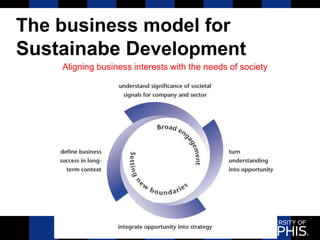

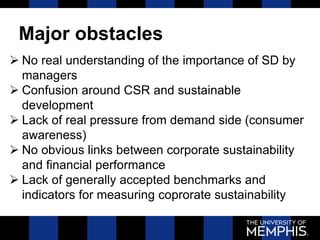

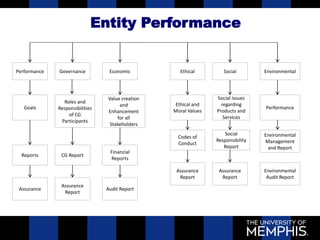

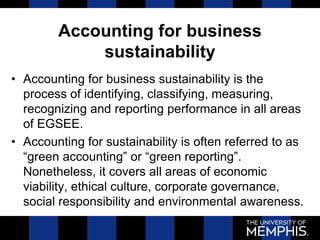

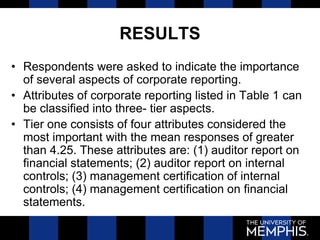

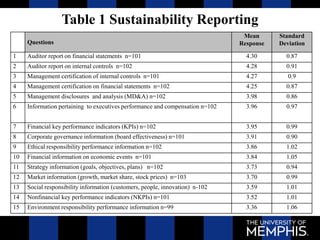

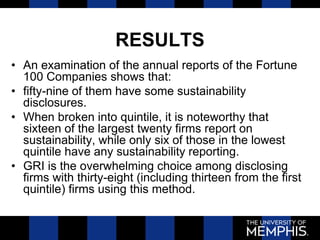

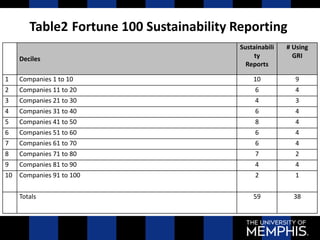

The document discusses the increasing demand for business sustainability and accountability reporting in response to global scrutiny and regulatory pressures. It highlights the importance of integrating economic, governance, social, ethical, and environmental (EGSEE) factors into corporate strategies to enhance long-term performance and societal well-being. Additionally, it provides insights from a survey of corporate reporting practices, suggesting that while sustainability disclosures are valued by investors, they are often prioritized lower than traditional financial disclosures.