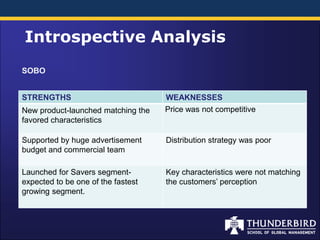

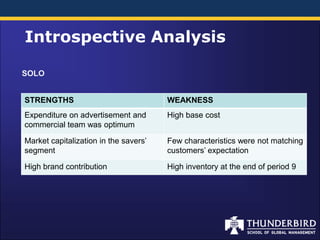

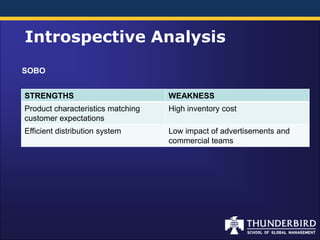

The document outlines the marketing strategy and performance of two products, Soft and Solo, targeting savers and shoppers segments, respectively. Initially, the company faced declines in sales and earnings, prompting a shift towards a new product, Sobo, alongside repositioning strategies and improved market research. Eventually, the company experienced significant revenue growth and established Solo as a top brand through effective marketing and distribution strategies, while also highlighting the importance of market research for future success.