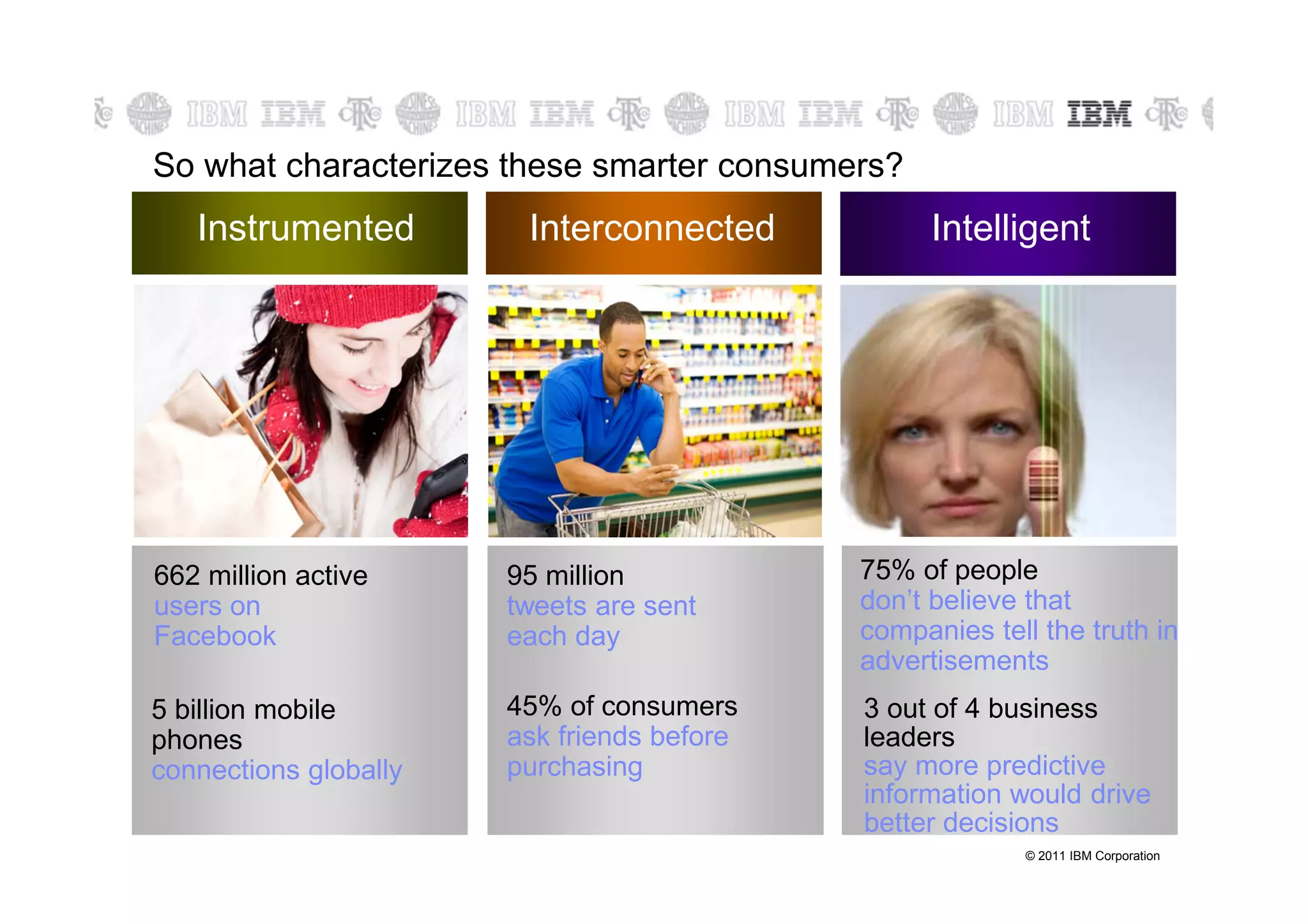

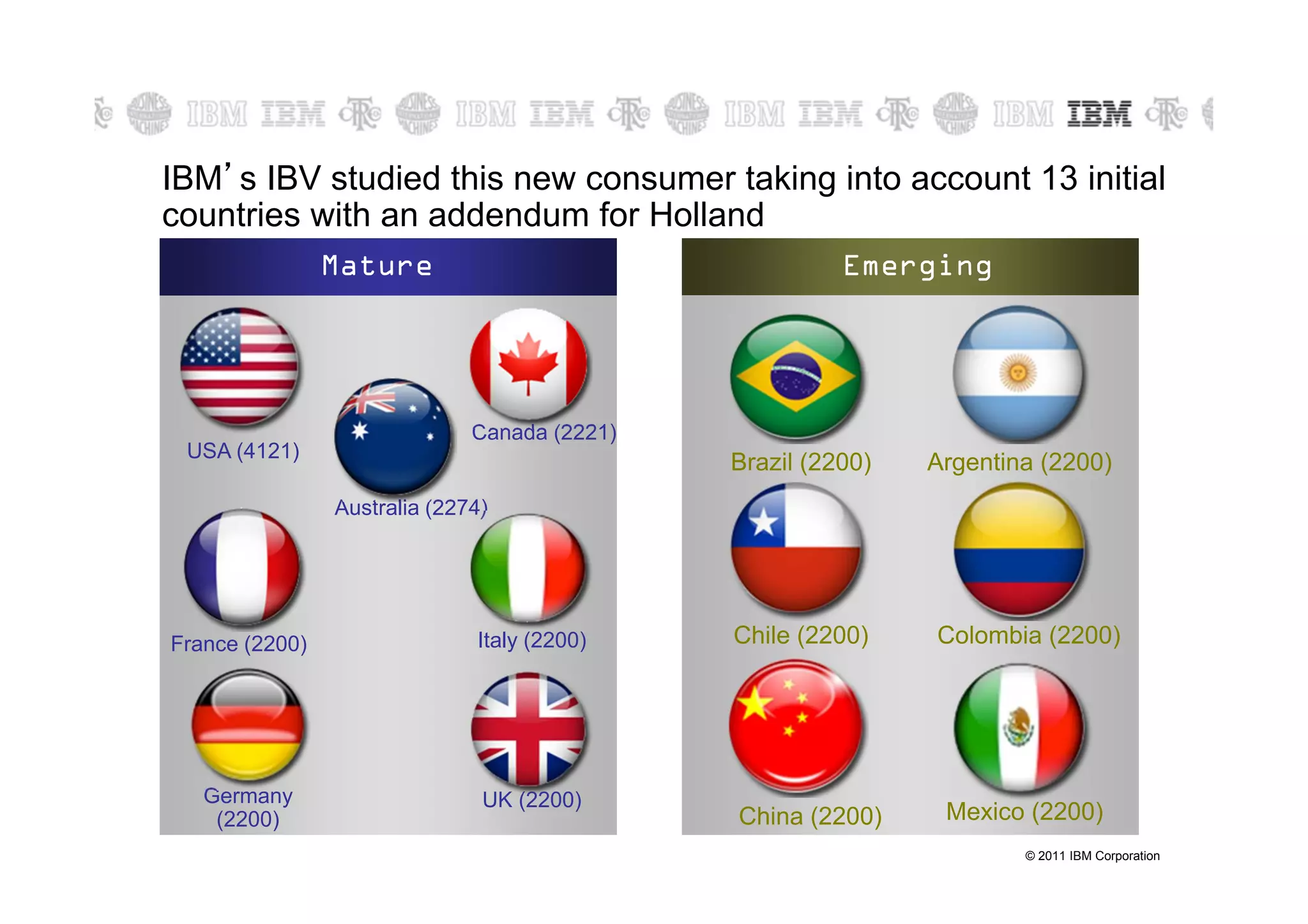

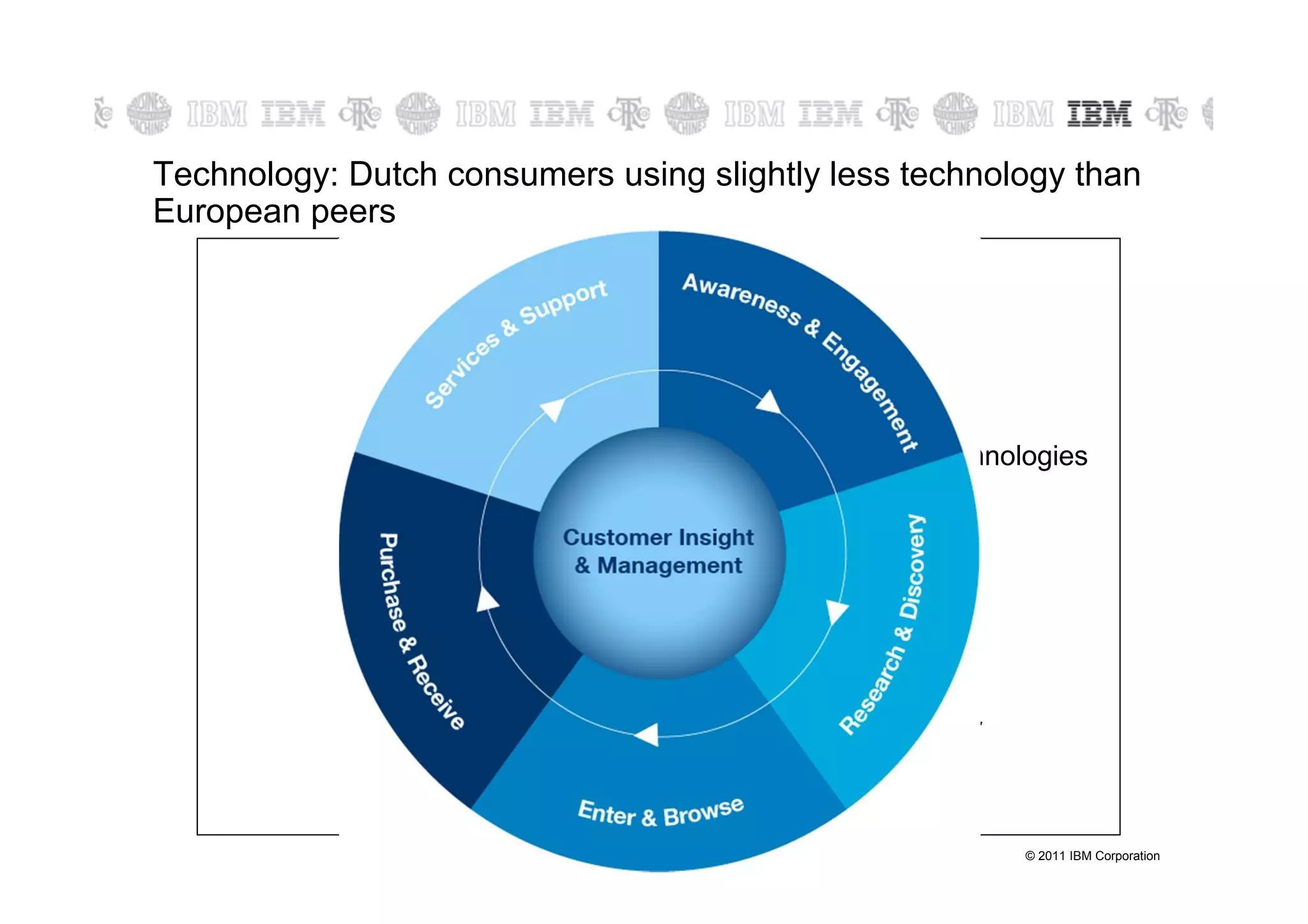

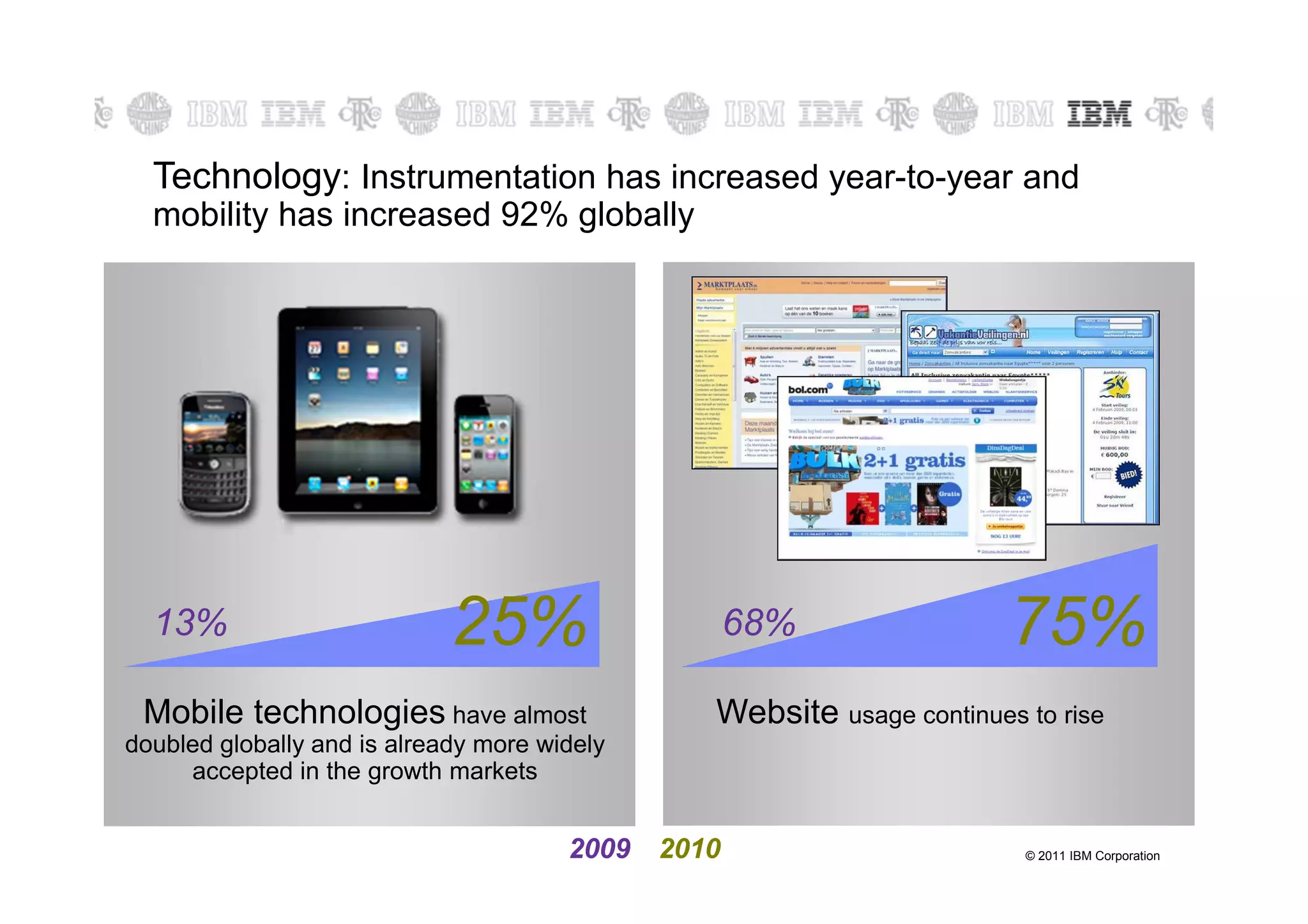

