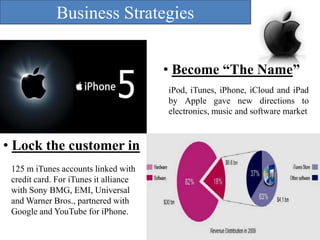

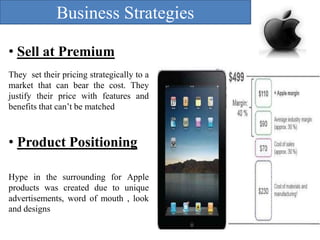

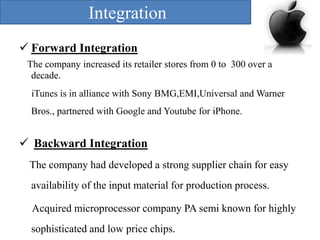

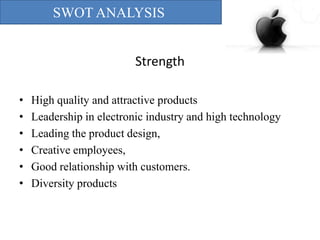

Apple communicates its core values of simplicity, elegance, exclusivity and innovation through its products. It has been successful in creating strong brand loyalty through consistent messaging and focusing on user experience above all else. Apple aims to own the primary technologies behind its products and participate in markets where it can make a significant contribution through innovation. Its business strategies include becoming known for iconic products, locking customers into its ecosystem, selling at a premium based on perceived value, keeping products and branding uniquely simple, and continually updating hardware and software. Apple has a competitive advantage through communicating effectively to its audience, strategic partnerships, product quality and being a leader in innovation.