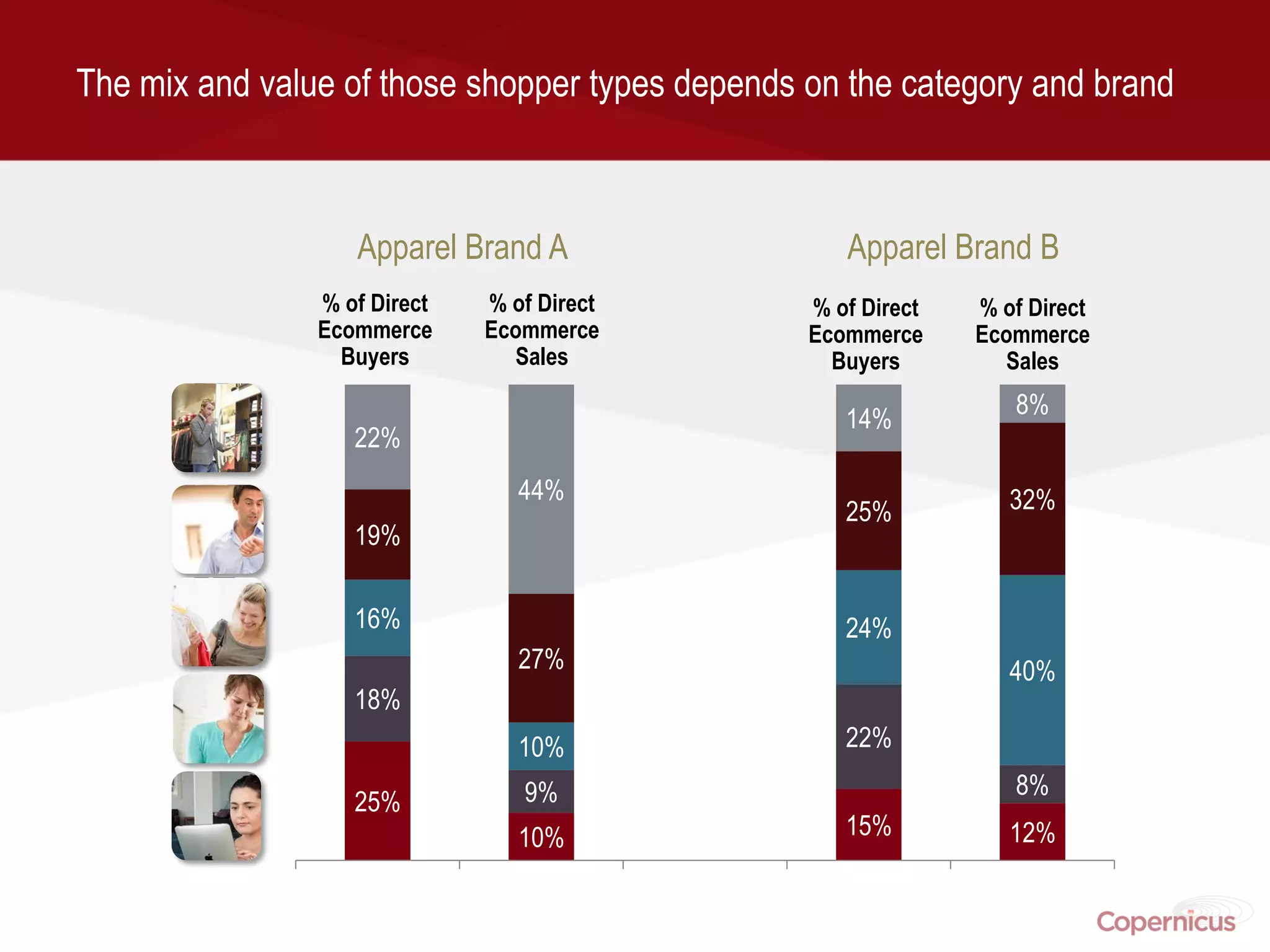