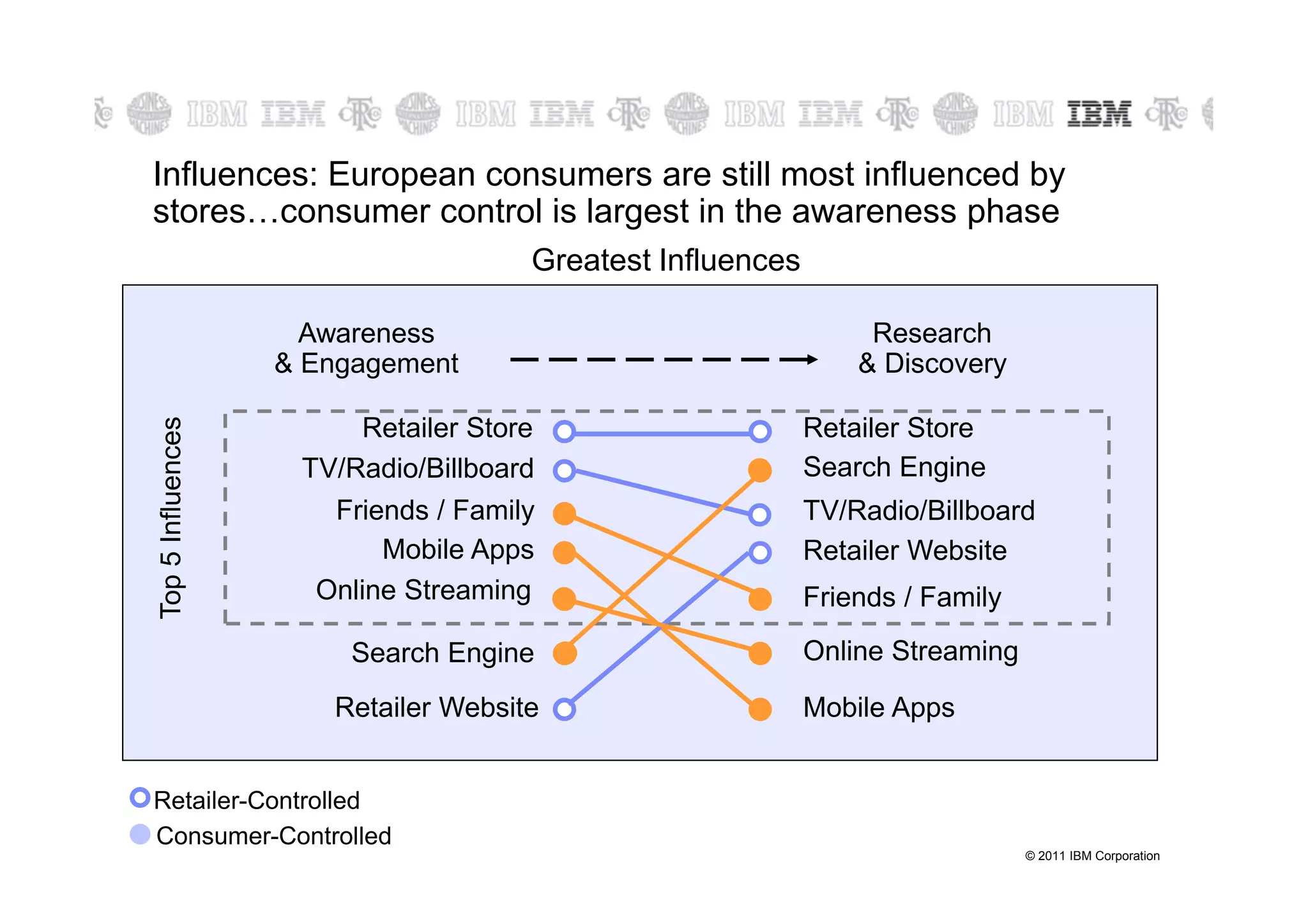

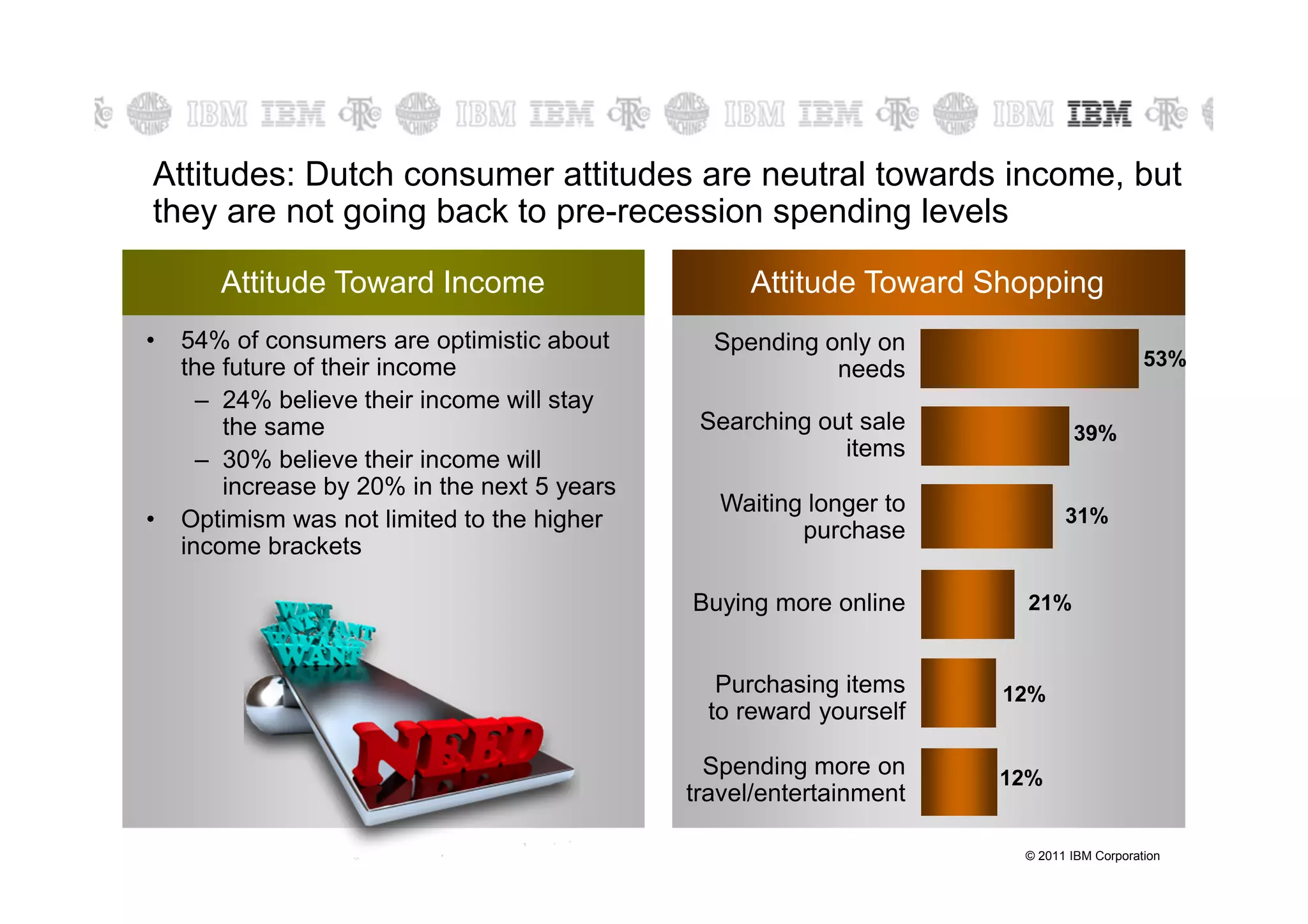

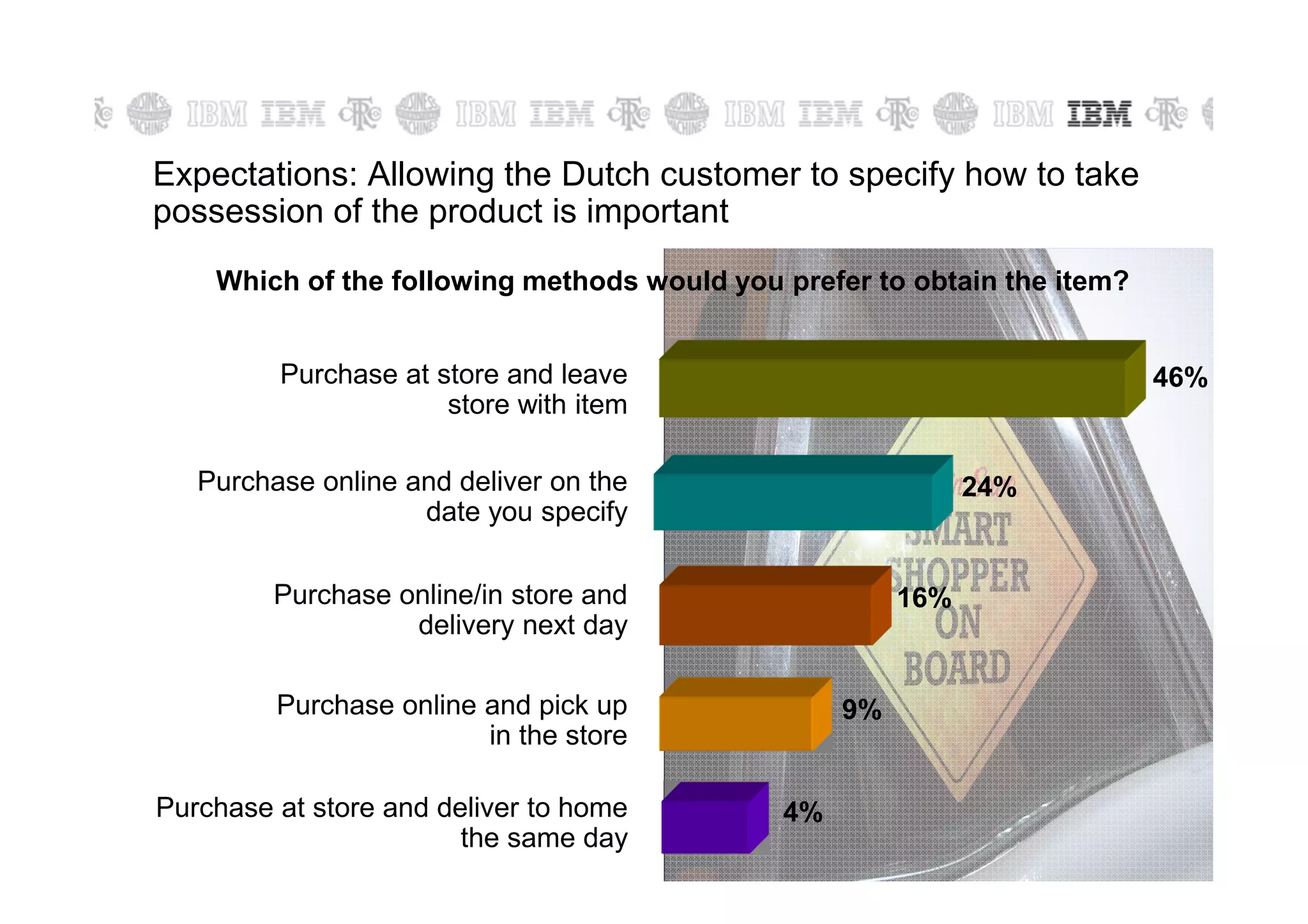

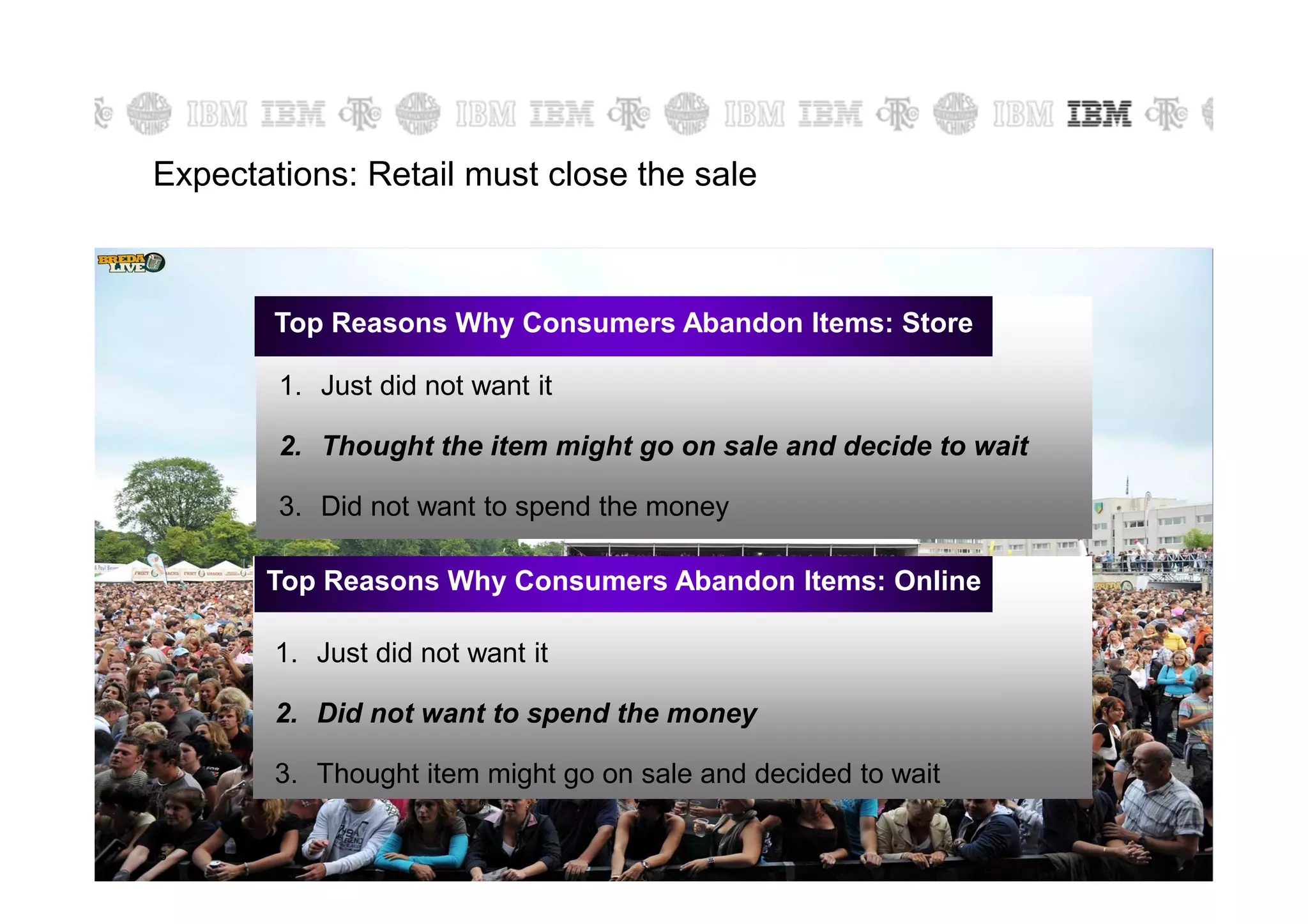

