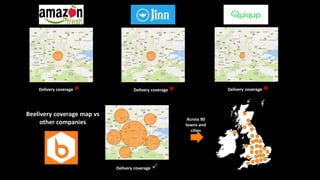

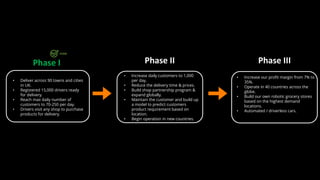

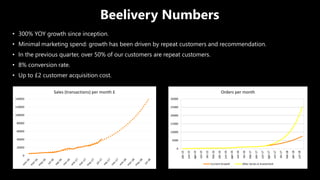

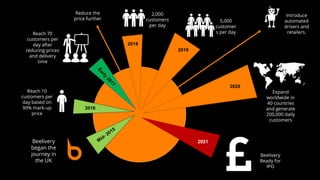

The document outlines three conferences aimed at empowering the European digital ecosystem to connect capital with entrepreneurs and promote funding for digital companies, particularly linking Israeli startups with European investors. It also provides an overview of Beelivery, a UK-based grocery delivery service, highlighting its rapid growth, operational strategy, and market focus on convenience and speed compared to competitors. Additionally, it details the activities and successes of Noah Advisors in facilitating mergers and acquisitions within the European internet sector, emphasizing their industry expertise and extensive network.