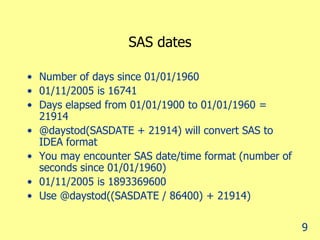

This document provides techniques for summarizing and investigating personal loan application data from March to September 2005 using IDEA. Some key findings include identifying colleagues with high approval rates or sales volumes, customers who took out multiple loans, and loans to older customers or for high values that may require further investigation. The document also demonstrates how to convert proprietary date fields to IDEA dates and calculate time periods between events to further analyze the data.