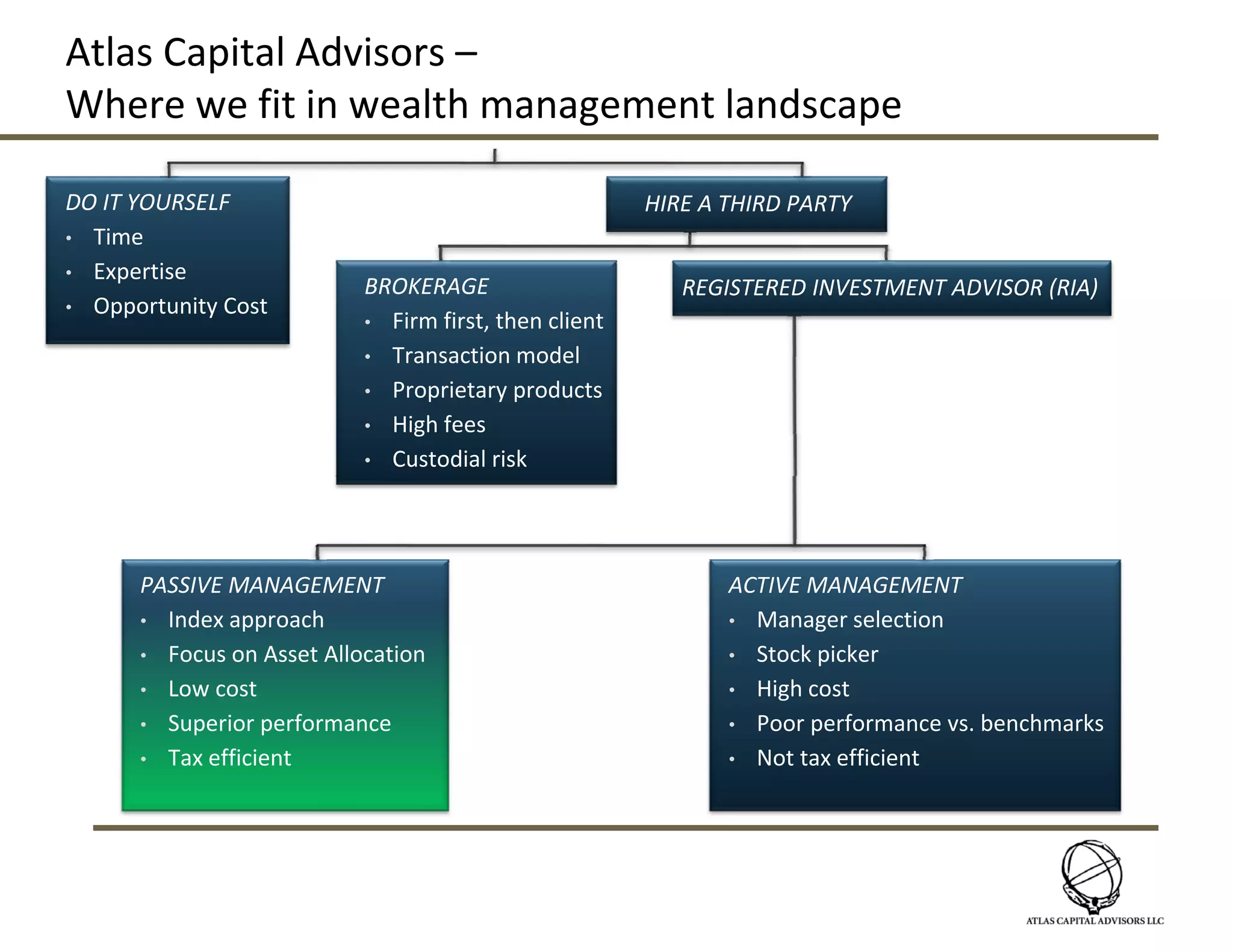

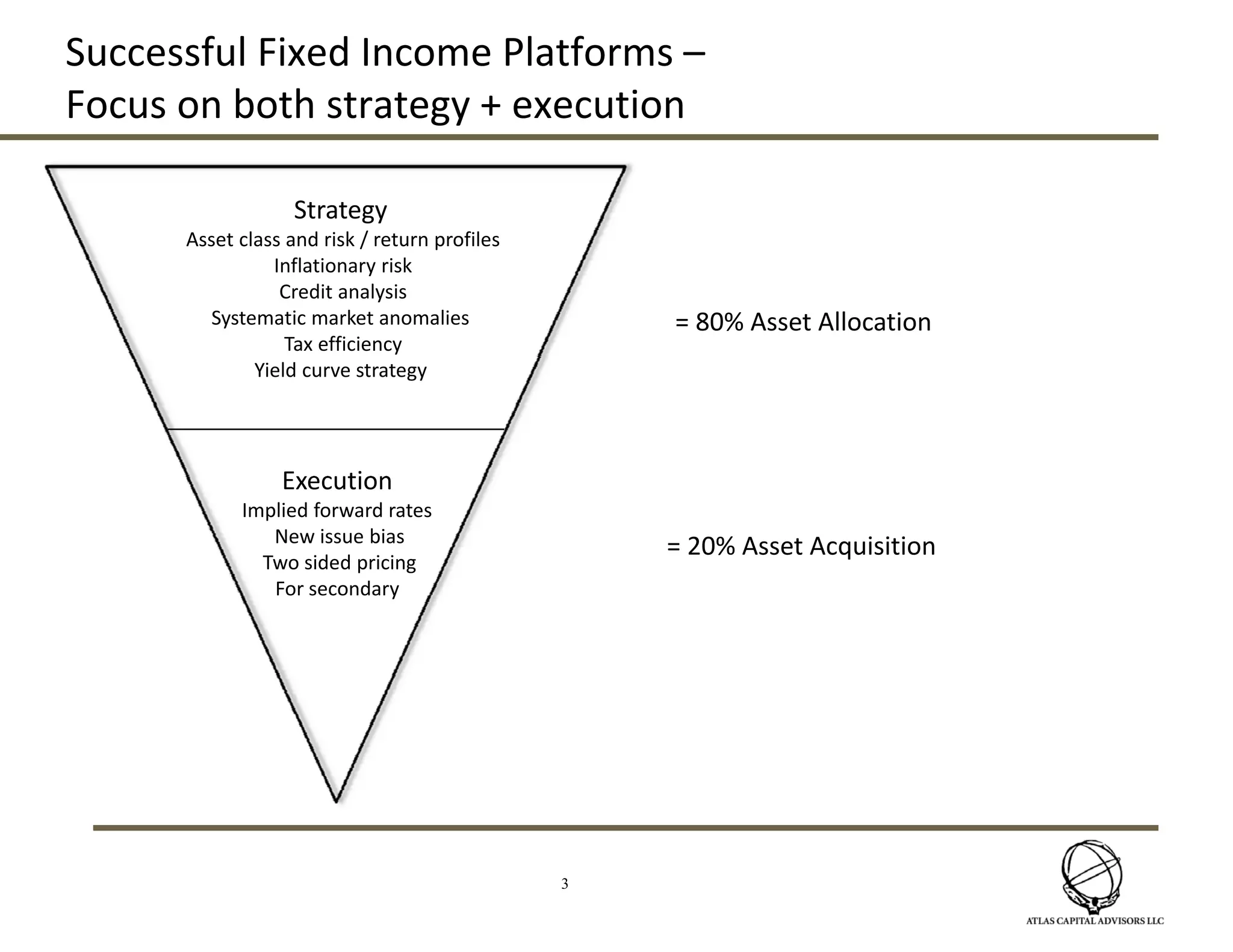

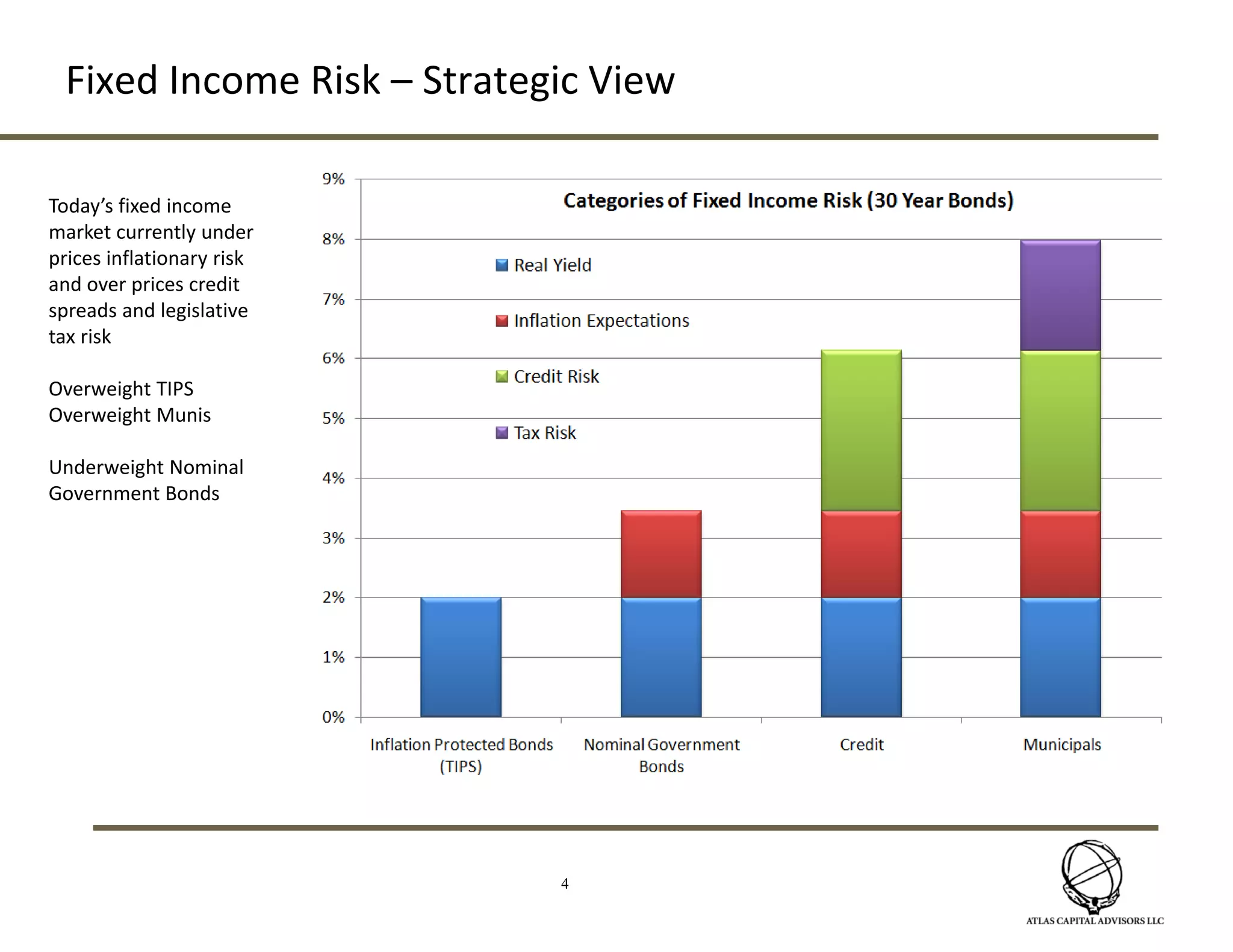

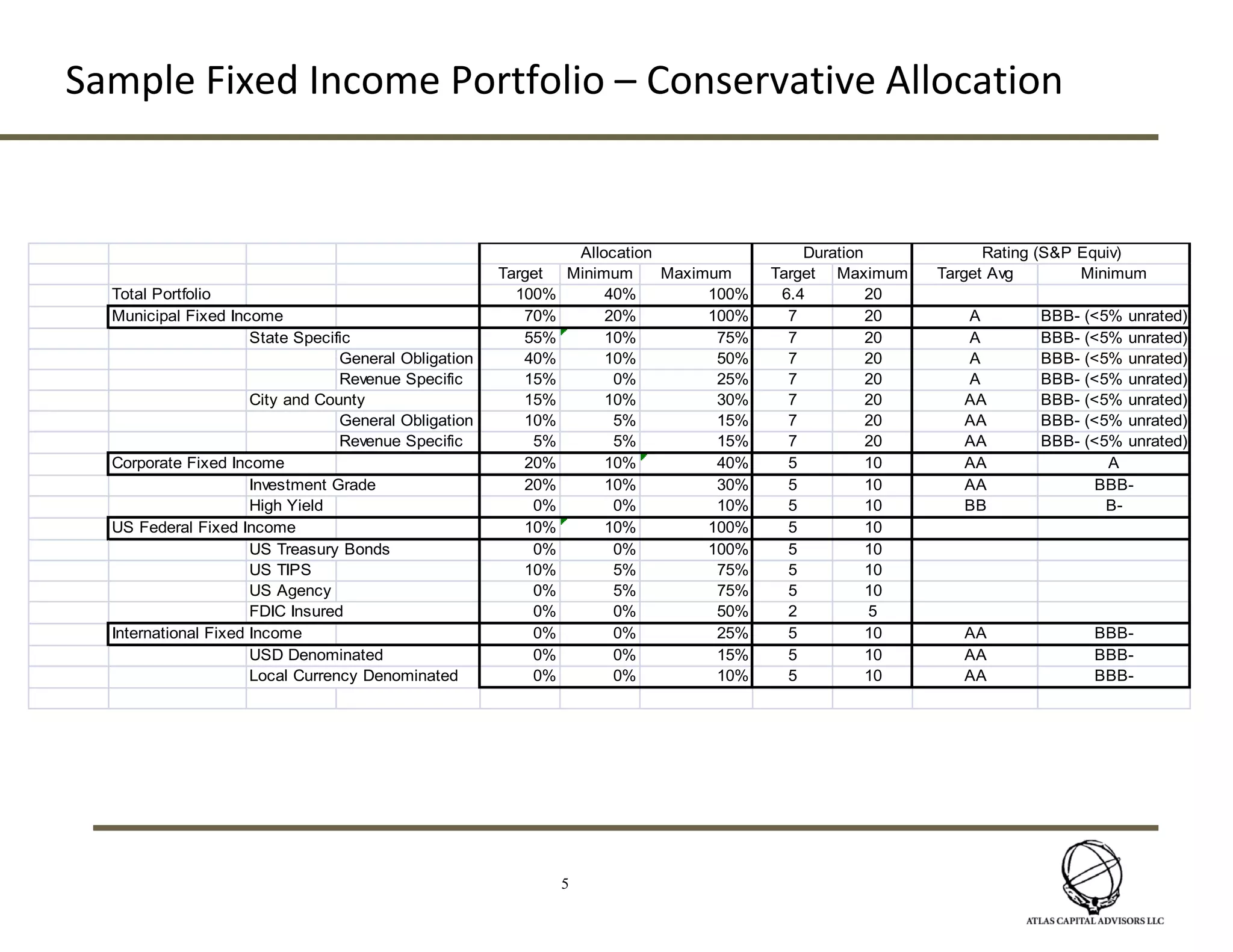

