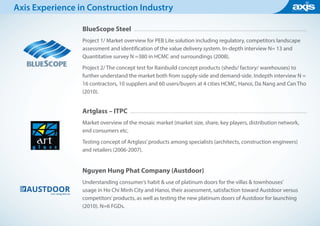

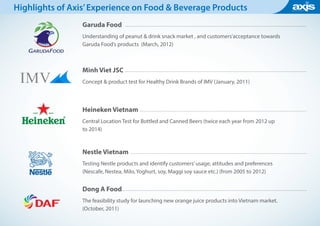

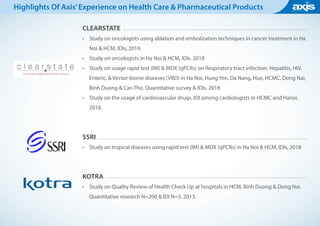

Axis Research Ltd. is an independent market research agency established in Ho Chi Minh City in 2001, offering customized research services across various industries. The company has a strong operational framework, extensive experience, and competitive advantages, including advanced research capabilities and ISO 9001-2008 certification. Axis conducts both B2C and B2B research, focusing on quality control and client collaboration throughout the research process.