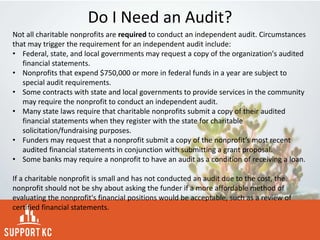

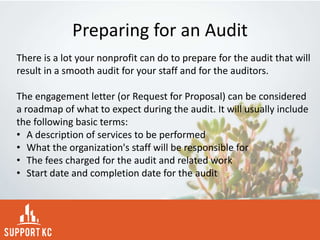

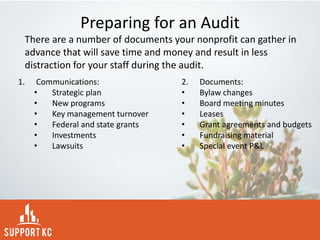

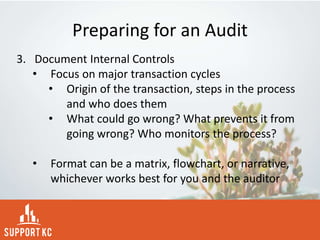

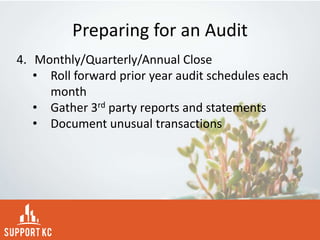

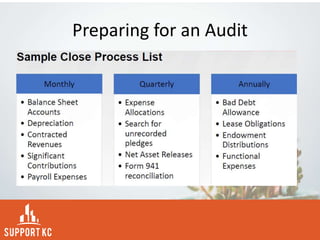

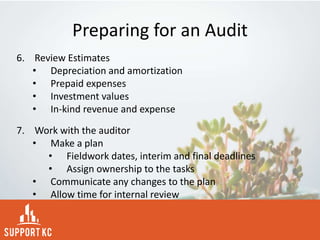

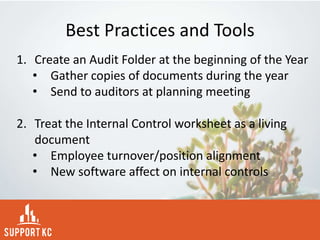

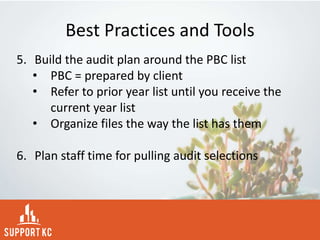

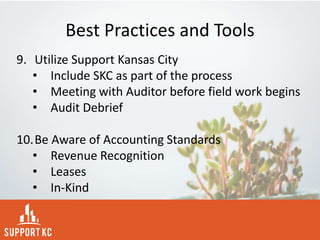

This document provides an overview of the audit process for non-profit organizations. It defines an audit as an independent examination of an organization's financial records, accounts, transactions, practices, and controls. It outlines what is involved in an audit, including analytical procedures, control testing, and substantive testing. It also discusses what triggers the need for an audit, how to prepare for an audit by gathering documents, reviewing internal controls and prior audits, and best practices like maintaining an audit folder and communicating with auditors. The goal is to have a smooth audit that provides value to both the organization and auditors.