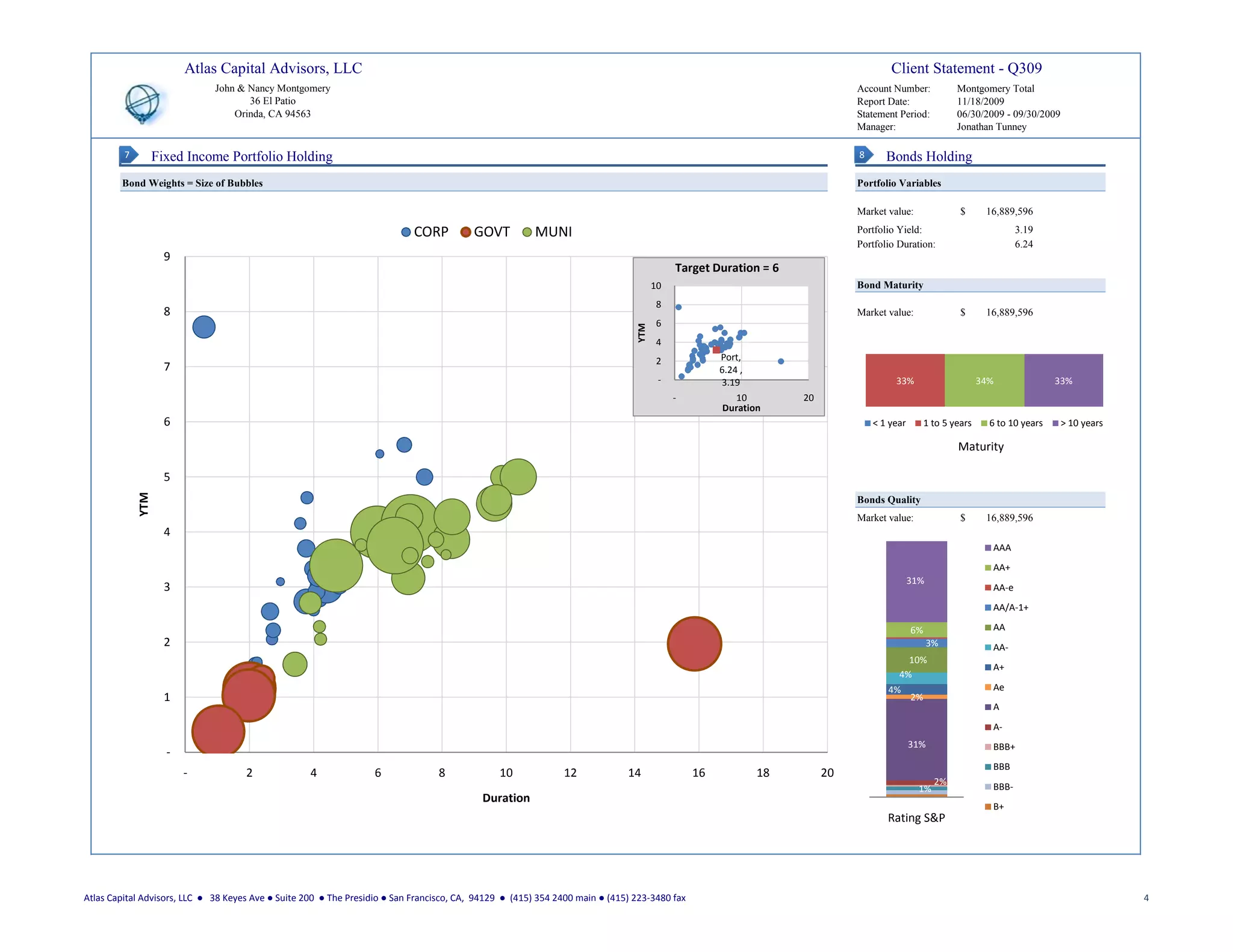

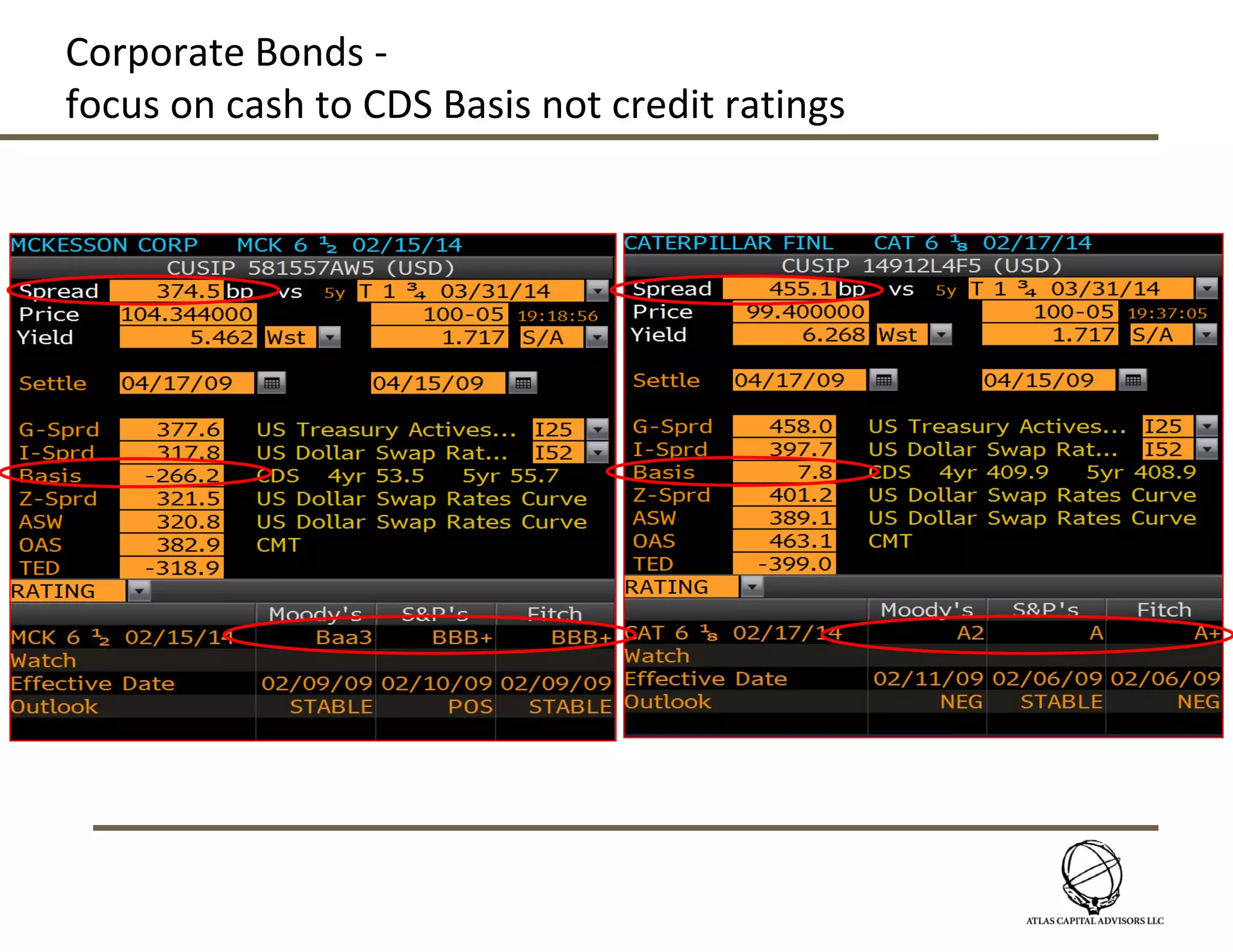

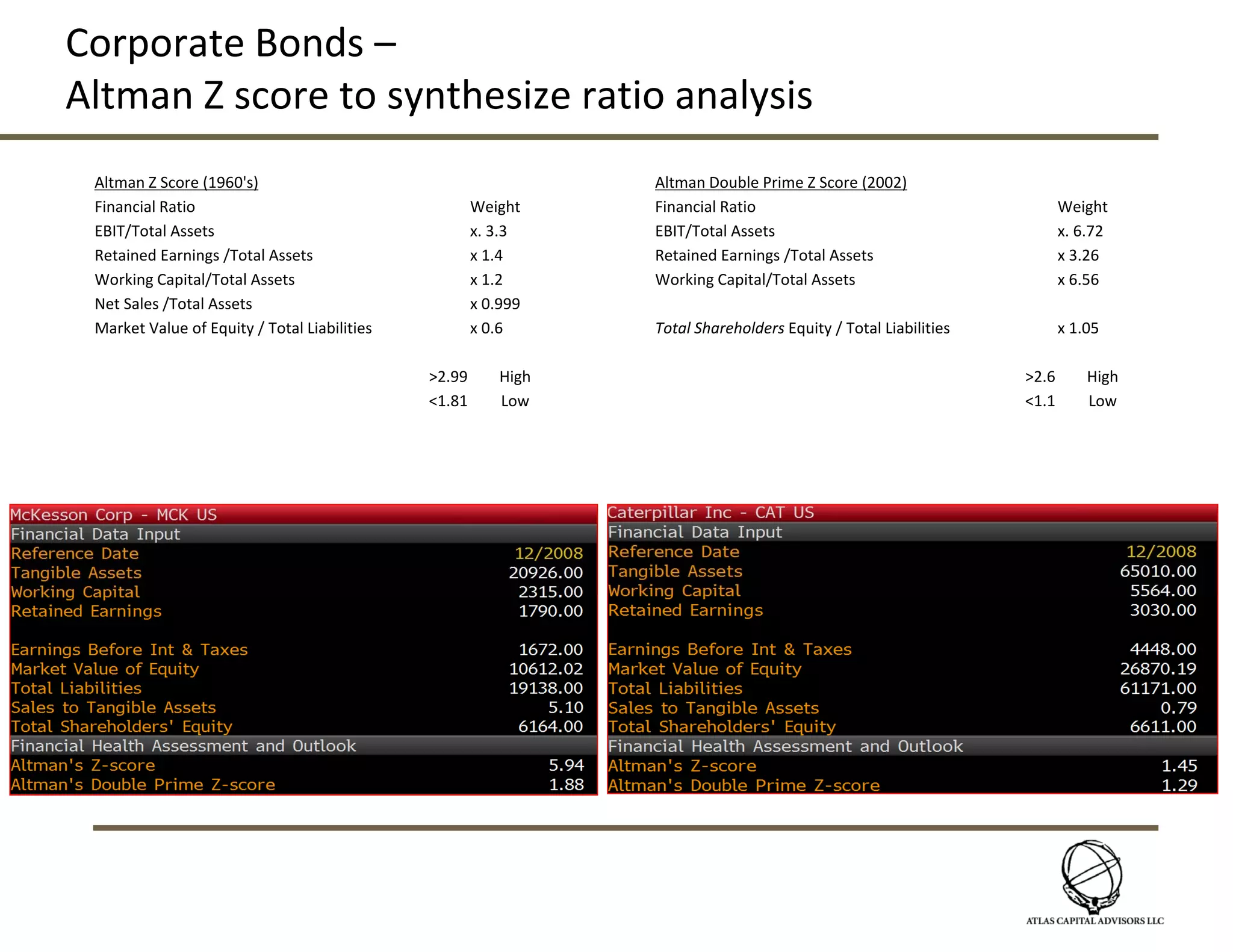

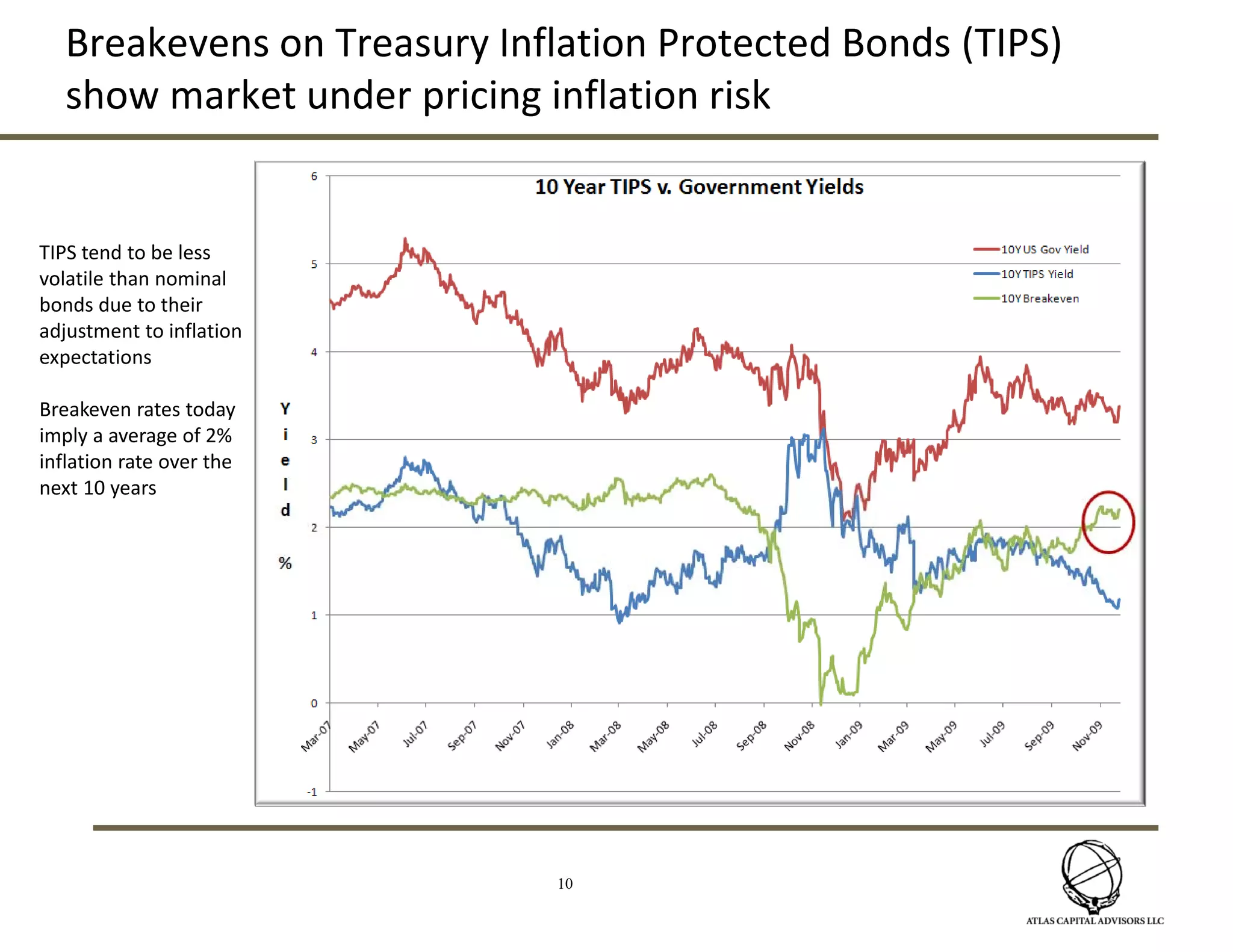

