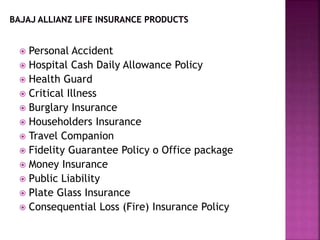

Bajaj Allianz Life Insurance is a joint venture between Bajaj Auto and Allianz AG. It is one of India's leading private life insurance companies. The document discusses Bajaj Allianz's profile, objectives of studying their sales strategies, research methodology used which included primary data collection through questionnaires and secondary data collection from websites and materials. It also discusses the company's vision, achievements, and products offered. The findings were that the sales promotion process was satisfying but new techniques could be used and more focus given to customer service, awareness, attention, and advertisements.