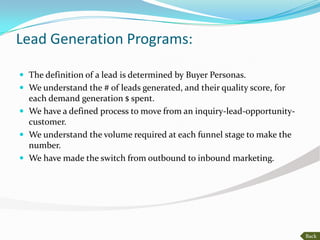

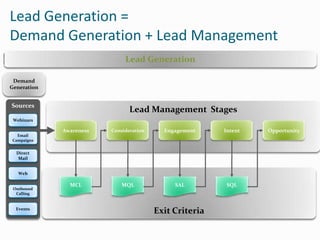

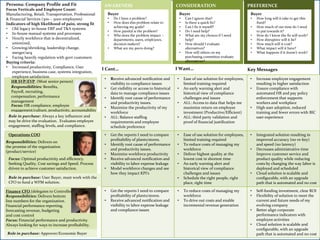

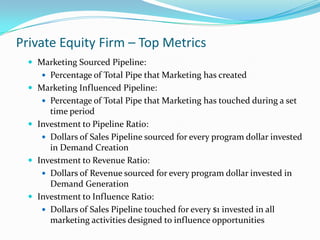

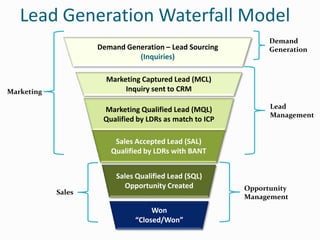

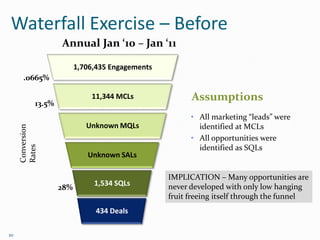

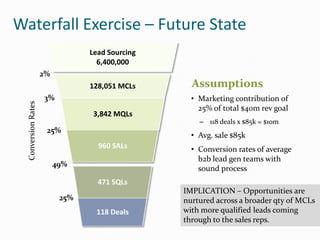

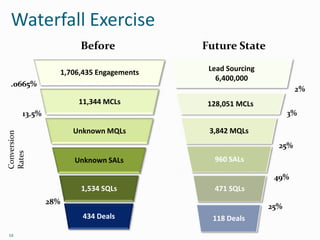

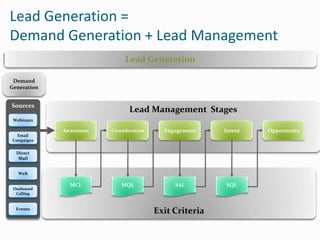

The document outlines the logistics for a webinar hosted by Sales Benchmark Index, including guidelines for participants during the presentation and information on a follow-up Q&A session. It features Dan Perry as the guest speaker and discusses lead generation, demand generation processes, and the importance of understanding buyer personas. Additionally, it promotes a future webinar on sales resource planning scheduled for October 13, 2011.