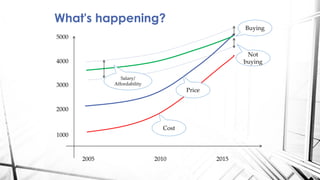

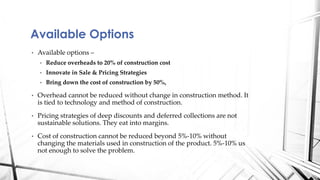

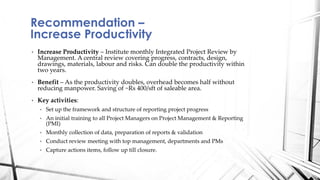

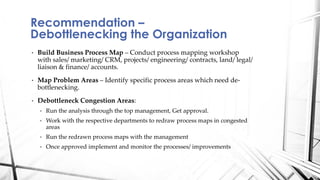

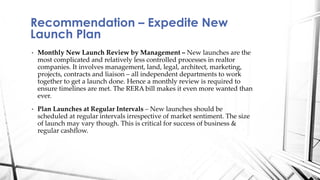

The document provides recommendations to improve the real estate industry in India. It notes that the industry is currently under debt with high inventory levels. It suggests increasing productivity through improved project monitoring to reduce overheads from 40% to 20% without cutting jobs. Other recommendations include expediting new launches, using alternative materials, implementing project cost accounting, and establishing an annual business plan with departmental targets. The document advocates for changes to modernize operations and improve affordability, sustainability, and profitability in the real estate sector.