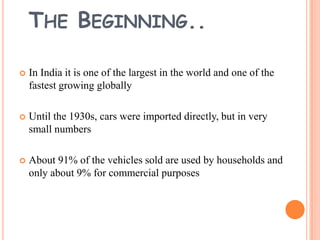

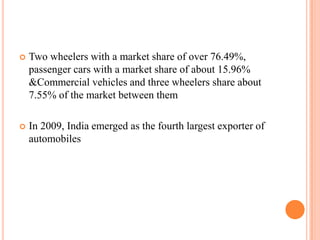

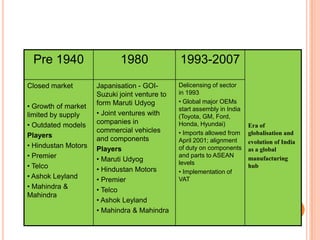

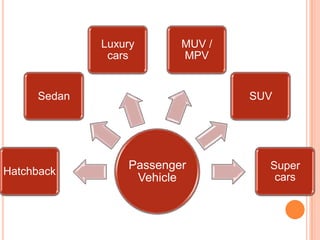

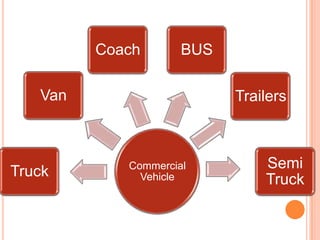

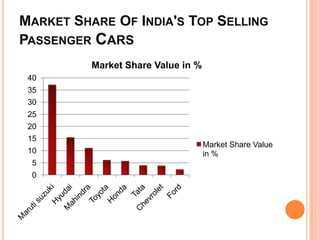

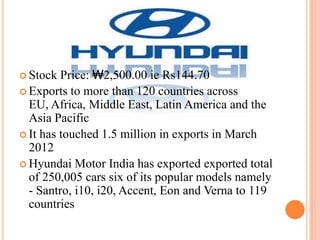

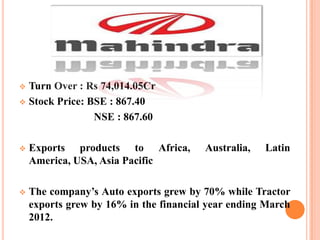

The automobile industry in India has grown significantly since the 1930s. By the 1980s, major global automakers began establishing joint ventures and assembly plants in India. Today, India has a large domestic market for both passenger and commercial vehicles, as well as becoming a major exporter. The top selling passenger vehicle brands are Maruti Suzuki, Hyundai, Mahindra, Toyota, and Honda. In two-wheelers, Hero MotoCorp has the largest market share, followed by Bajaj and TVS. These companies have established domestic sales networks and also export vehicles to over 100 countries worldwide.