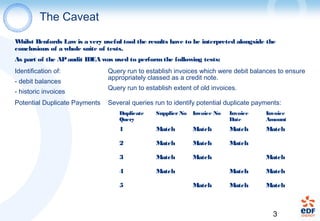

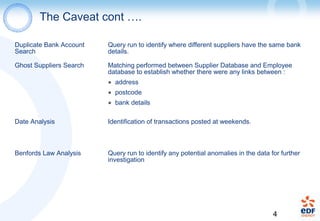

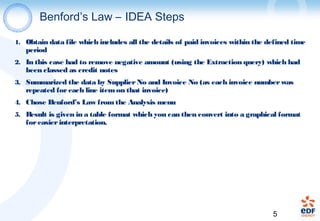

The internal audit department conducted an audit of accounts payable data over several months to identify potential duplicate payments, unusual supplier activity, unusual payment activity, and potential ghost suppliers. As part of the audit, Benford's Law was used to analyze the data, along with other tests like identifying debit balances, historic invoices, potential duplicate payments based on supplier number, invoice number, invoice date, and invoice amount, duplicate bank accounts, and ghost suppliers by matching supplier and employee address, postcode, and bank details. The results of applying Benford's Law to the extracted accounts payable data were presented in table and graphical formats for easier interpretation as part of the audit.