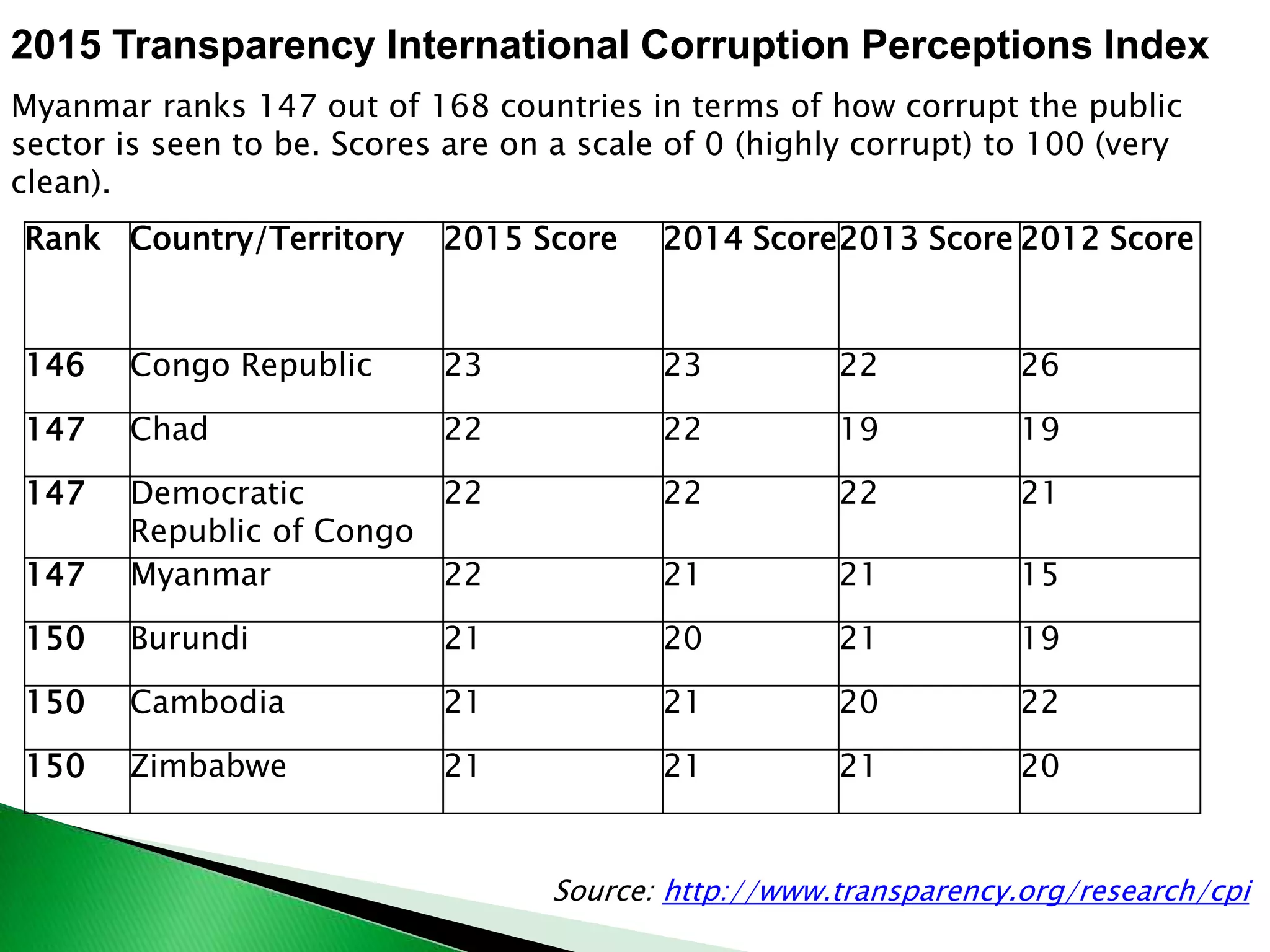

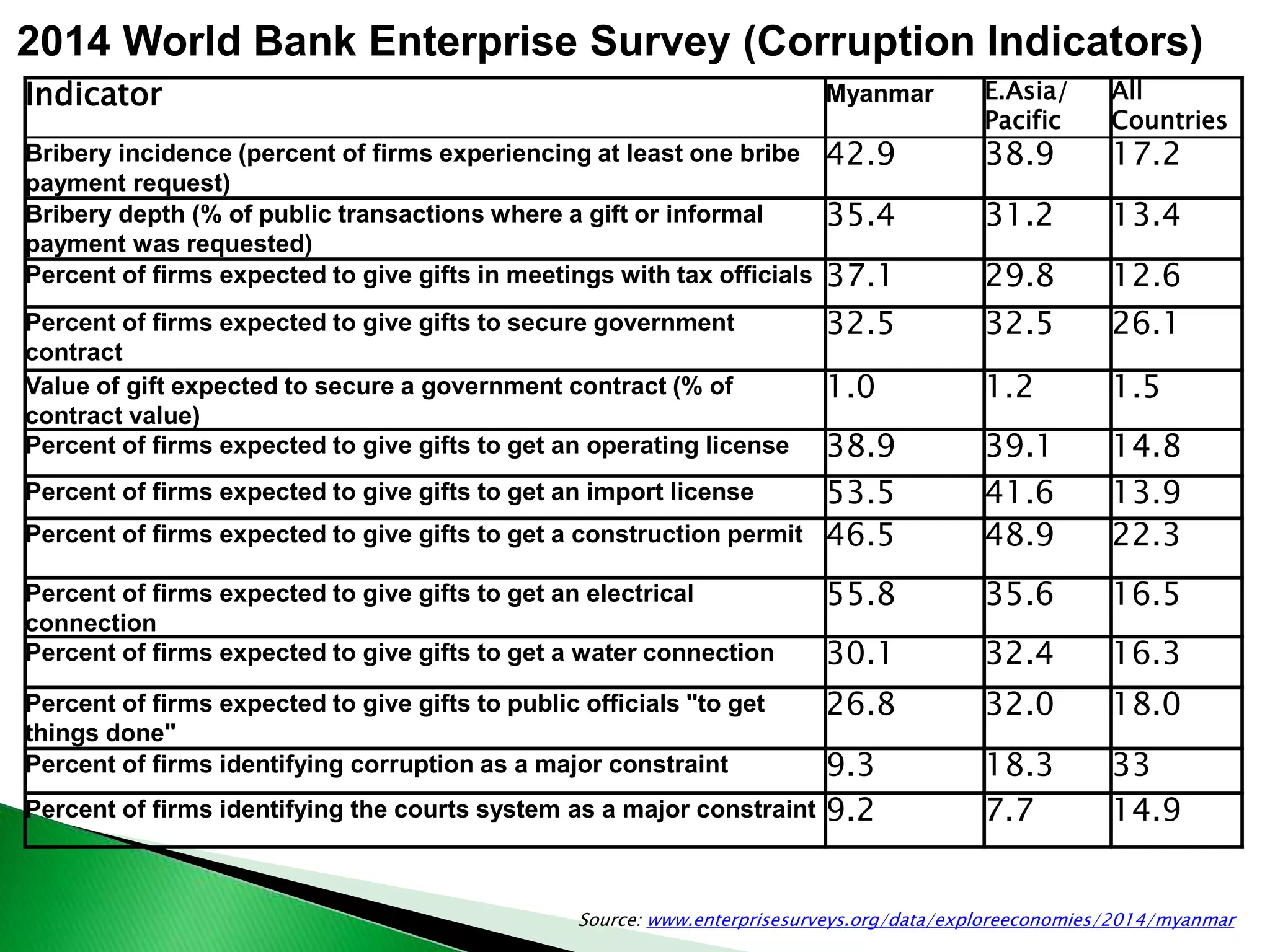

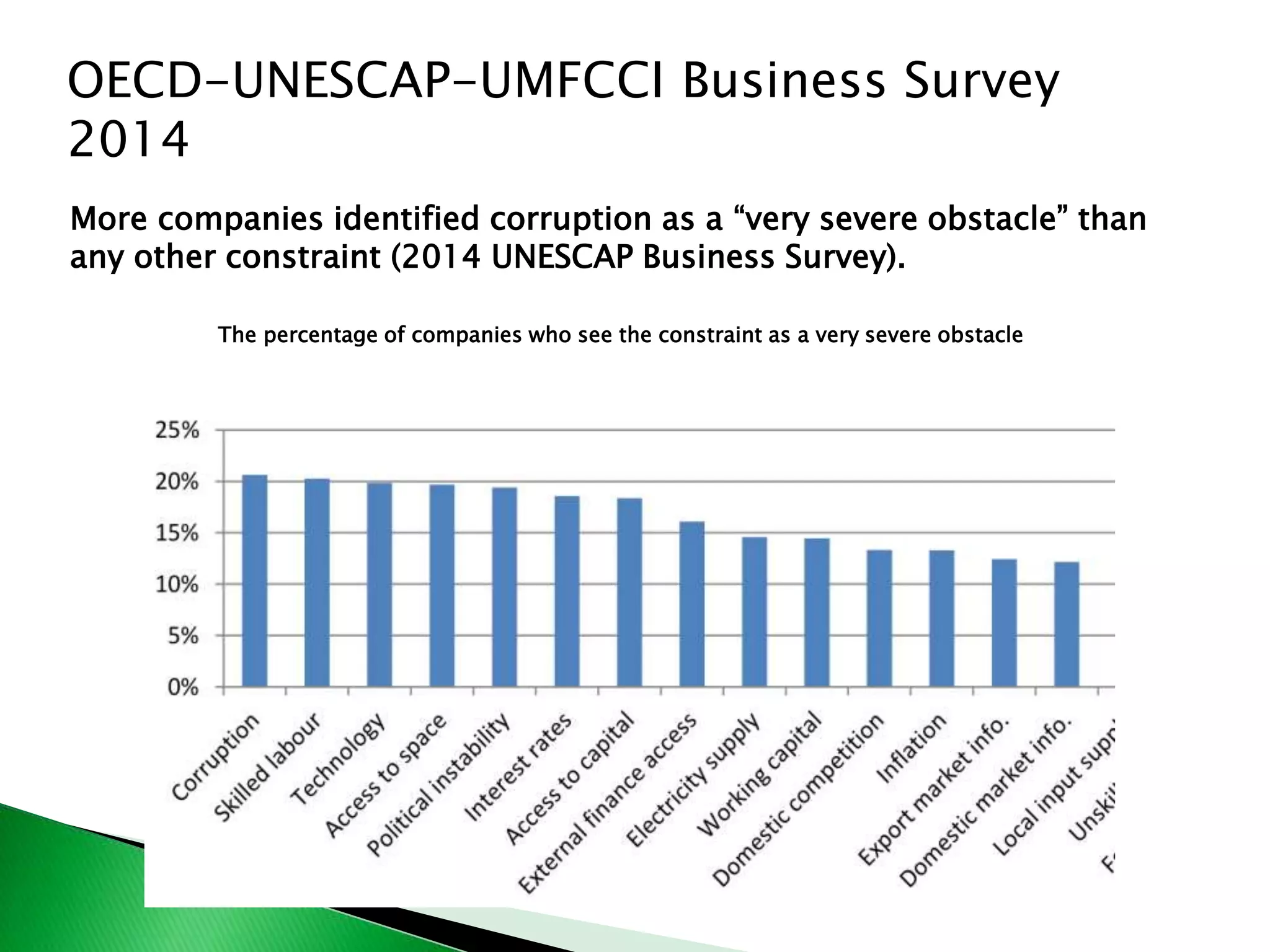

