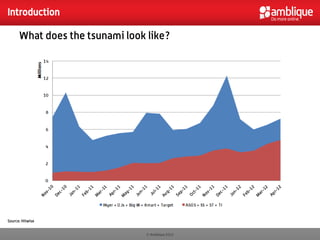

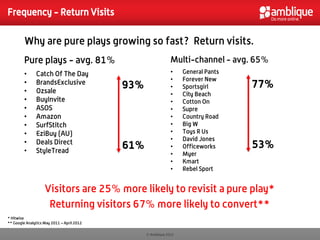

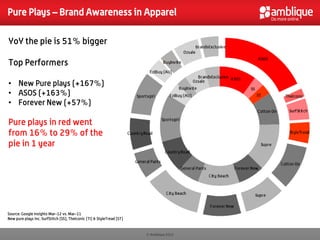

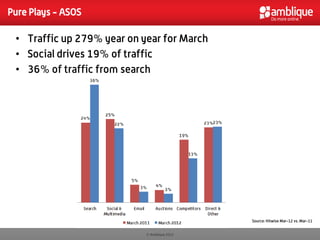

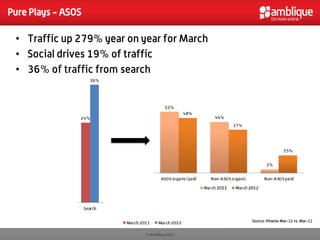

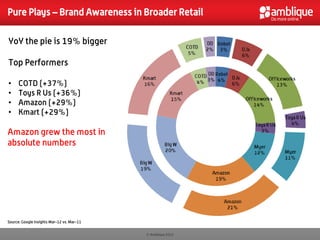

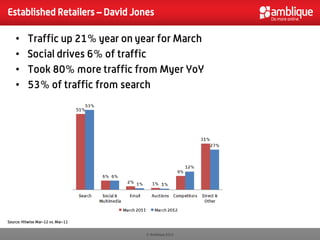

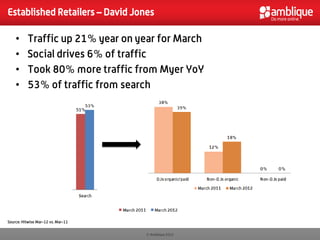

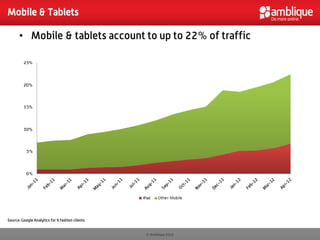

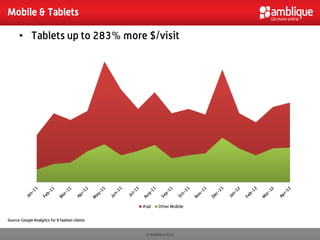

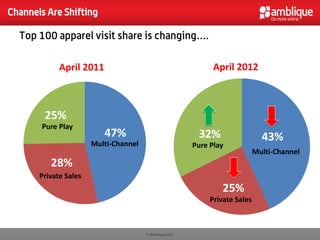

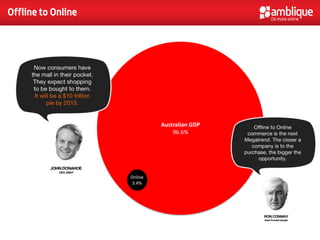

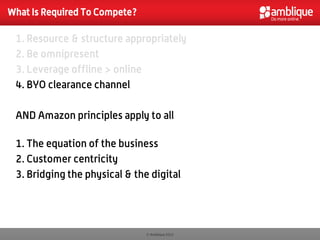

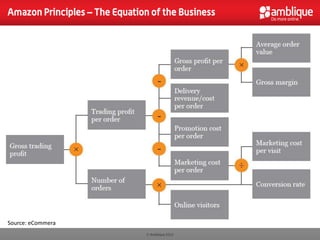

The document analyzes the growth of pure play retailers compared to multi-channel stores, noting that pure plays have a significantly higher rate of return visits and conversions. Key trends include the increasing influence of mobile traffic and social media in driving sales, with specific examples of successful brands like ASOS and Forever New. It concludes that established retailers must adapt to these changes and compete by leveraging online strategies while integrating physical and digital sales channels.