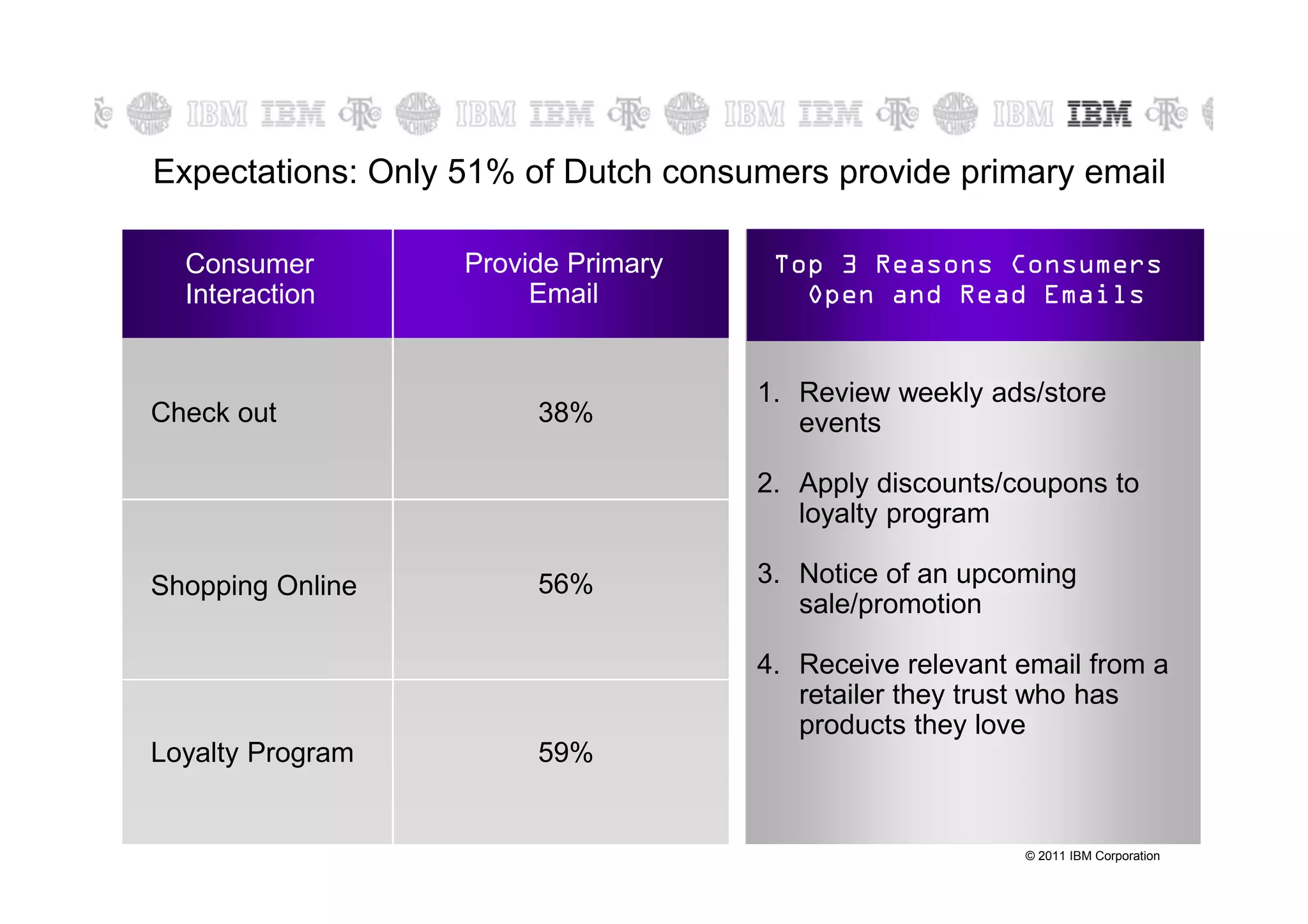

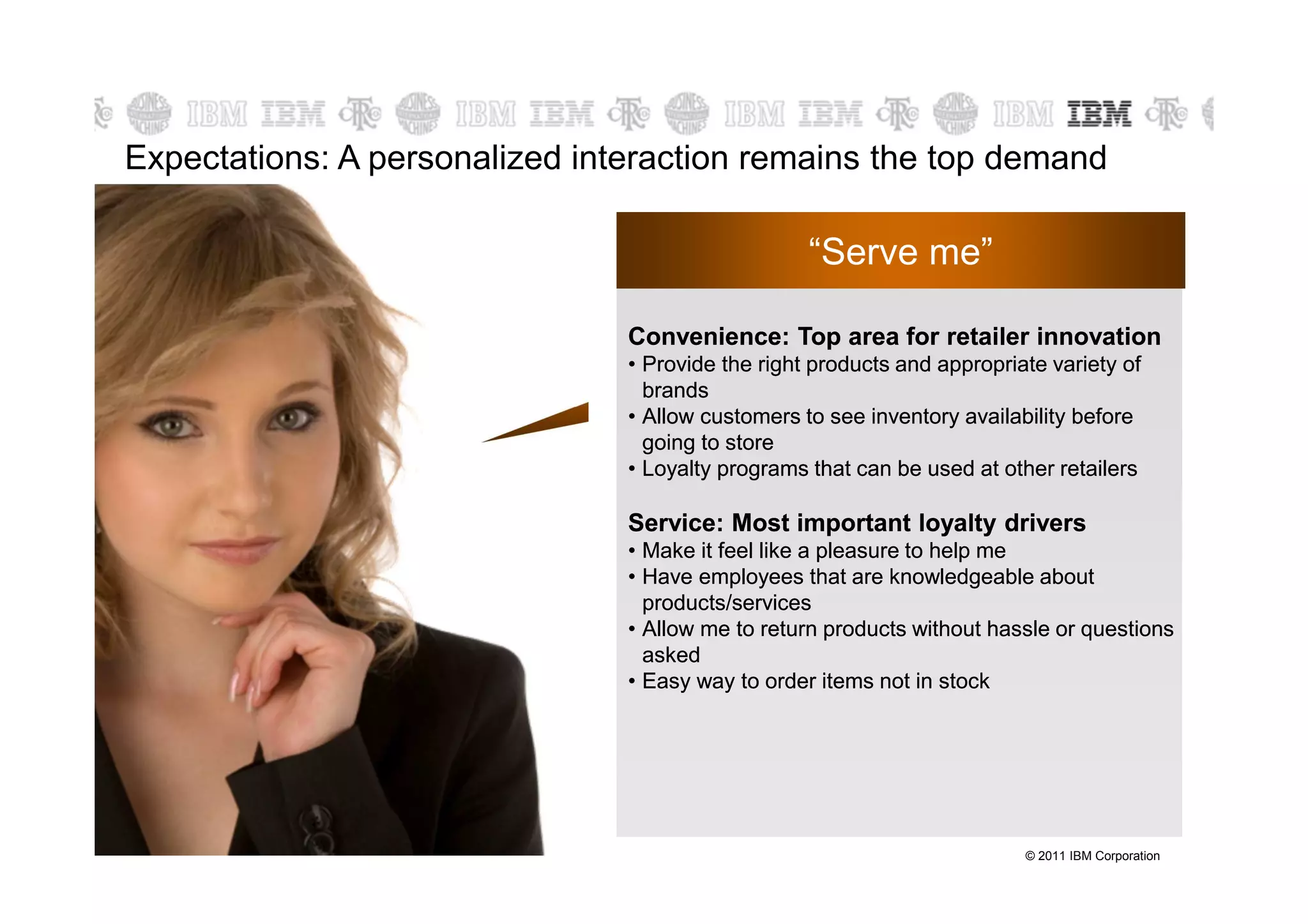

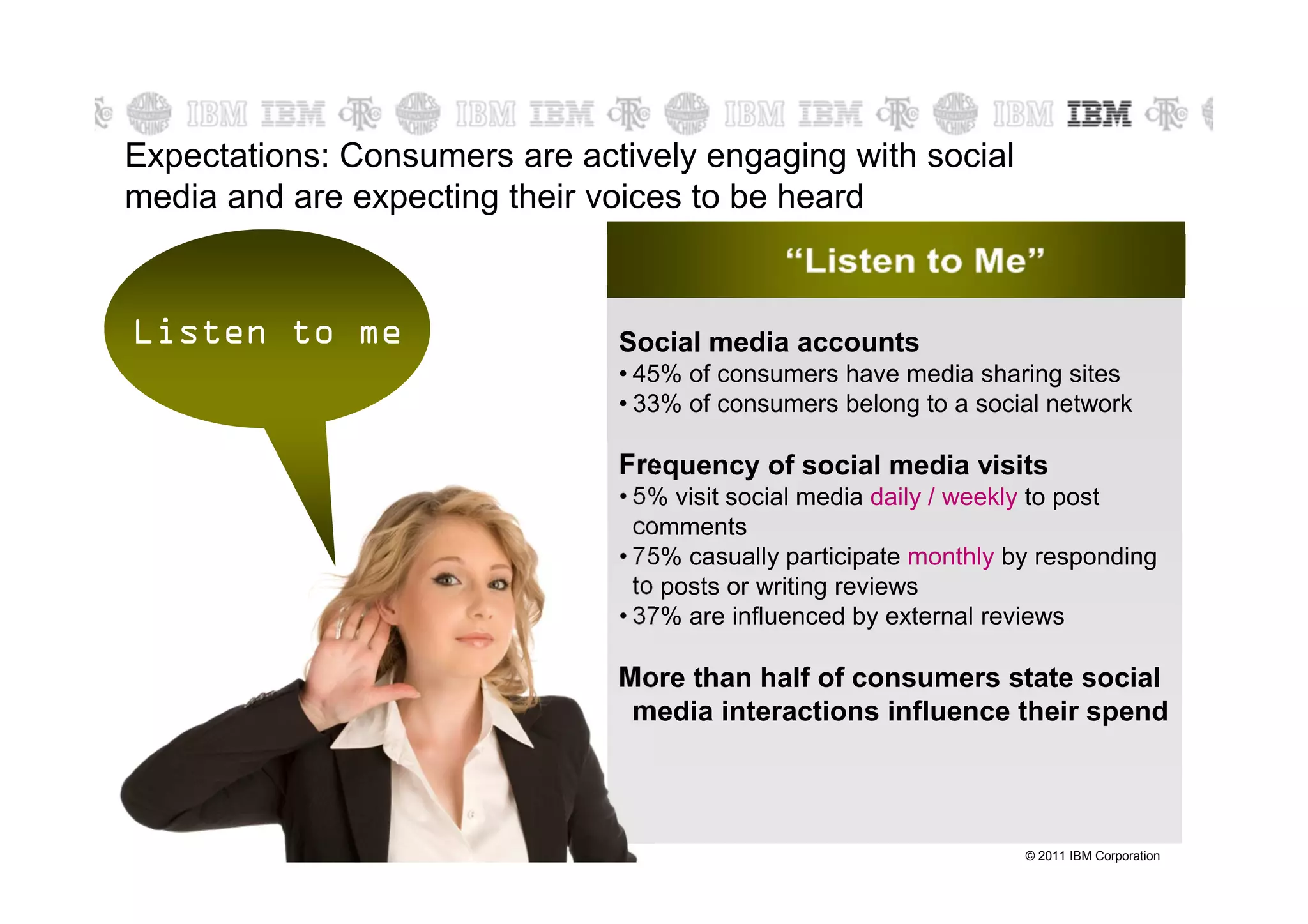

