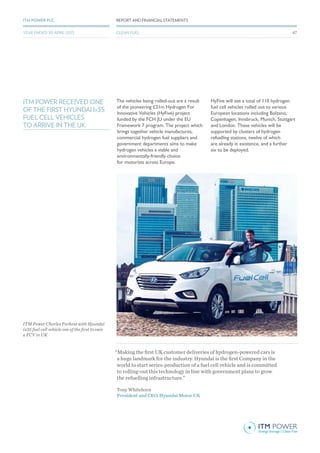

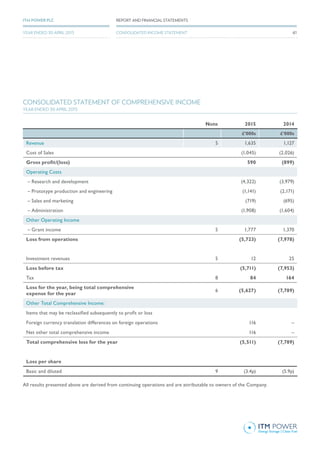

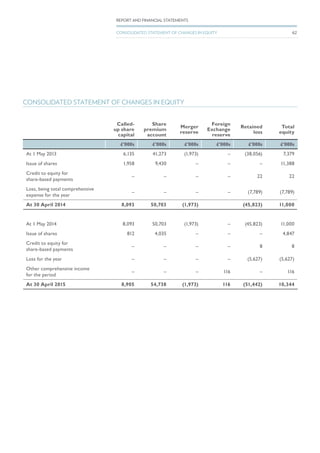

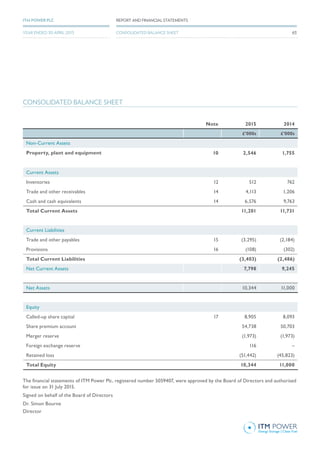

This document provides an annual report and financial statements for ITM Power Plc for the year ended 30 April 2015. It summarizes ITM Power's business activities in energy storage and clean fuel production using hydrogen, outlines its key financial results for the year and corporate developments. It highlights ITM Power's technical achievements in the year including increased hydrogen output, stack cost reductions and commercial progress including new contracts and funding.