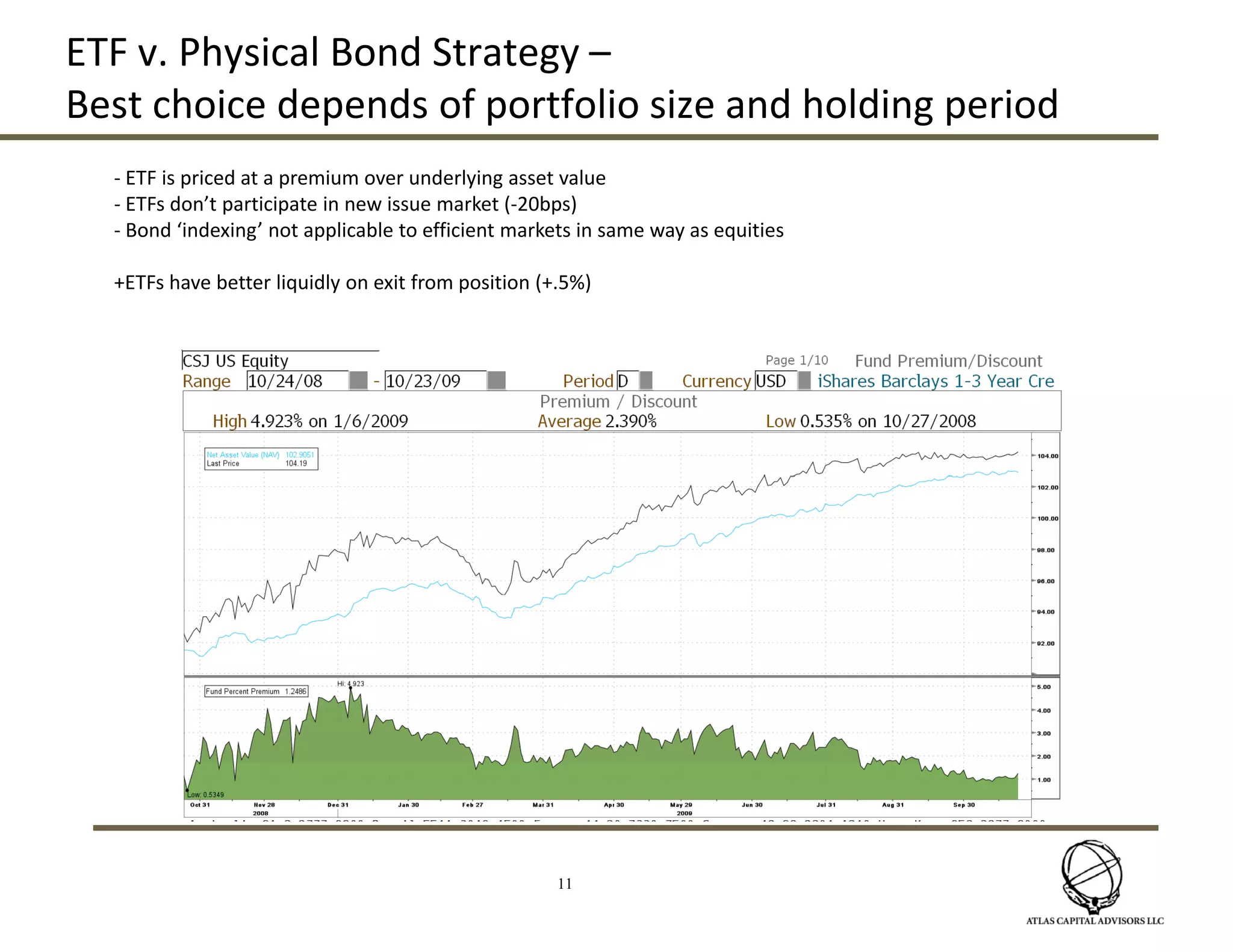

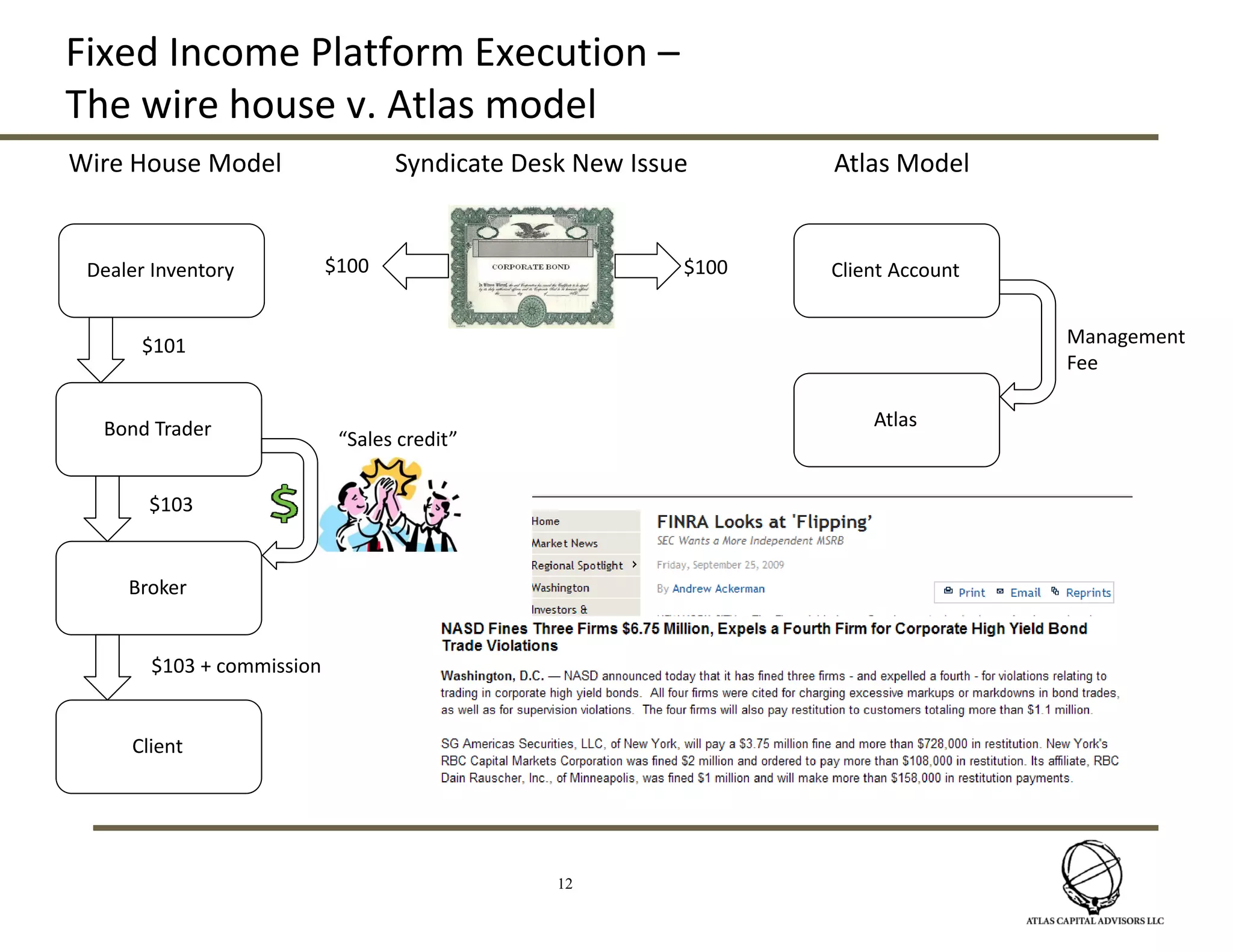

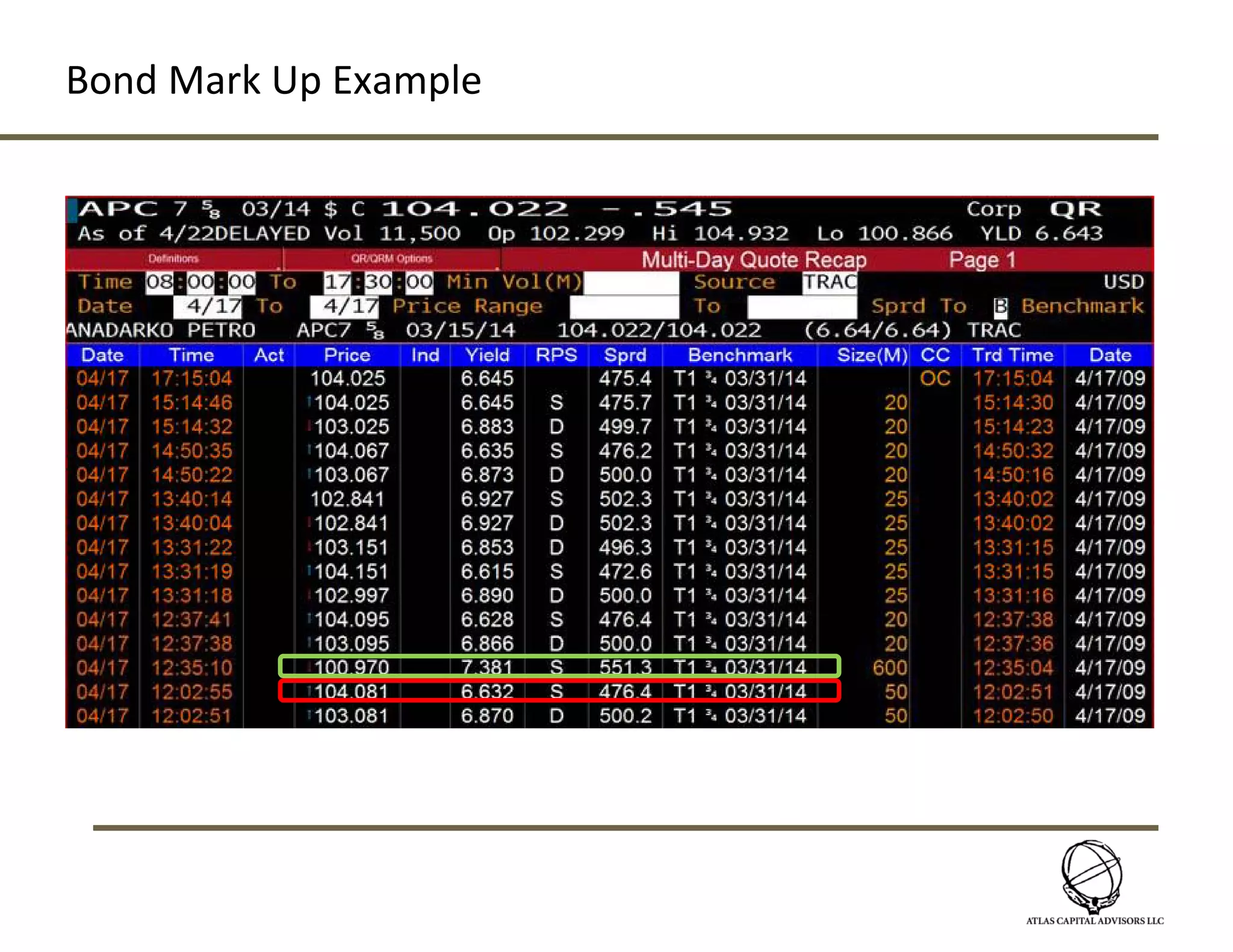

