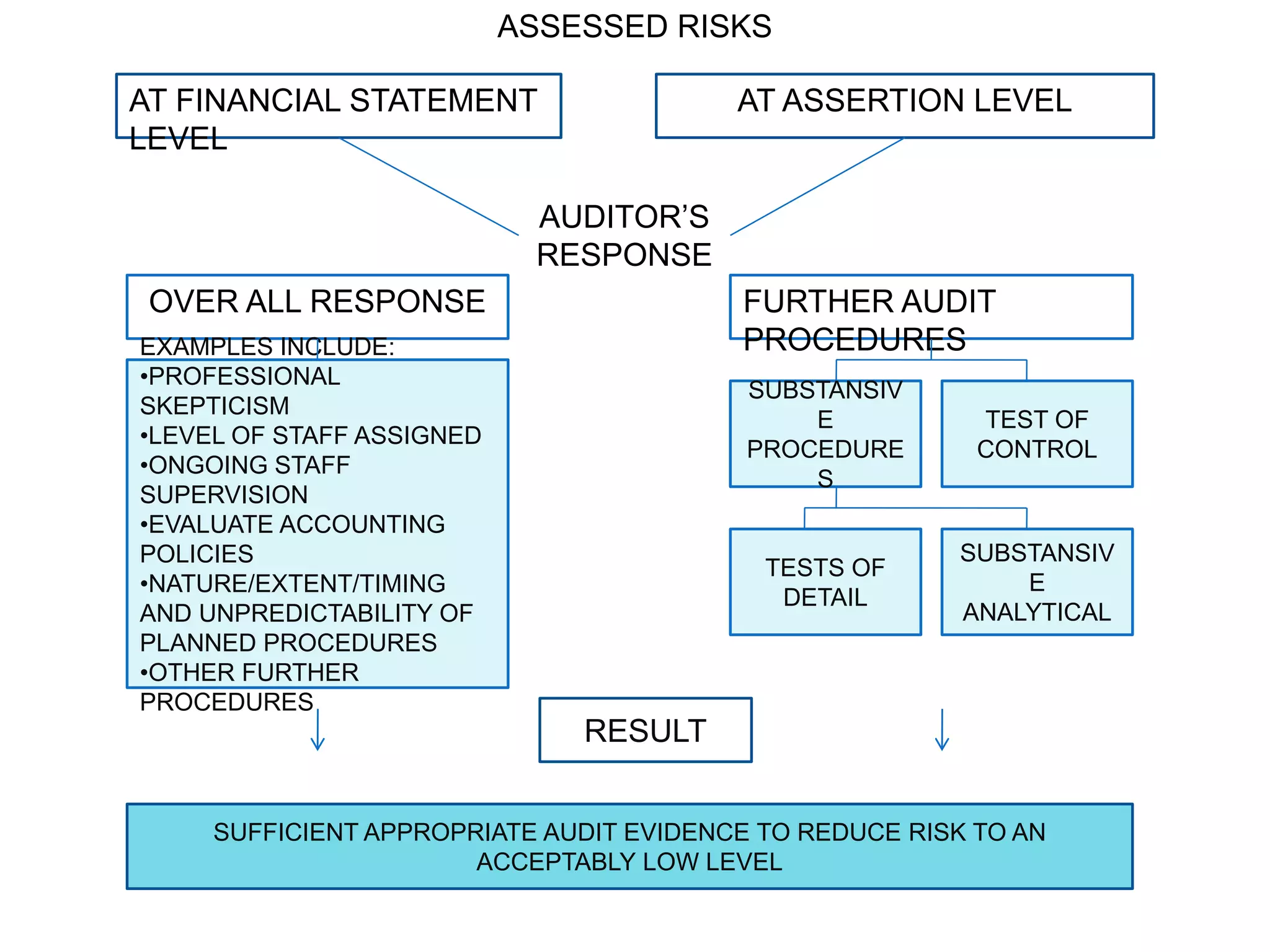

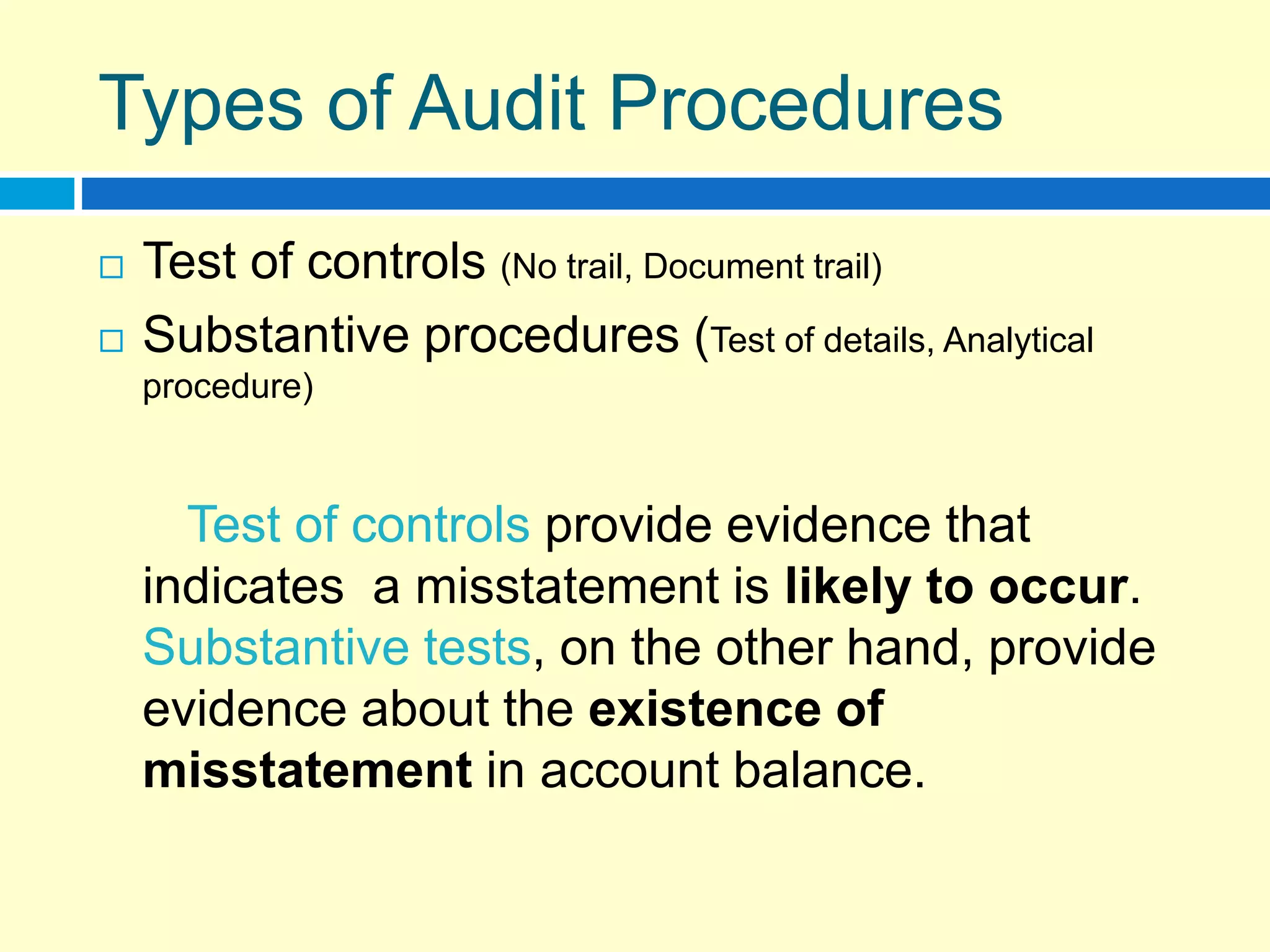

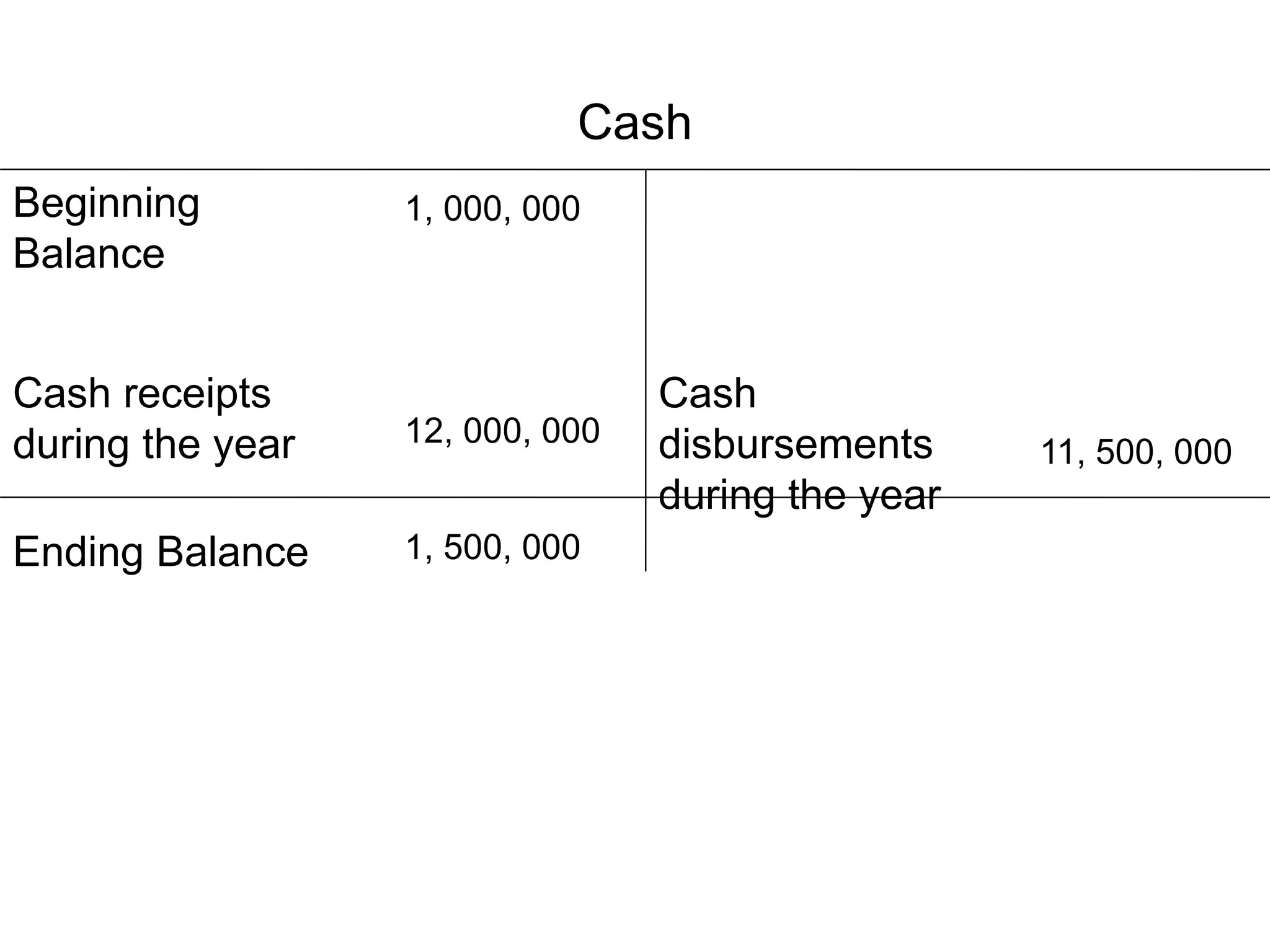

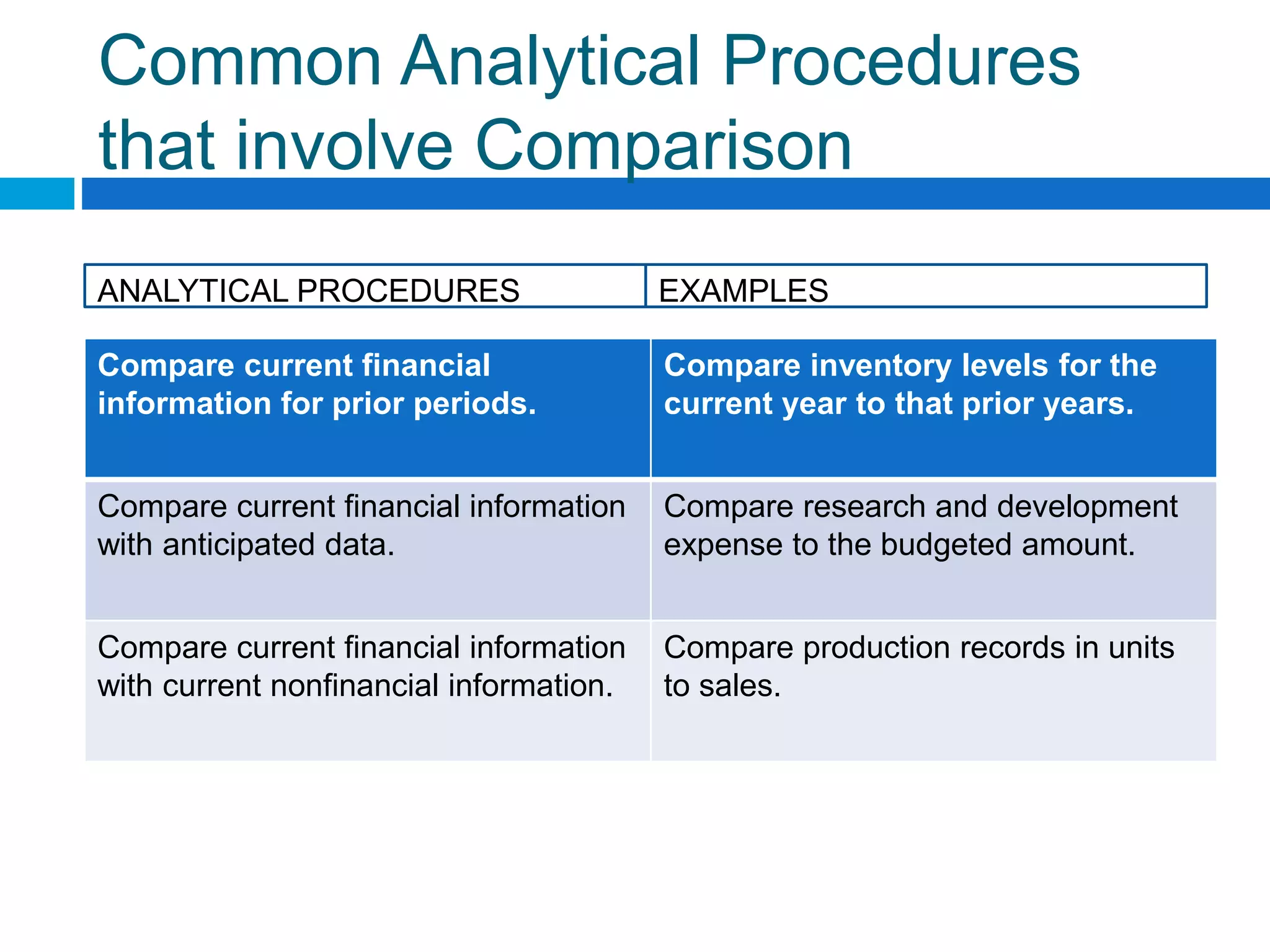

The document discusses an auditor's response to assessed risks during a financial audit. It explains that the auditor determines the likelihood of audit risk during an assessment and designs audit procedures to gather sufficient evidence and reduce risk. The auditor can perform tests of controls, substantive procedures like tests of details and analytical procedures. Tests of controls check that controls are working as intended while substantive procedures search for misstatements. The document provides examples of different types of audit procedures.