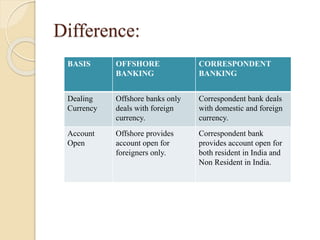

The document discusses correspondent banking and offshore banking, explaining that correspondent banks facilitate international services such as money transfers and currency exchange for other banks, while offshore banking units operate outside their home country and primarily handle transactions in foreign currency. Advantages of correspondent banking include rapid fund movement and assistance with securities, whereas offshore banking offers higher service levels and access to international investment opportunities. The key differences lie in their currency dealings and account opening eligibility, with correspondent banks servicing both residents and non-residents, while offshore banks cater specifically to foreigners.