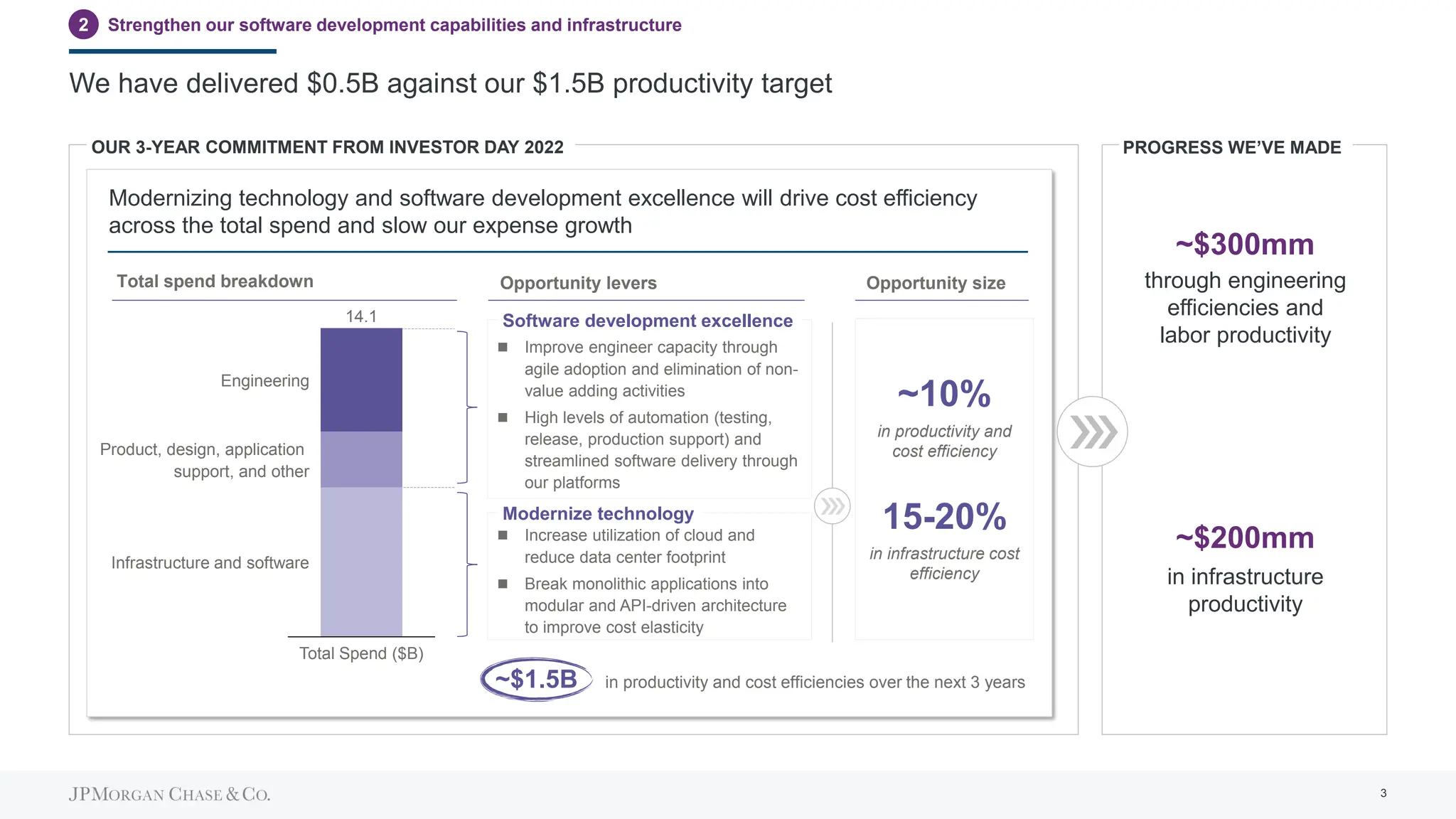

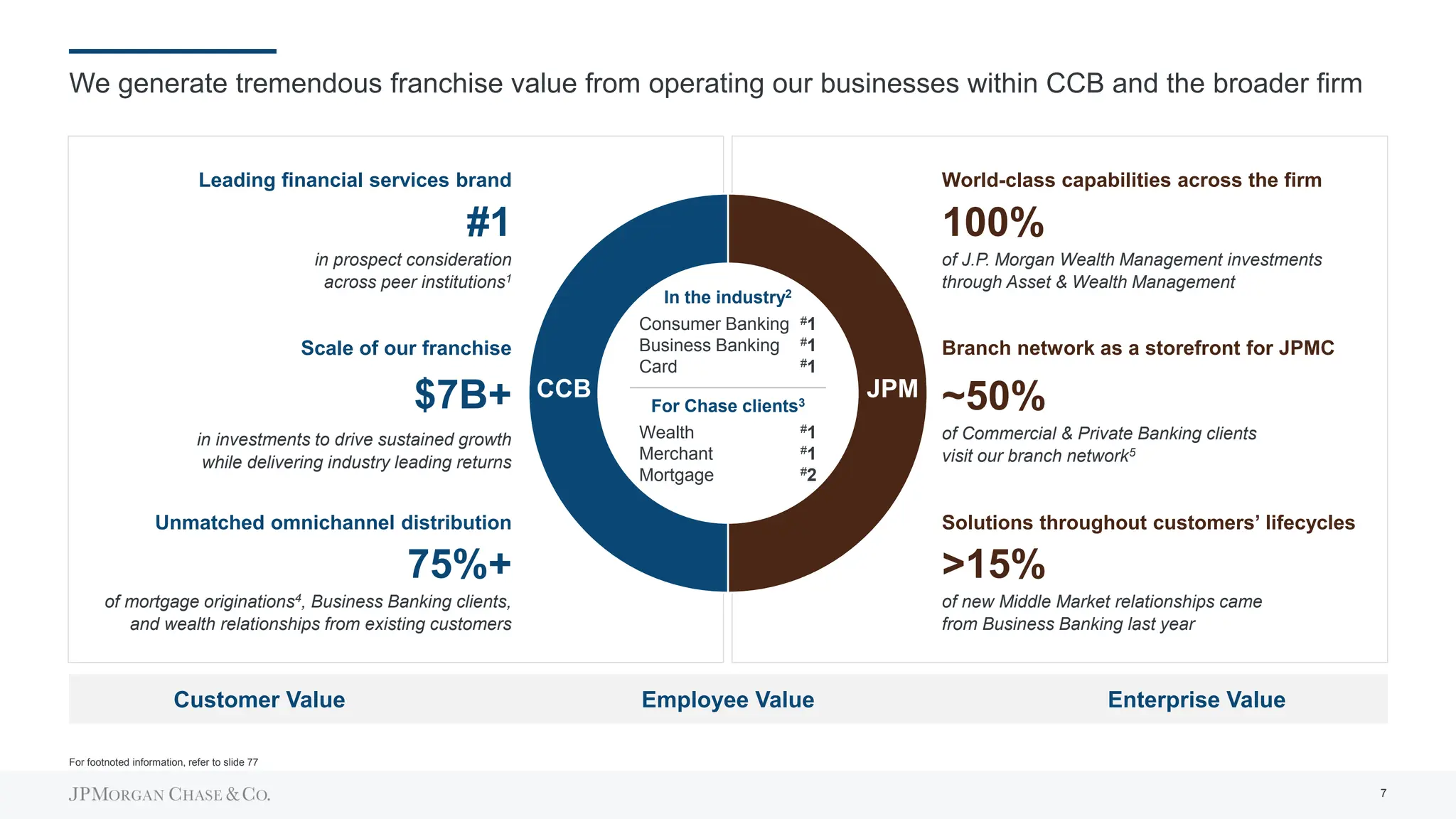

The document outlines a firm's operational overview, financial performance, and strategic outlook, emphasizing its global diversified model, customer-centric approach, and commitment to sustainability and community support. Key financial metrics demonstrate strong growth across various segments, with a robust balance sheet prepared for macroeconomic uncertainties. The firm remains focused on improving its services, technology investments, and enhancing client experiences while navigating complex regulatory environments.