This document summarizes the key financial information from Paraná Banco's 2Q11 conference call. Some of the highlights include:

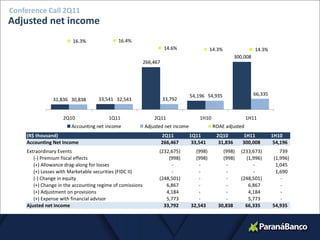

- Adjusted net income for 1H11 was R$66.3 million, a 20.8% increase from 1H10.

- Total assets reached R$3,258.6 million in 2Q11, a 10.3% increase from 2Q10.

- Loan portfolio totaled R$1,753.1 million in 2Q11, a 22.5% increase from 2Q10.

- Fitch upgraded Paraná Banco's rating from "A-(bra)" to "A(bra)".