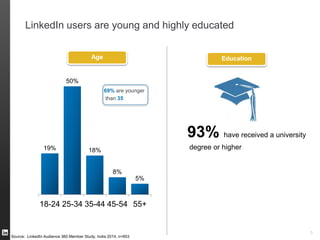

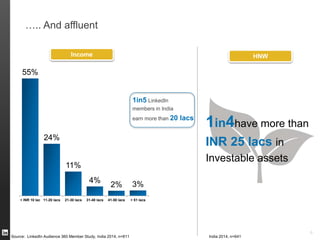

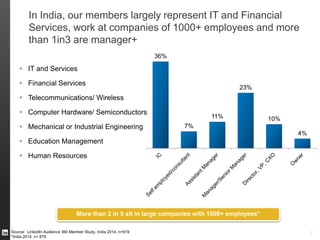

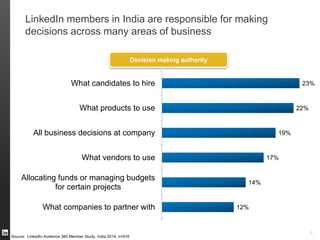

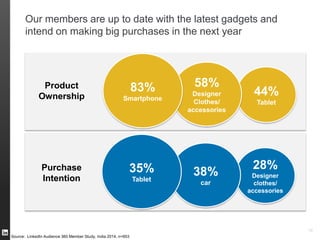

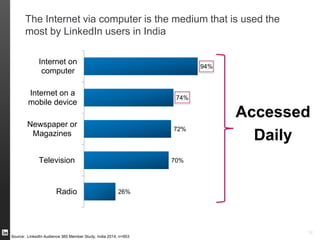

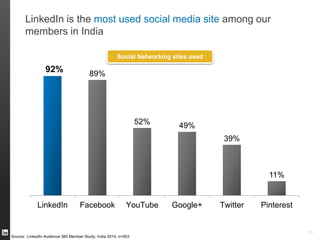

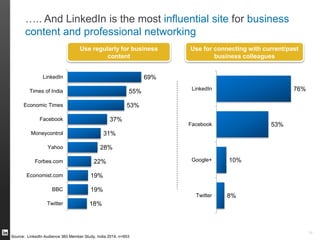

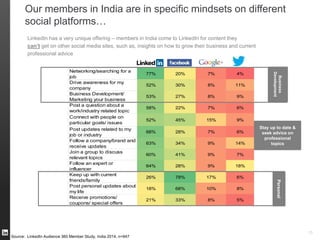

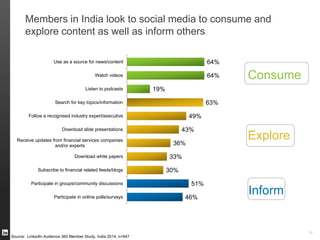

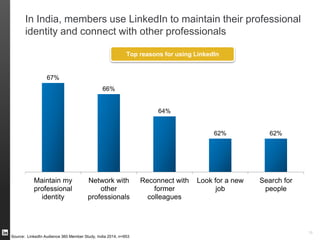

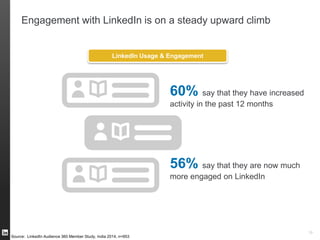

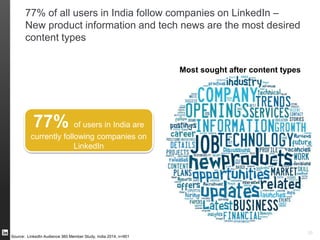

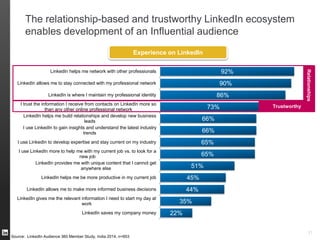

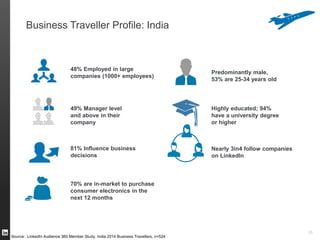

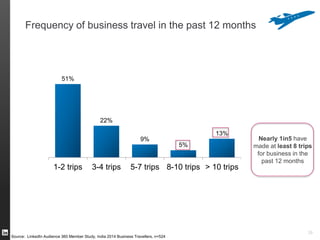

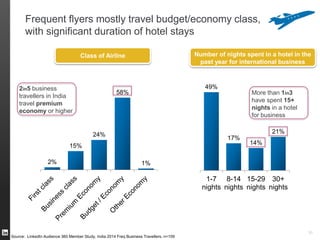

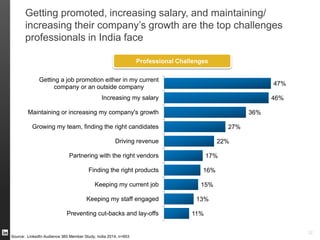

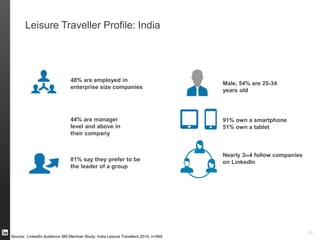

The document presents the findings of a LinkedIn member study in India conducted in March 2014, highlighting the demographics, income, education, and professional influence of Indian LinkedIn users. It indicates that the majority of respondents are affluent, young, and well-educated professionals with significant decision-making authority in their organizations. The findings also show that LinkedIn is a preferred platform for these individuals to engage with professional content and connect with others in their industry.