This presentation discusses the development of adaptive trading systems that can operate in either trend mode or cycle mode. It begins with the philosophical background justifying market cycles and how they can be measured. It then demonstrates how to identify the current market mode using cycle phase calculations. Trading strategies are proposed to either follow trends when the market is trending or trade cycles when the market is ranging. Code examples are provided to program adaptive trend following and cycle trading systems in TradeStation. The systems are backtested on currency and stock market data with positive results.

![SLIDE 22

A Useful Code Fragment

(Enables Excel Manipulation of Equity Curves)

If Date>Date[1] then

Print(File(“c:tsgrowthtest.txt”),date,”,”,

netprofit + positionprofit(0));

Prints an ASCII file called TEST.TXT

The file is your day-by-day equity curve

Located in the C:TSGROWTH directory. You

must have previously created this directory

You can call this file and manipulate the data

with Excel](https://image.slidesharecdn.com/mesapresentationprofitableadaptivetradingsystems-230415201708-1e6c0e9c/75/__MESA-presentation-Profitable-Adaptive-Trading-Systems-ppt-22-2048.jpg)

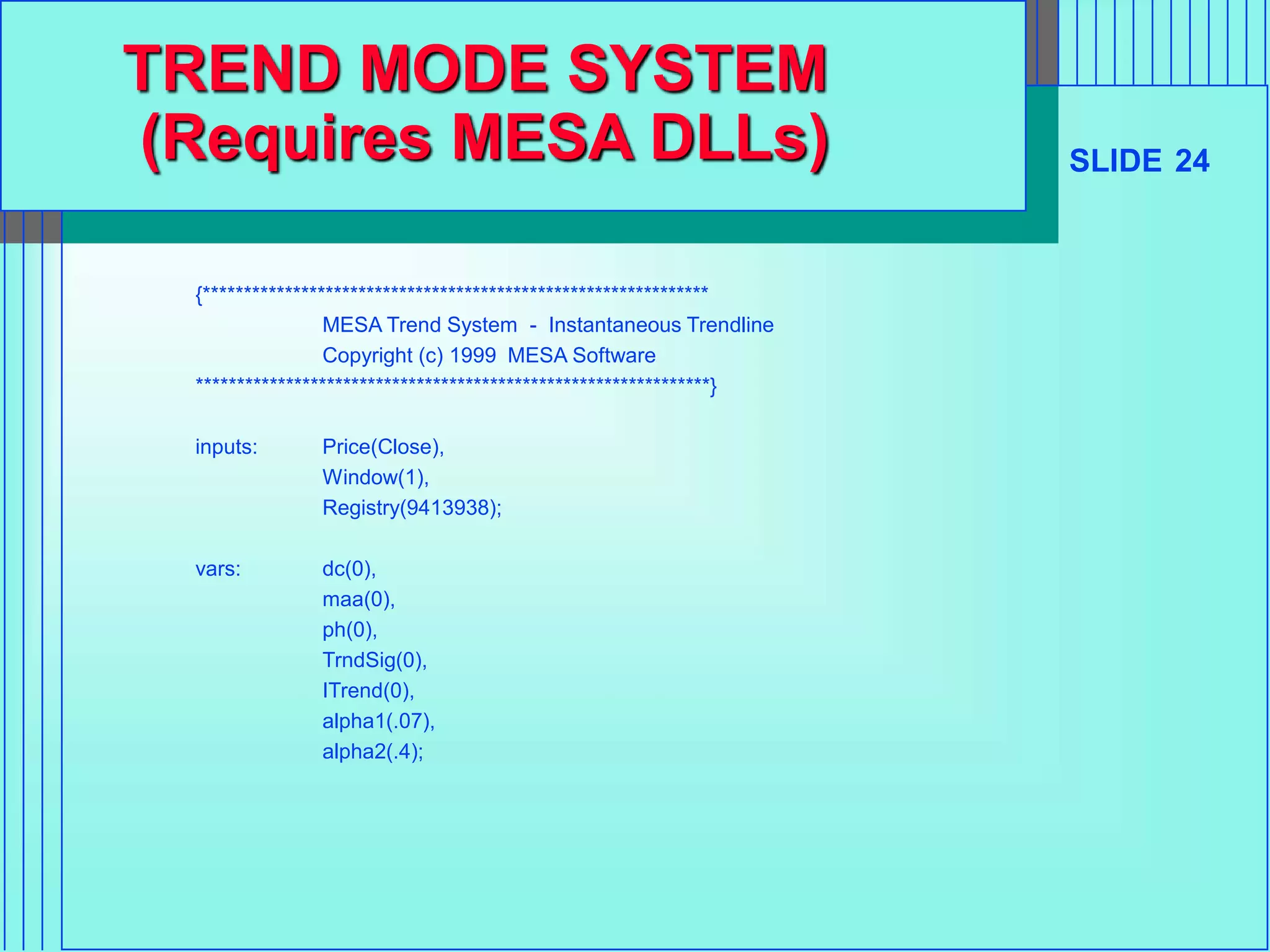

![SLIDE 26

TREND MODE SYSTEM

(Concluded)

If CurrentBar > 51 then begin

if TrndSig crosses over ITrend or TrndSig crosses under ITrend then begin

if checkalert then alert = true;

end;

value1 = alpha1*ITrend + (1 - alpha1)*value1[1];

value2 = alpha2*value1 + (1 - alpha2)*value2[1];

If value1 Crosses Over value2 then buy;

If value1 Crosses Under value2 then sell;

end;](https://image.slidesharecdn.com/mesapresentationprofitableadaptivetradingsystems-230415201708-1e6c0e9c/75/__MESA-presentation-Profitable-Adaptive-Trading-Systems-ppt-26-2048.jpg)