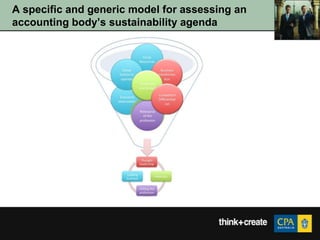

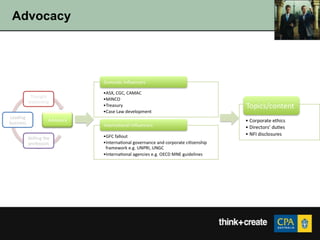

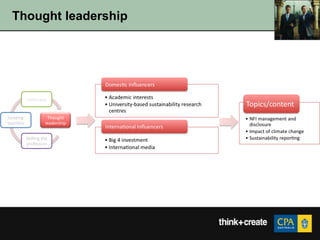

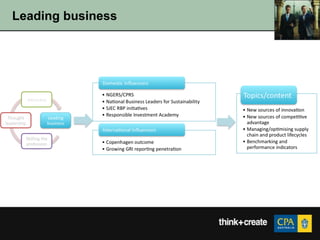

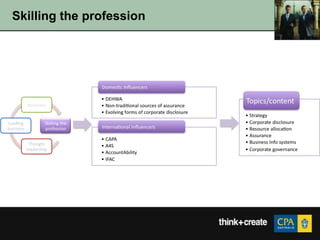

The document discusses a model for assessing an accounting body's sustainability agenda. It analyzes key internal and external drivers that shape the body's sustainability efforts and how these drivers impact the business model. The model groups the drivers and matches them to components of the business model like advocacy, thought leadership, leading business, and skilling the profession. It provides examples of how sustainability reporting is affecting accountants' roles and skills.