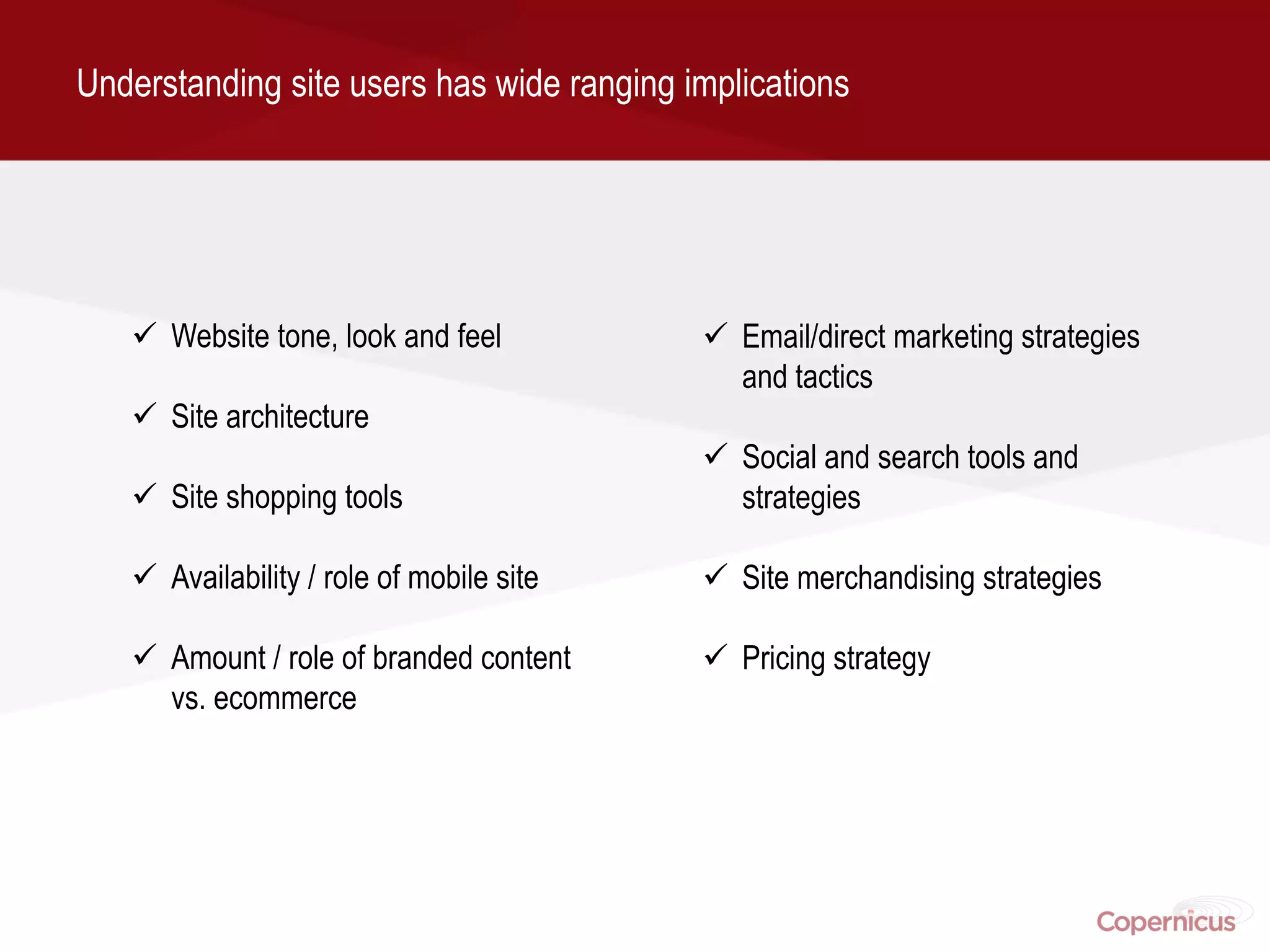

