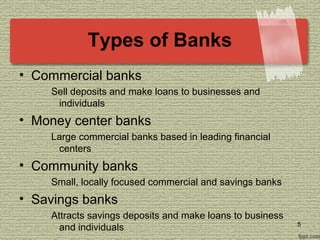

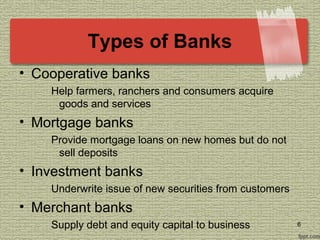

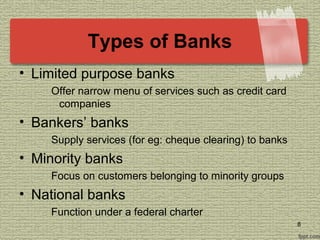

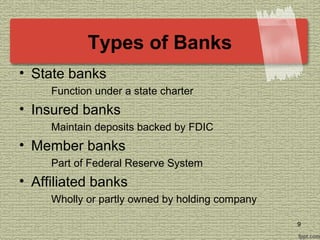

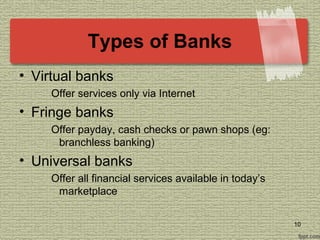

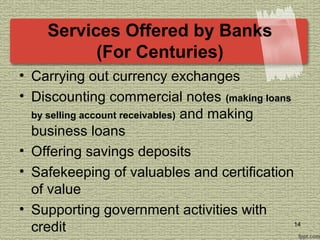

Banks serve important economic functions by converting deposits into loans and providing credit to individuals, businesses, and governments. They offer a variety of services including checking and savings accounts, loans, financial advising, and more. Common types of banks include commercial banks, savings banks, investment banks, and others that differ in their focus and services. Banks face competition from other financial institutions like credit unions, mutual funds, and insurance companies. Technological changes and globalization are trends affecting both banks and other financial institutions.