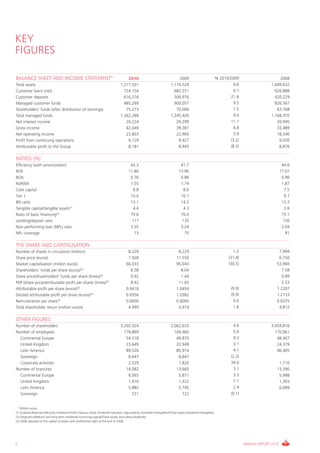

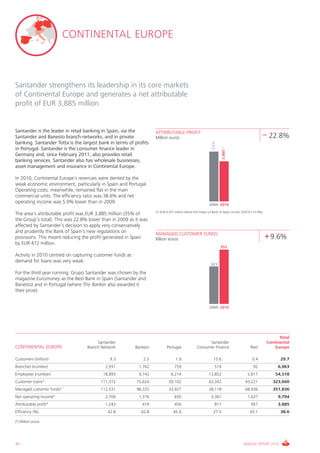

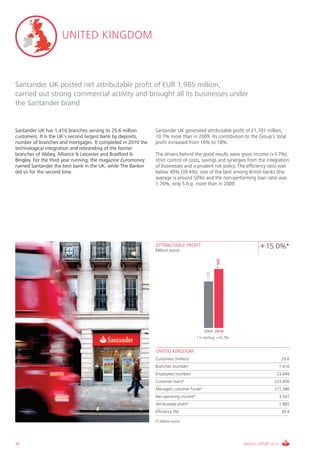

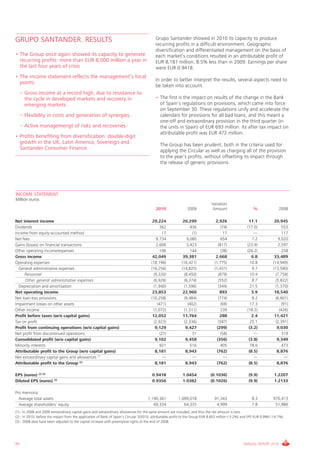

This annual report summarizes Santander Group's performance in 2010. Some key highlights include:

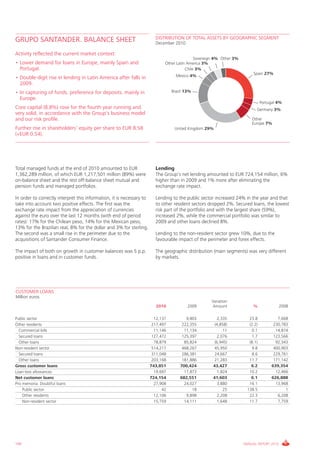

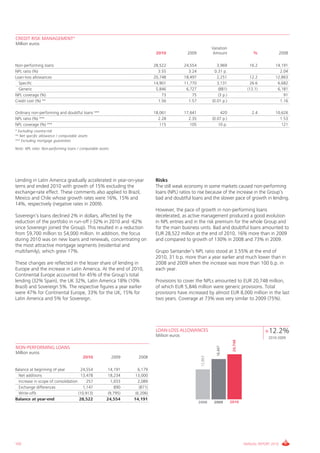

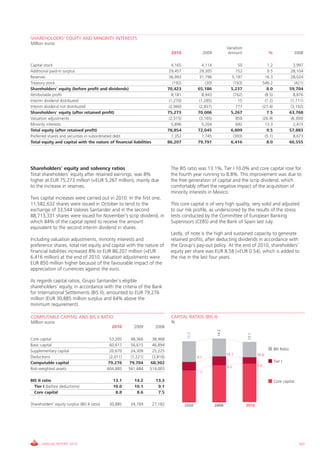

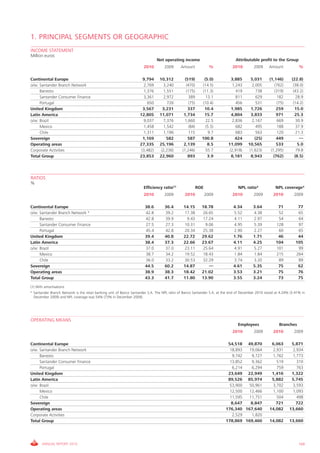

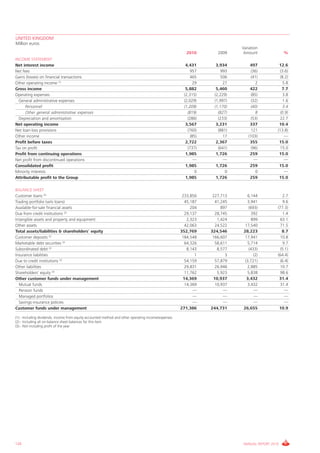

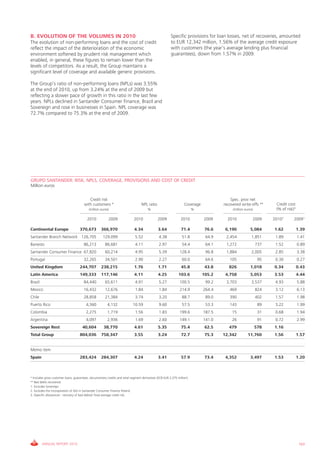

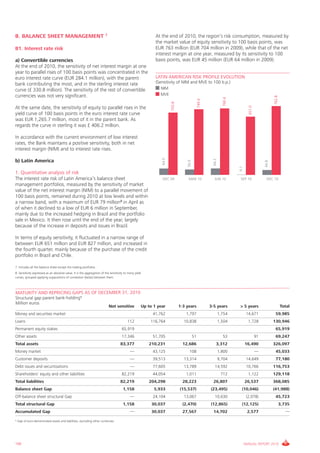

- Total assets grew 9.6% to €1.22 trillion and customer loans grew 6.1% to €724 billion.

- Attributable profit to the Group declined 8.5% to €8.18 billion, as profit from continuing operations fell 3.2% to €9.13 billion.

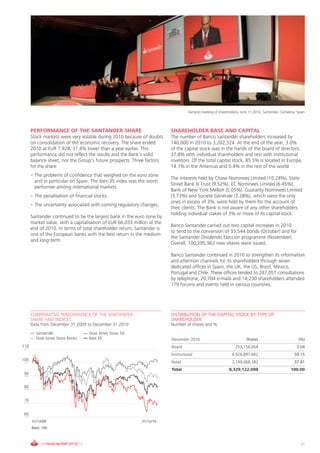

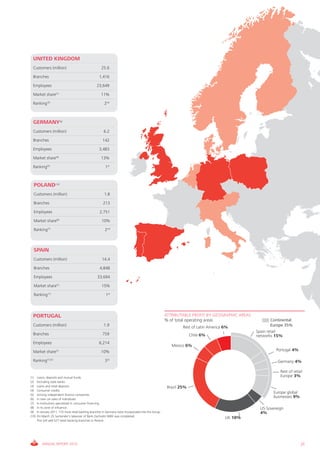

- The Group has a presence across Europe, Latin America, and the United States, with over 14,000 branches and 178,000 employees worldwide.