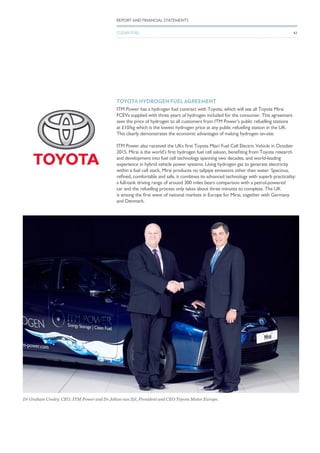

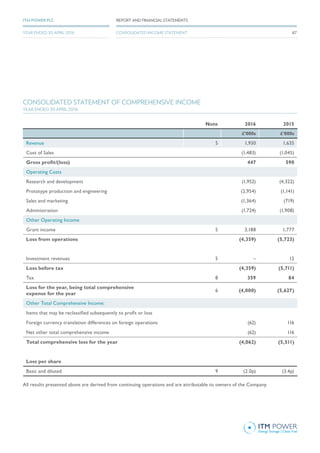

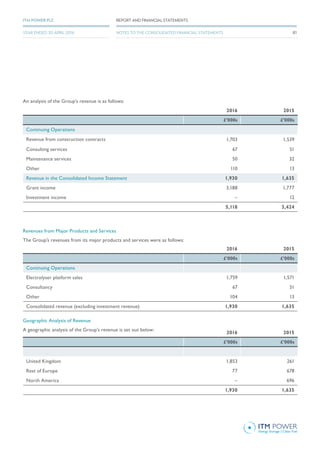

ITM Power PLC, a company focused on integrated hydrogen energy solutions, reported significant growth in 2016 with revenues of £8.19 million, driven by an increasing global demand for hydrogen refuelling and energy storage services. The company is positioned well in the market, supported by strategic partnerships and grants for initiatives in hydrogen refuelling stations and power-to-gas systems. With major automotive OEMs beginning to roll out fuel cell electric vehicles, ITM Power aims to capitalize on the clean transport and energy storage sectors.