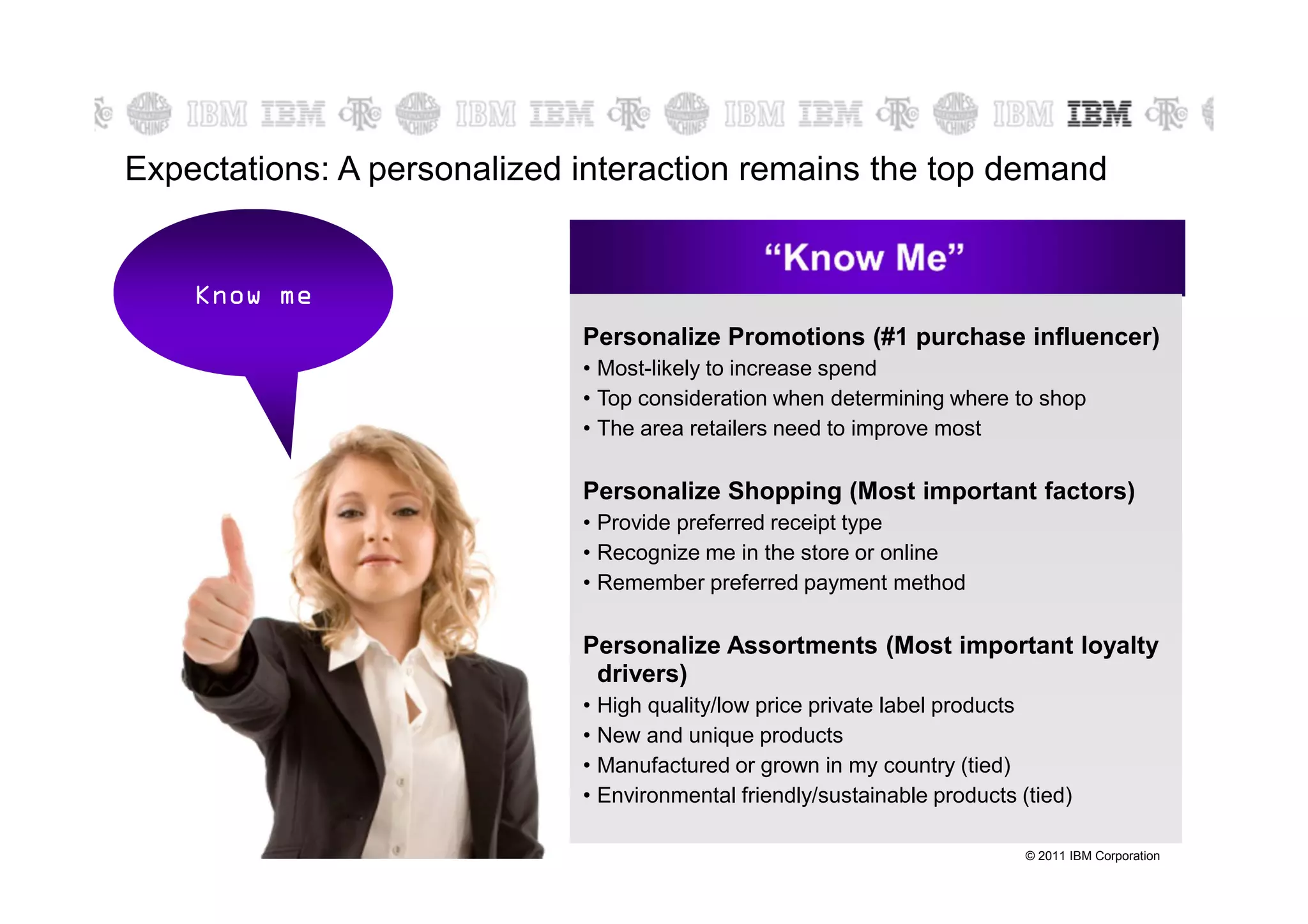

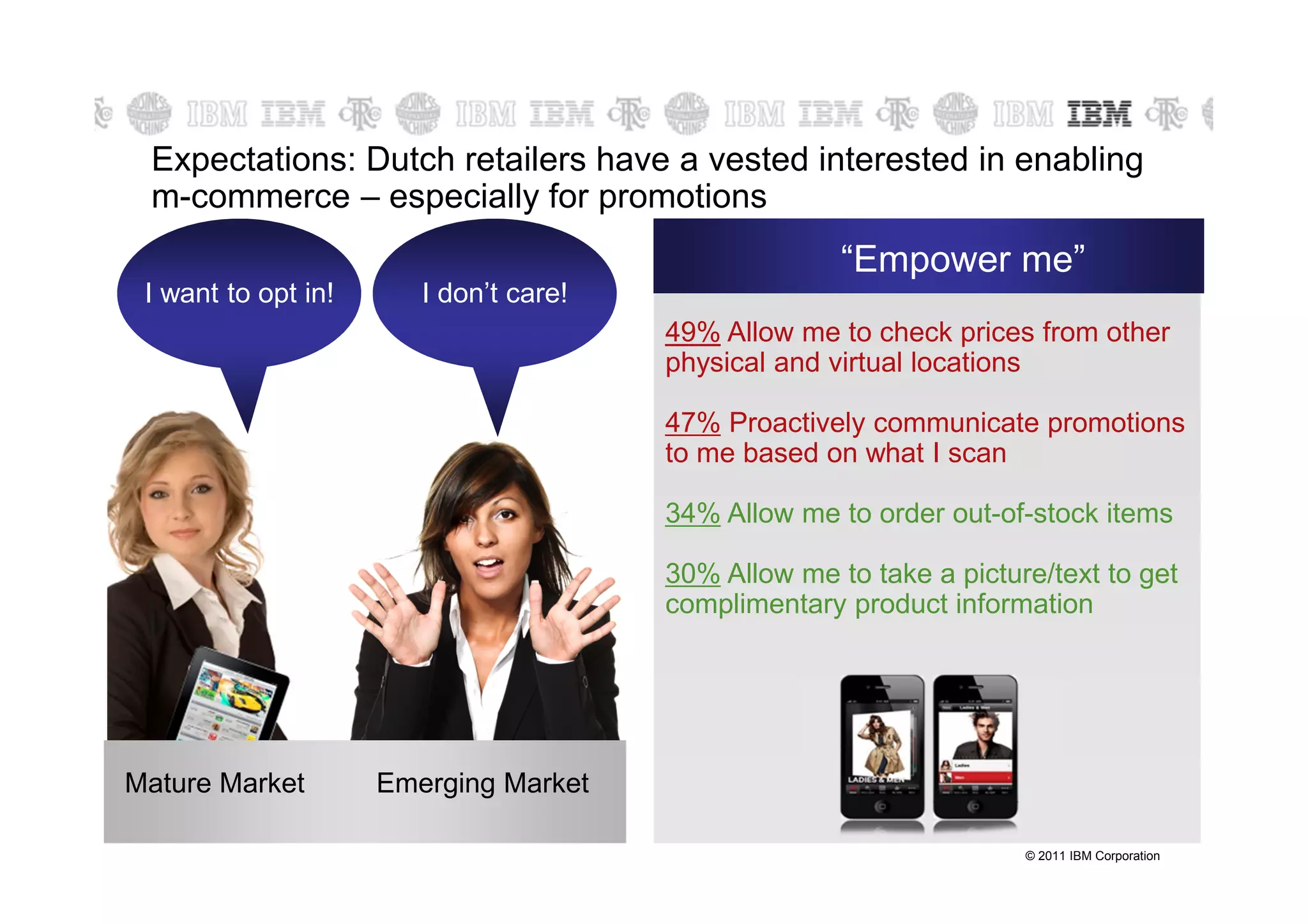

The document discusses how today's consumers are smarter and more technology-savvy. It notes that 662 million people are active on Facebook, 95 million tweets are sent daily, and 5 billion mobile phone connections exist globally. The document then summarizes research by IBM on the profile of smarter consumers, noting that they are more instrumented, interconnected, and intelligent. It provides data on how Dutch consumers compare to European peers in their use of technology and their influences, attitudes, and expectations around shopping and retailers. The key expectations are for retailers to know customers, serve them with convenience and personalization, listen to their voices including via social media, and empower them.