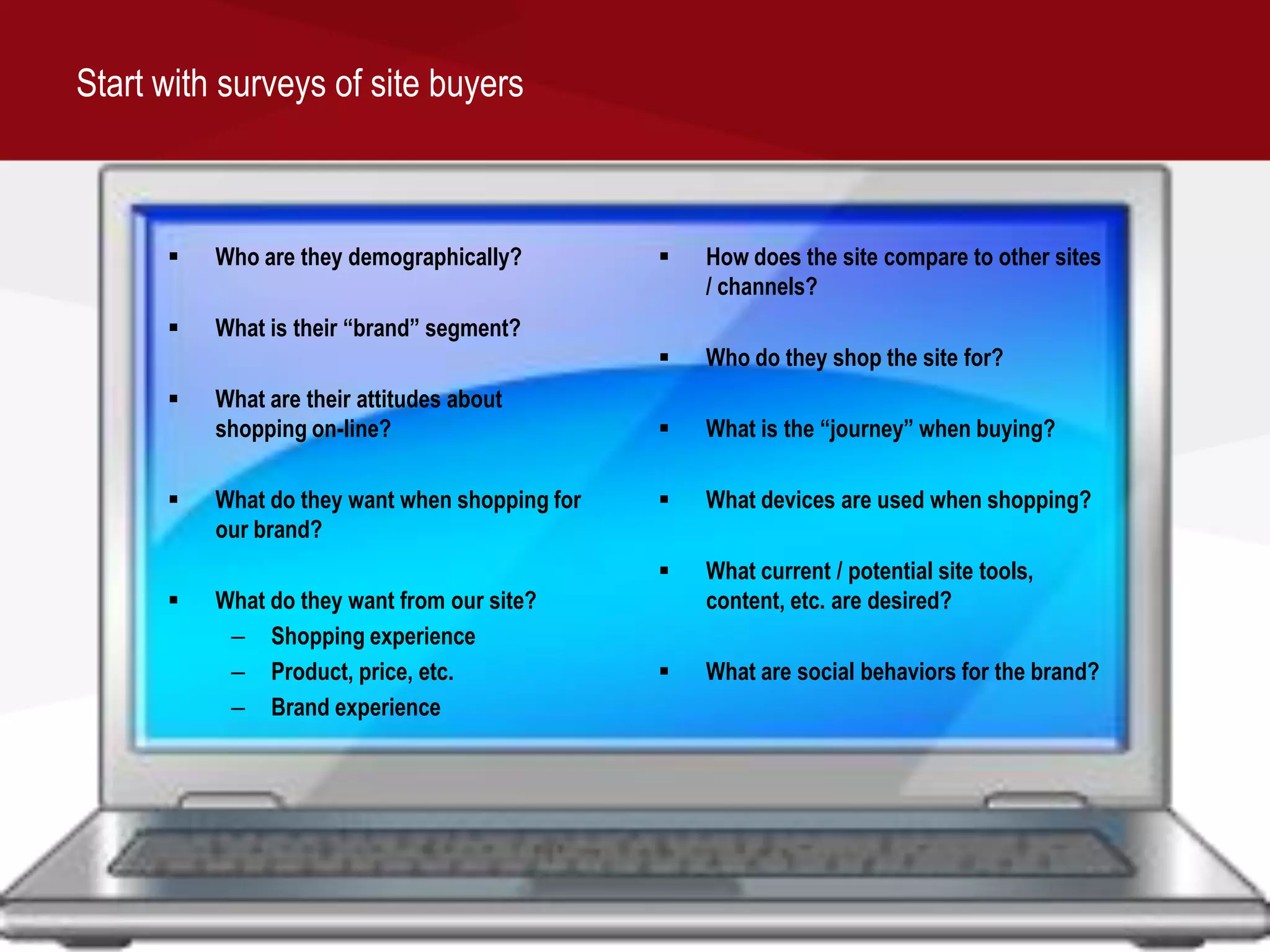