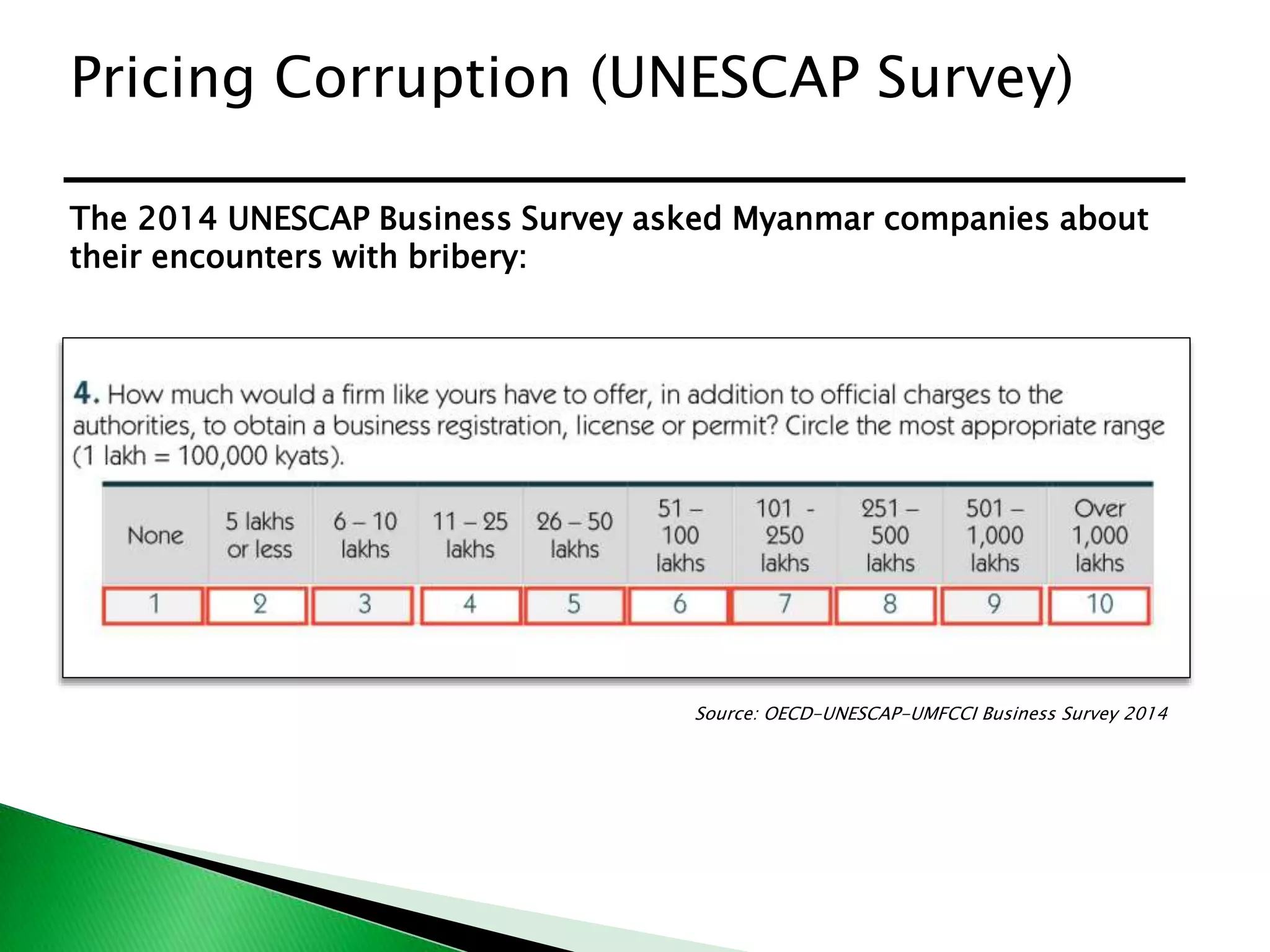

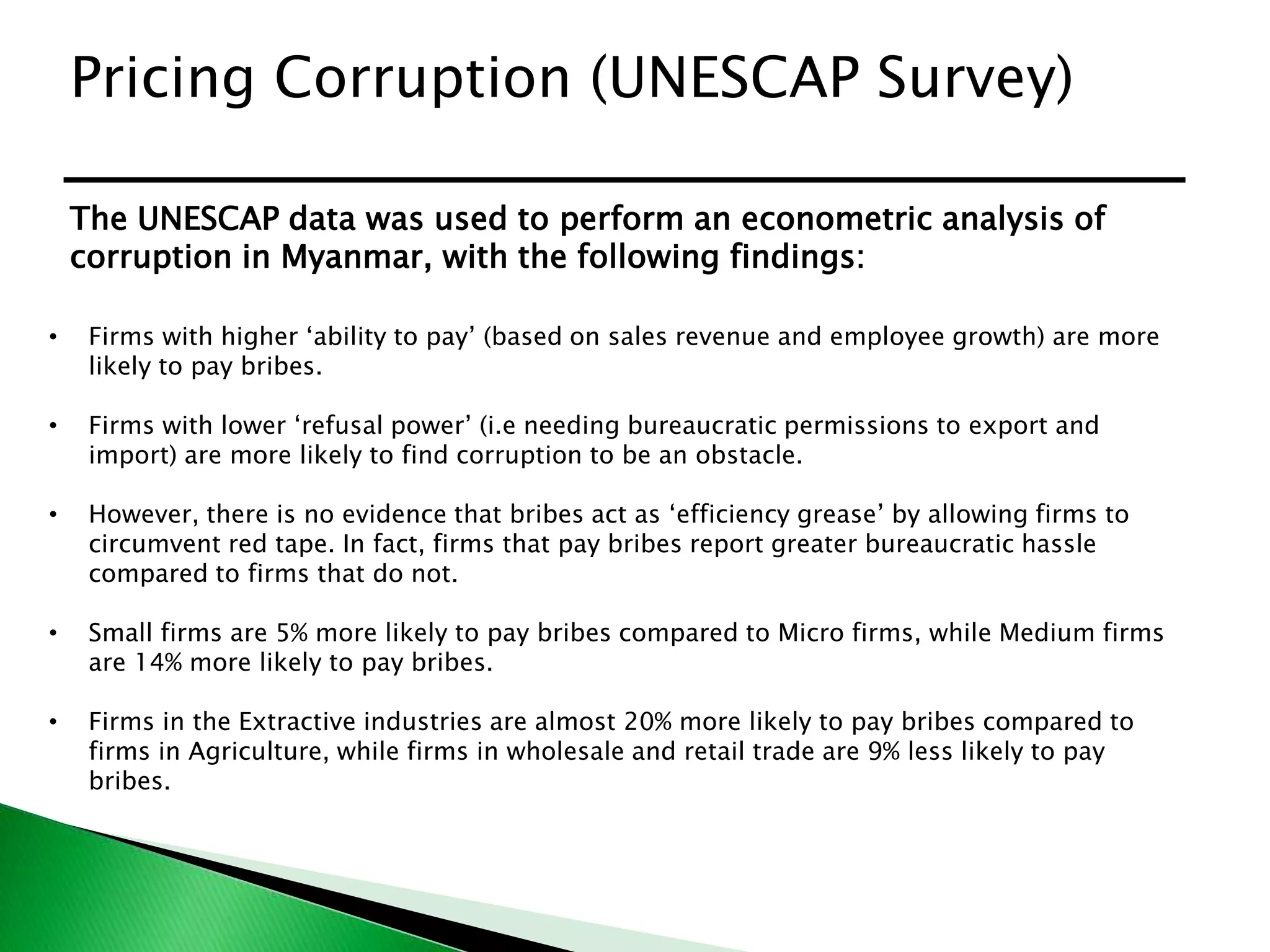

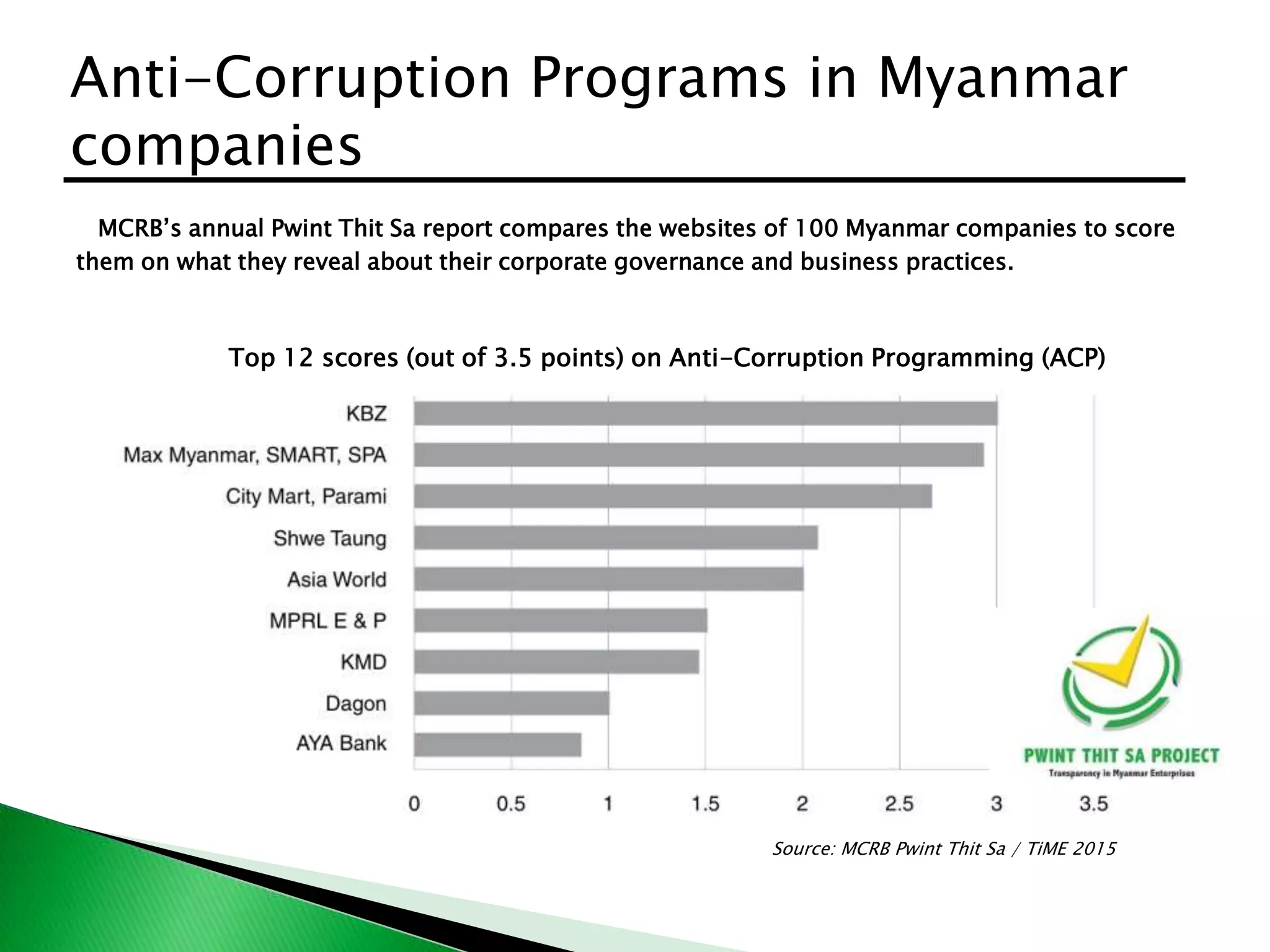

The document discusses corruption in Myanmar, highlighting the country's ranking of 147 out of 168 on the Transparency International Corruption Perceptions Index with a score of 22. It presents data from various surveys indicating a high incidence of bribery among firms, with 42.9% experiencing bribe requests, and explores the relationship between company size and likelihood to pay bribes. Additionally, it mentions the Myanmar Centre for Responsible Business's initiatives to improve corporate governance and anti-corruption measures.