicare like Medicare Advantage plans, Medigap plans, and Part D prescription drug plans. Specific plan types like HMOs, PPOs, and POS plans are defined.

![Medicare Part A

(Hospital Insurance) Cont…

Part A Deductibles

[2013] Hospital stay per benefit period:

Days 1-60 [$1184] per benefit period

Days 61-90 [$296] per day

Days 91-150 [$592] per day

[2013] Skilled Nursing Facility:

Days 1-20 [$0] per day

Days 21-100 [$148] per day

Copyright by BIA 10/20/2014 BIA

11](https://image.slidesharecdn.com/biamedicare101presentationnew-141021091220-conversion-gate01/85/BIA-Medicare-101-Presentation-Long-Form-11-320.jpg)

![Medicare Part B Cont…

What do I pay for Medicare Part B?

Part B premium is based on Part B medical costs and annual income level per

individual

[2013] Part B Premium Annual Income per Individual

$104.90 [$85,000 or less]

$146.00 [$85,001 to $107,000]

$209.80 [$107,001 to $160,000]

$272.70 [$160,000 to $214,000]

$335.70 More than [$214,000]

Double amounts listed above for married couples filing jointly

Premiums are deducted from the Social Security benefits, or billed quarterly

Copyright by BIA 10/20/2014 BIA

14](https://image.slidesharecdn.com/biamedicare101presentationnew-141021091220-conversion-gate01/85/BIA-Medicare-101-Presentation-Long-Form-14-320.jpg)

![Medicare Part B Cont…

Deductibles & Coinsurance for

Deductible:

2013 [$147] per year

Other Services:

Patient pays [20%] of approved amount, after

deductible. {Medicare pays 80%}

[50%] for most Outpatient mental healthcare

services.

There is no OOP maximum, risk is unlimited

Copyright by BIA 10/20/2014 BIA

15](https://image.slidesharecdn.com/biamedicare101presentationnew-141021091220-conversion-gate01/85/BIA-Medicare-101-Presentation-Long-Form-15-320.jpg)

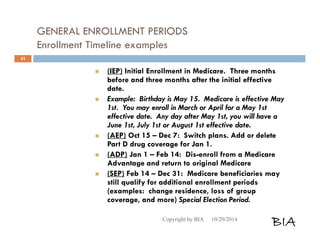

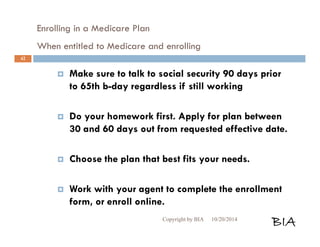

![Enrolling in a Medicare Plan

When entitled to Medicare and enrolling Cont…

Submit it during the appropriate enrollment

period.

You may not combine an MA-only PPO or HMO

with a stand-alone PDP. Choose one or the other.

If you did not have creditable coverage in [2006],

your monthly plan premium may be slightly

higher when you enroll in Part D coverage plan

(MAPD, PDP).

Copyright by BIA 10/20/2014 BIA

43](https://image.slidesharecdn.com/biamedicare101presentationnew-141021091220-conversion-gate01/85/BIA-Medicare-101-Presentation-Long-Form-43-320.jpg)