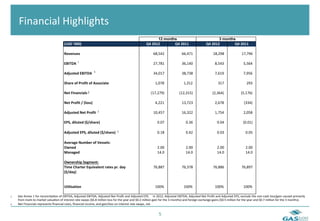

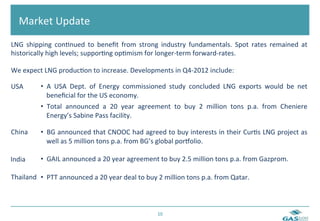

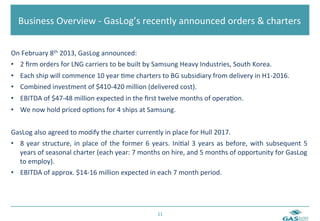

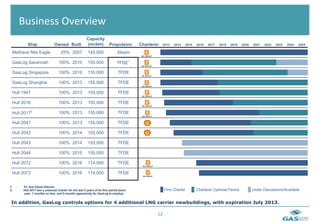

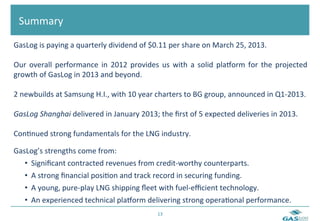

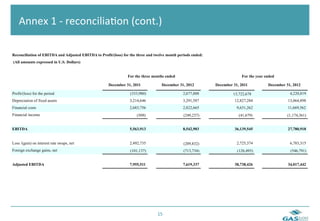

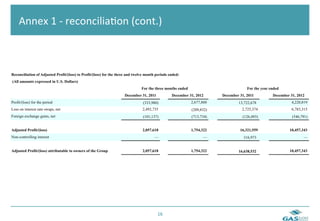

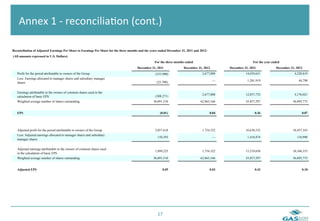

GasLog Ltd. reported financial results for the fourth quarter and full year of 2012. For Q4, revenue was $18.3 million with a profit of $2.7 million. For the full year, revenue totaled $68.5 million with a profit of $4.2 million. Additionally, GasLog took delivery of a new LNG carrier ahead of schedule and contracted for two new LNG vessels to be delivered in 2016 with 10-year charters.