This document provides information about Al-Meezan Bank and monetary policy in Pakistan. Some key points:

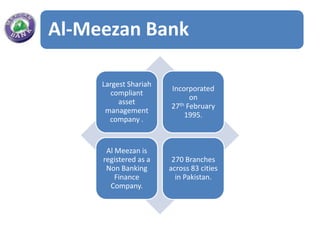

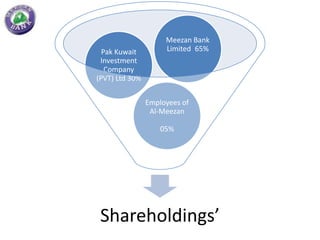

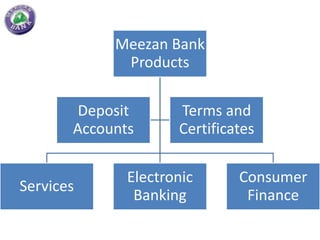

- Al-Meezan is the largest Shariah-compliant asset management company in Pakistan, incorporated in 1995 with 270 branches across 83 cities.

- Its vision is to establish Islamic banking as the first choice and its mission is to be a premier Islamic bank offering innovative Shariah-compliant products and services.

- The objectives of monetary policy/credit control in Pakistan include regulating money supply, increasing investment and employment, and controlling inflation and price stability. Tools used include interest rates, open market operations, and reserve requirements.

- Transaction costs are fees charged by financial institutions for