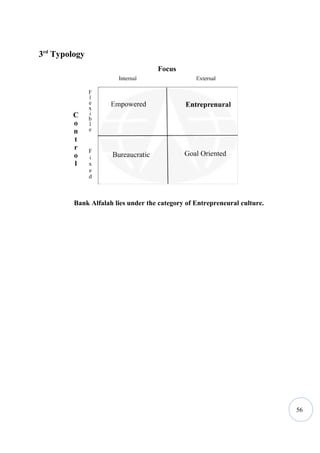

Bank Al-Falah was established in 1997 as a commercial bank and provides various banking services through over 100 branches across Pakistan. The document discusses Bank Al-Falah's planning processes including goals, strategies and factors considered, as well as its organizational structure, leadership approaches, controls, ethics, culture and design. It also outlines the bank's history, management team, and approaches to planning, organizing, leading, controlling and other functions.