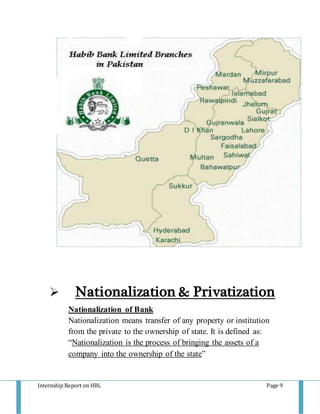

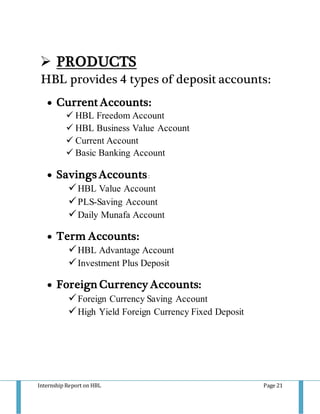

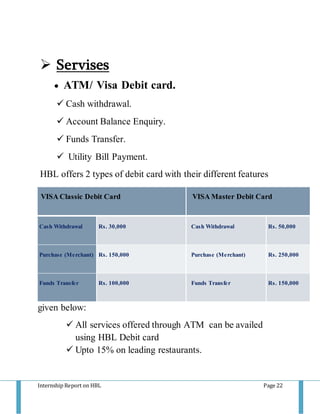

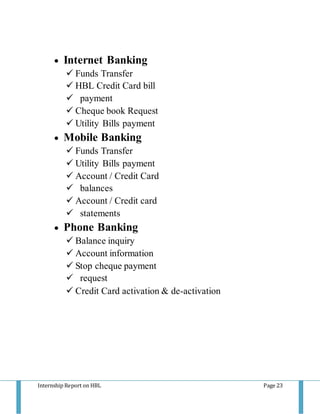

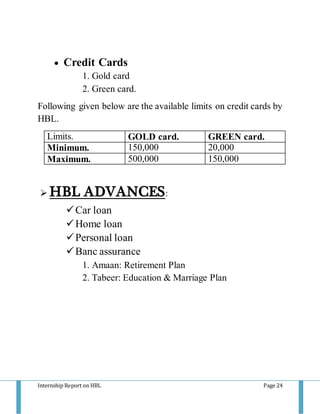

The internship report on Habib Bank Limited (HBL) describes an enriching experience that enhanced understanding of the banking sector, highlighting HBL's prominent role in Pakistan's financial landscape and its extensive network of branches. The report covers the bank's history, vision, mission, services, products, and strategic evaluations including a SWOT analysis, along with acknowledgments to mentors and supportive staff. Key recommendations suggest improving management efficiency and enhancing customer engagement to maintain HBL's competitive edge in the market.