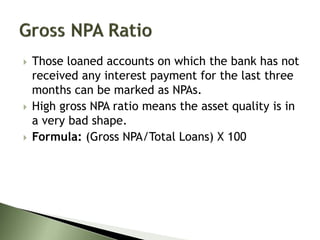

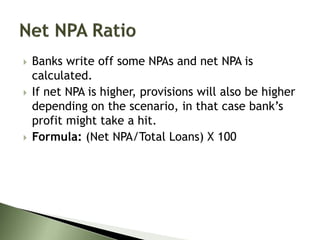

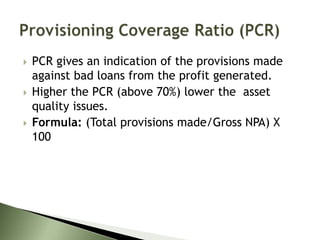

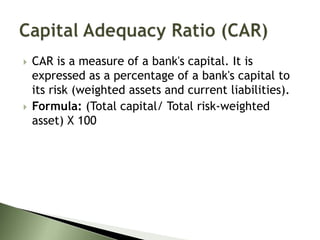

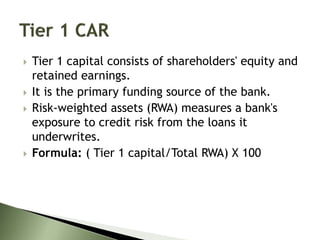

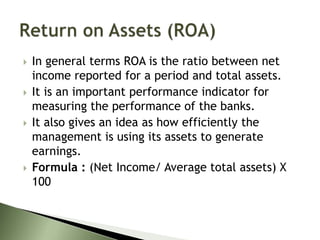

This document defines and provides formulas for several key financial ratios and terms that are used to analyze bank performance based on their annual reports. These include: Gross NPA Ratio, Net NPA Ratio, Provisioning Coverage Ratio, Total Capital Adequacy Ratio, Tier 1 and Tier 2 CAR, CASA Ratio, Net Interest Margin, Non Interest Income, and Return on Assets. Formulas and brief explanations are provided for each ratio. The purpose is to help people who do their own research on bank performances.