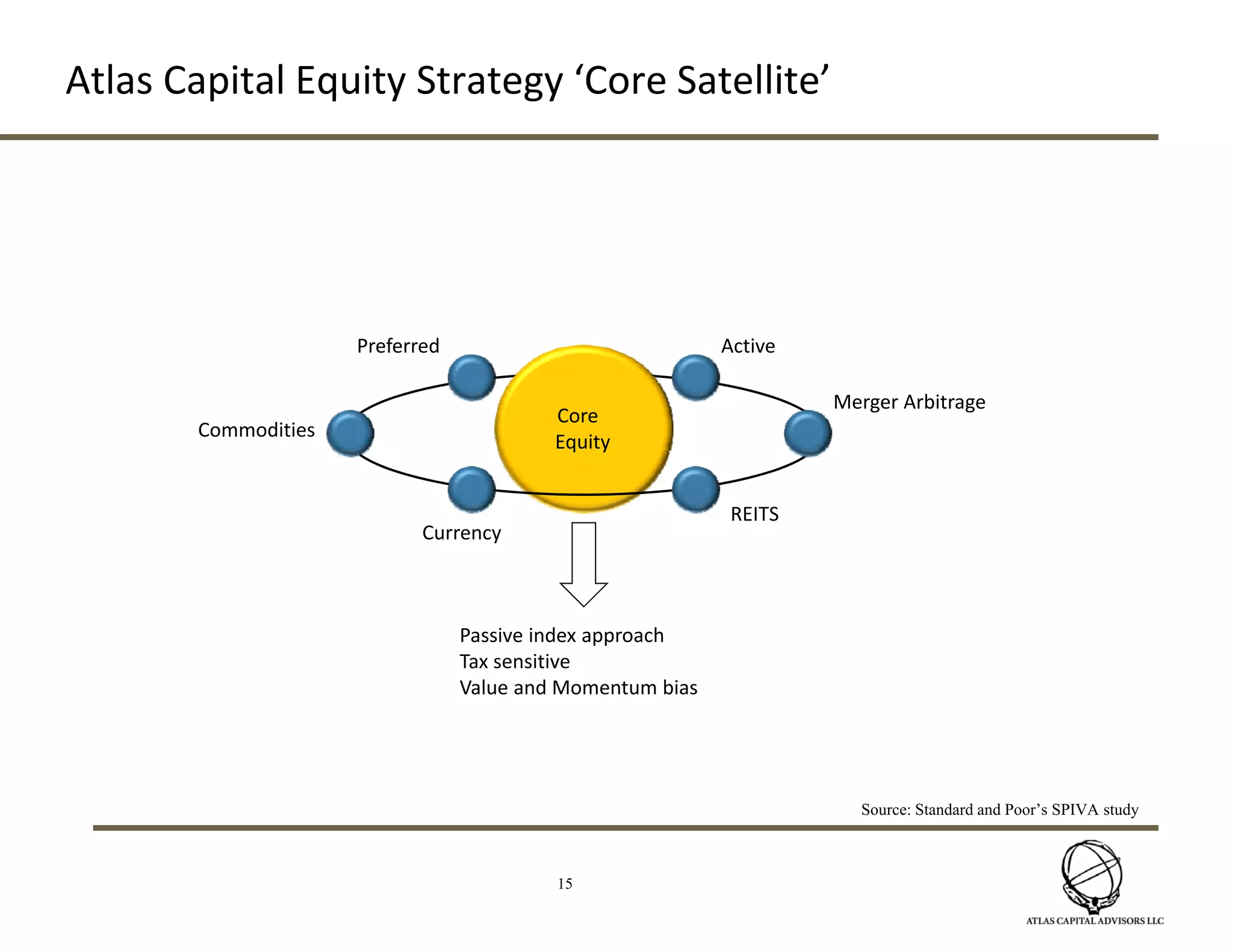

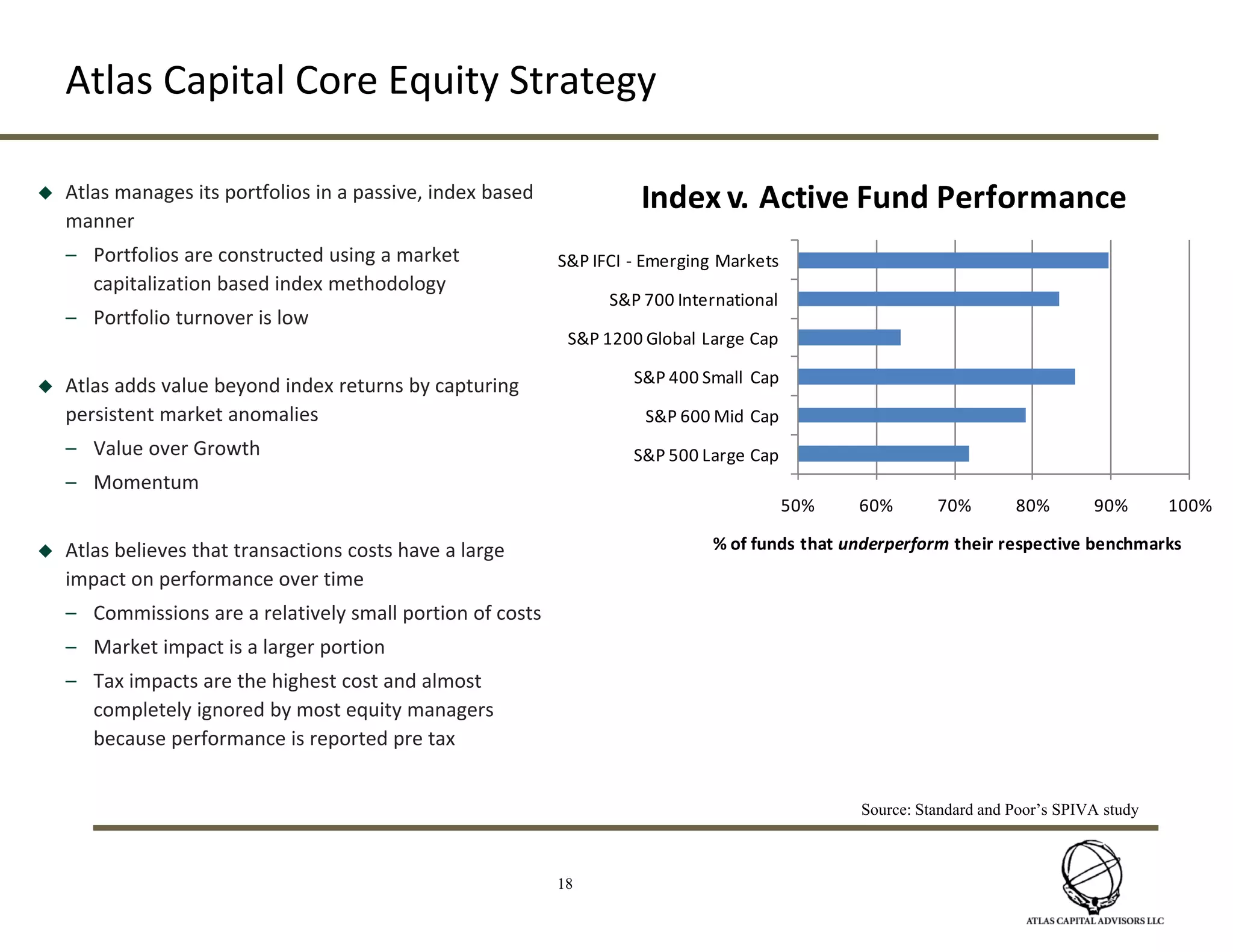

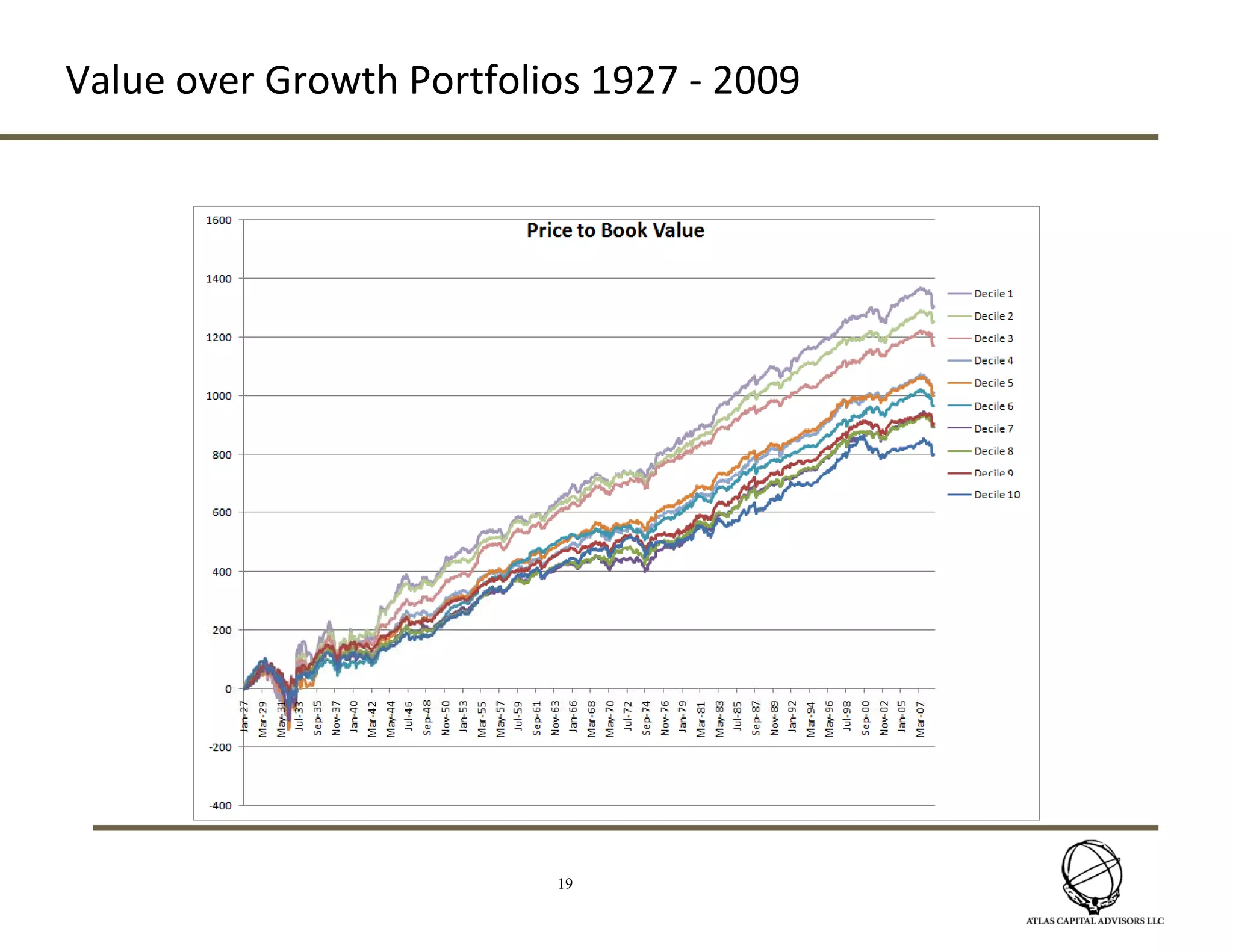

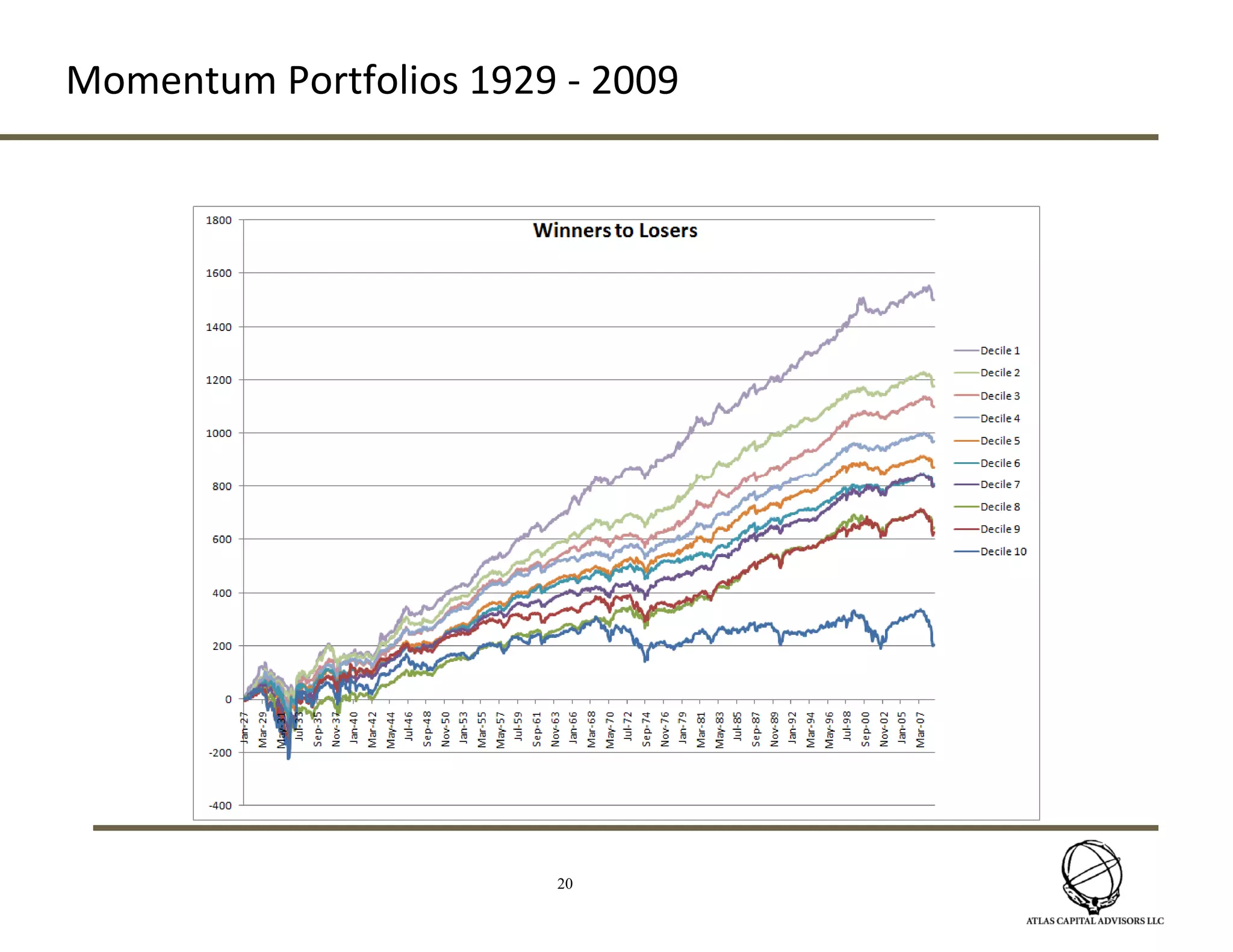

