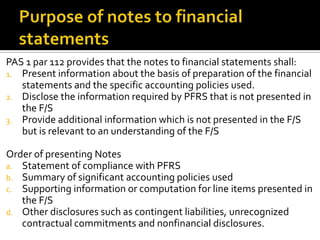

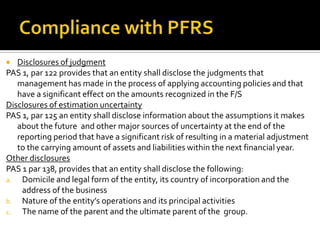

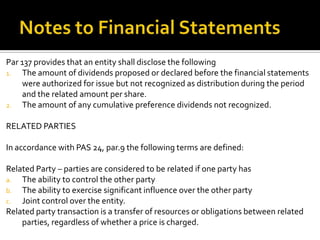

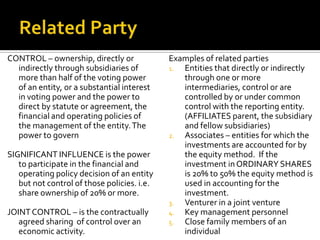

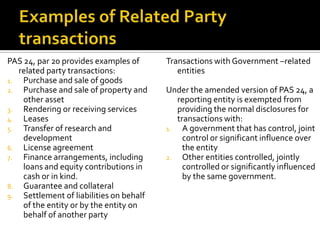

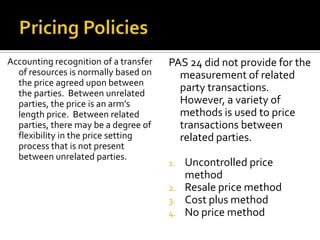

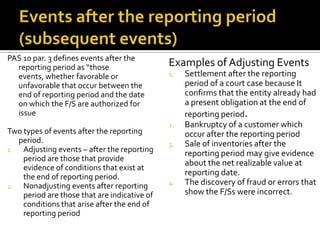

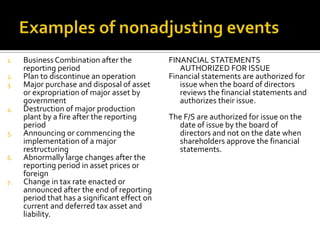

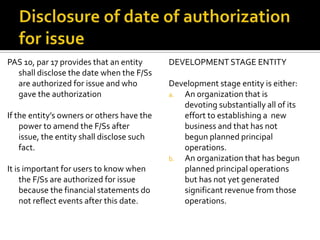

The document discusses key aspects of notes to financial statements according to Philippine Accounting Standards. It explains that notes provide additional narrative descriptions and disclosures to supplement the information in the main financial statements. The notes must be presented systematically and disclose important accounting policies, judgments, estimates, related party transactions, and post-reporting events. The document also provides examples of required note disclosures and the accounting treatment for different types of events and transactions.