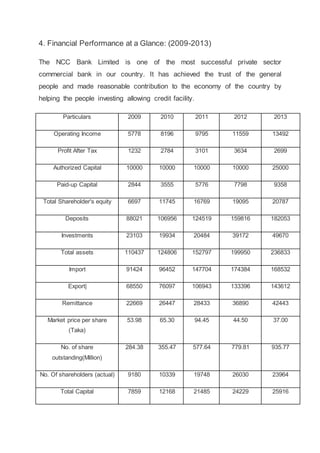

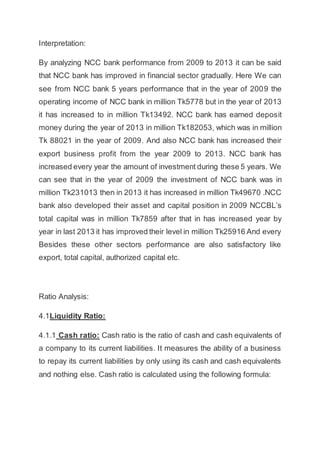

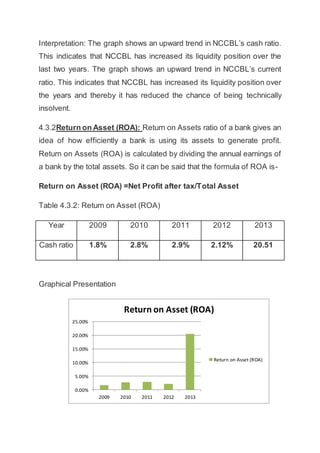

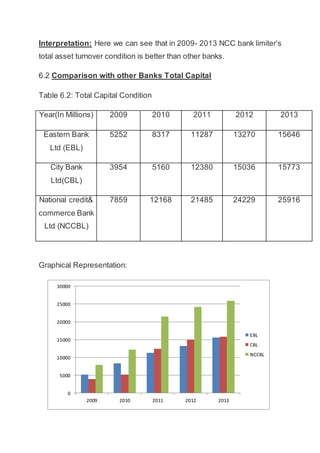

NCC Bank Limited saw steady financial growth from 2009-2013. Operating income increased from 5778 million Taka in 2009 to 13492 million Taka in 2013. Deposits grew from 88021 million Taka to 182053 million Taka over this period. Ratios such as return on assets, return on equity, and earnings per share generally increased, though return on assets saw a dramatic decline in 2013. A comparison of financial metrics to other banks, Eastern Bank Limited and City Bank Limited, showed that NCC Bank Limited had stronger performance in total assets and capital, though its ratios sometimes trailed the other banks.