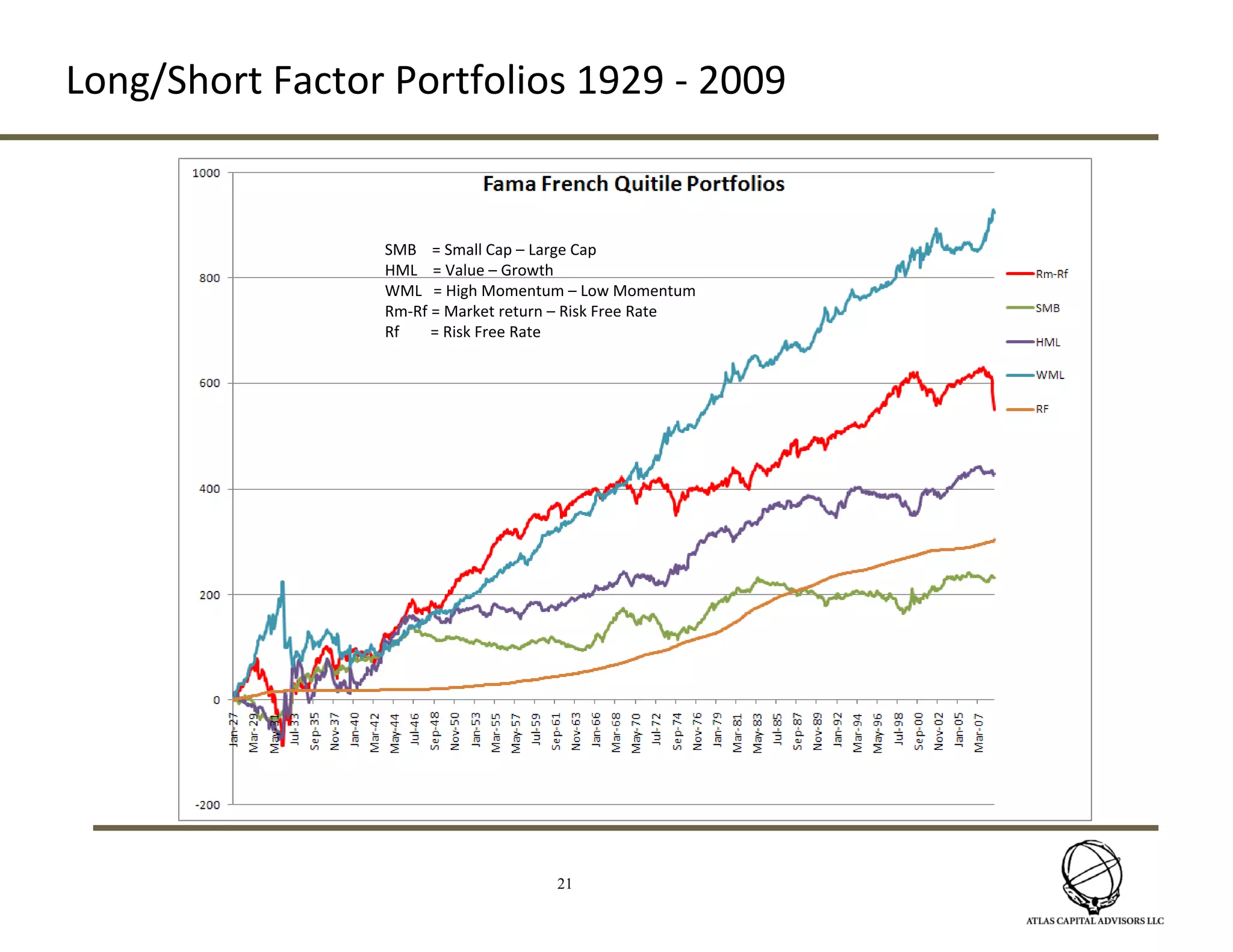

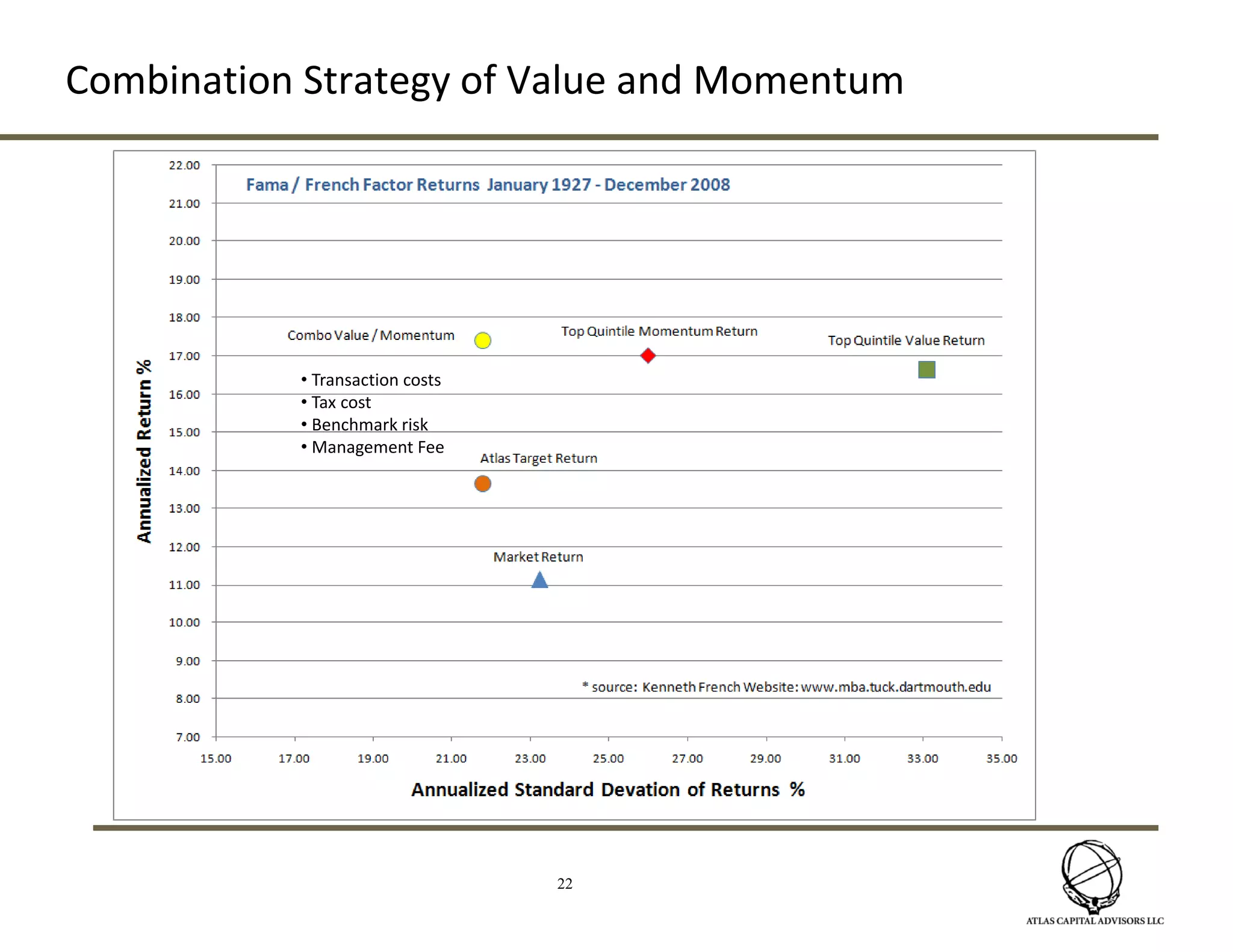

Atlas Capital Advisors provides wealth management services including passive index investing with a focus on minimizing costs, as well as active strategies pursuing factors like value, momentum, and market anomalies. Their fixed income platform emphasizes strategic asset allocation and inflation hedging over credit ratings, while their equity platform uses a "core satellite" approach combining passive index investing with strategies targeting persistent market factors. They aim to add value through factor exposures while controlling transaction costs and taxes.