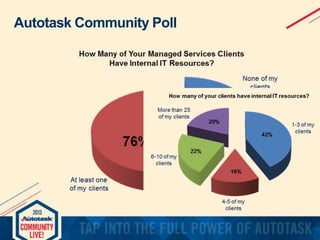

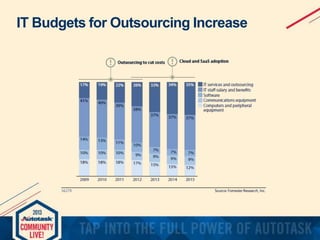

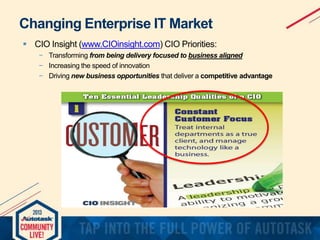

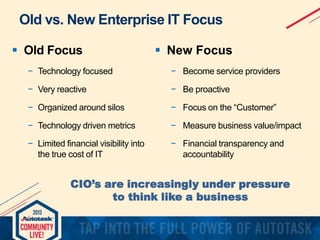

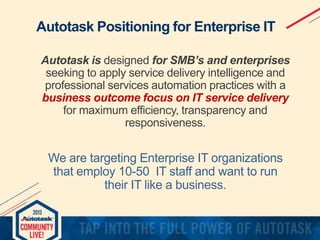

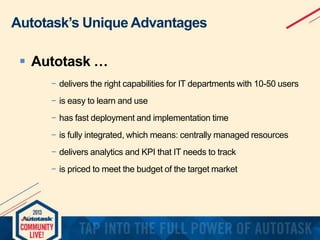

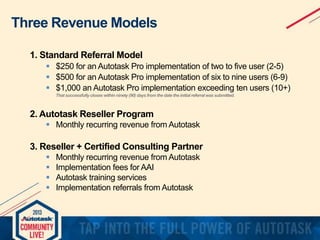

The document discusses the changing landscape of enterprise IT, highlighting challenges faced by CIOs who are pressed to do more with fewer resources while aligning IT with business objectives. It emphasizes the advantages of Autotask in addressing the needs of these organizations, particularly those with 10-50 IT staff, and presents various models for partners to leverage Autotask for revenue generation. The document concludes with an encouragement to engage potential clients within existing customer bases to adapt to the evolving market demands.