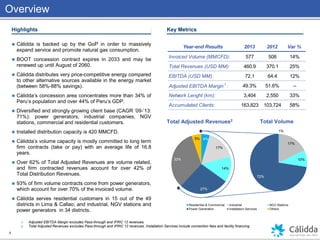

The document provides an overview of Cálidda's results and significant developments in 2013. Some key points:

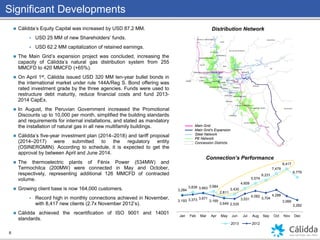

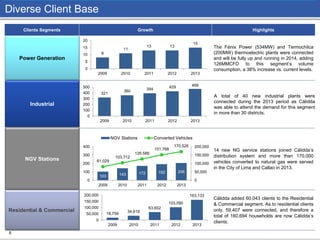

- Cálidda expanded its natural gas distribution network by over 850 km and increased capacity from 255 MMCFD to 420 MMCFD.

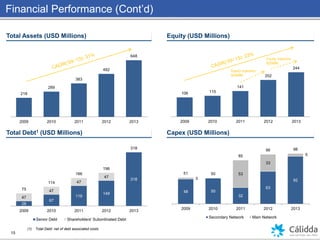

- It issued $320 million in bonds and increased equity by $87.2 million.

- The customer base grew 58% to over 163,000 customers, with record monthly connections in November.

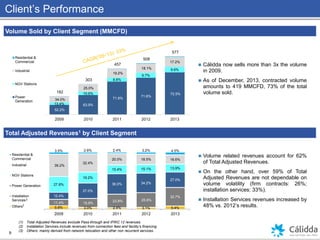

- Financial performance was strong with revenues up 25%, EBITDA up 12%, and adjusted EBITDA margin at 49.3%.