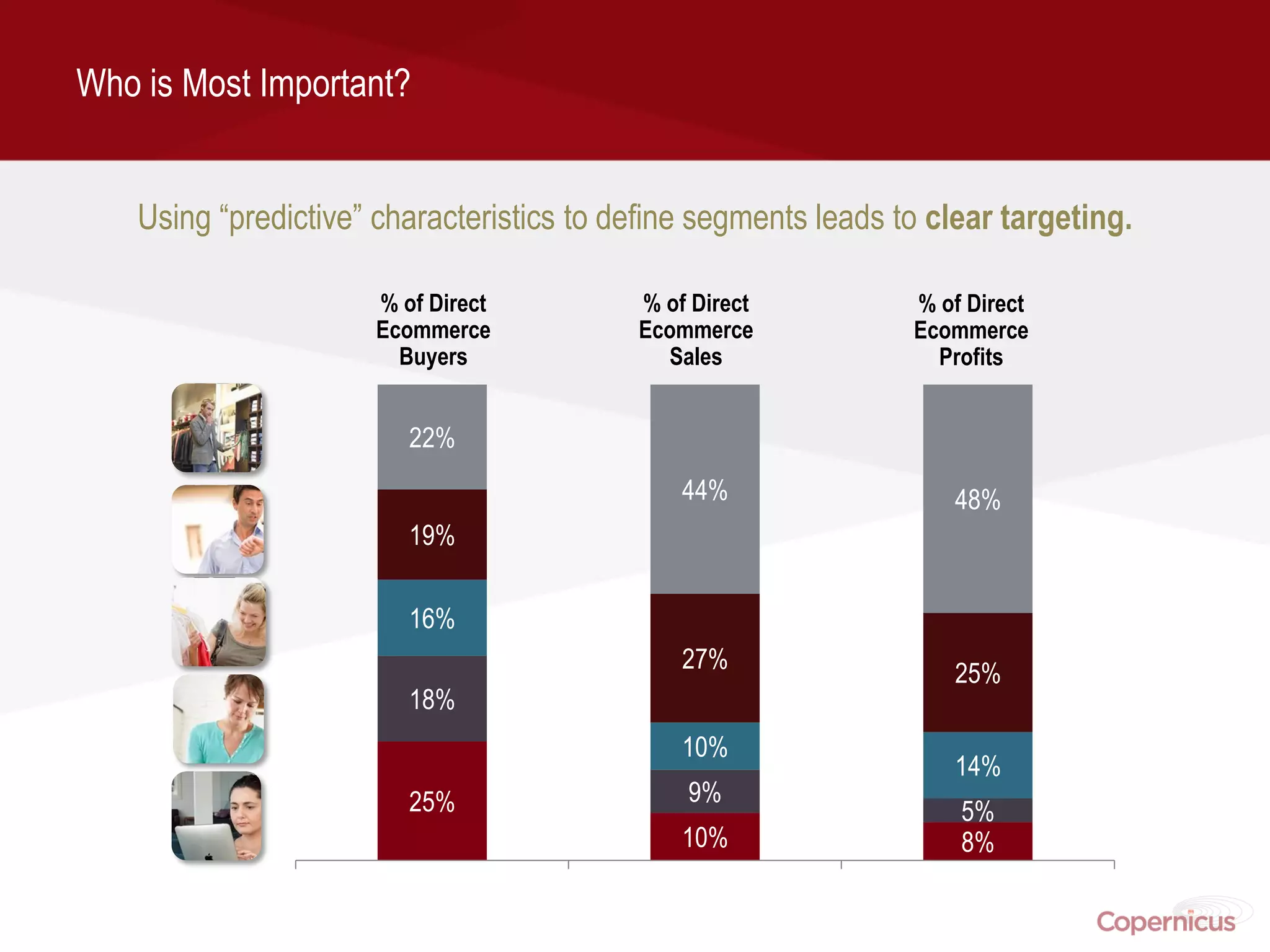

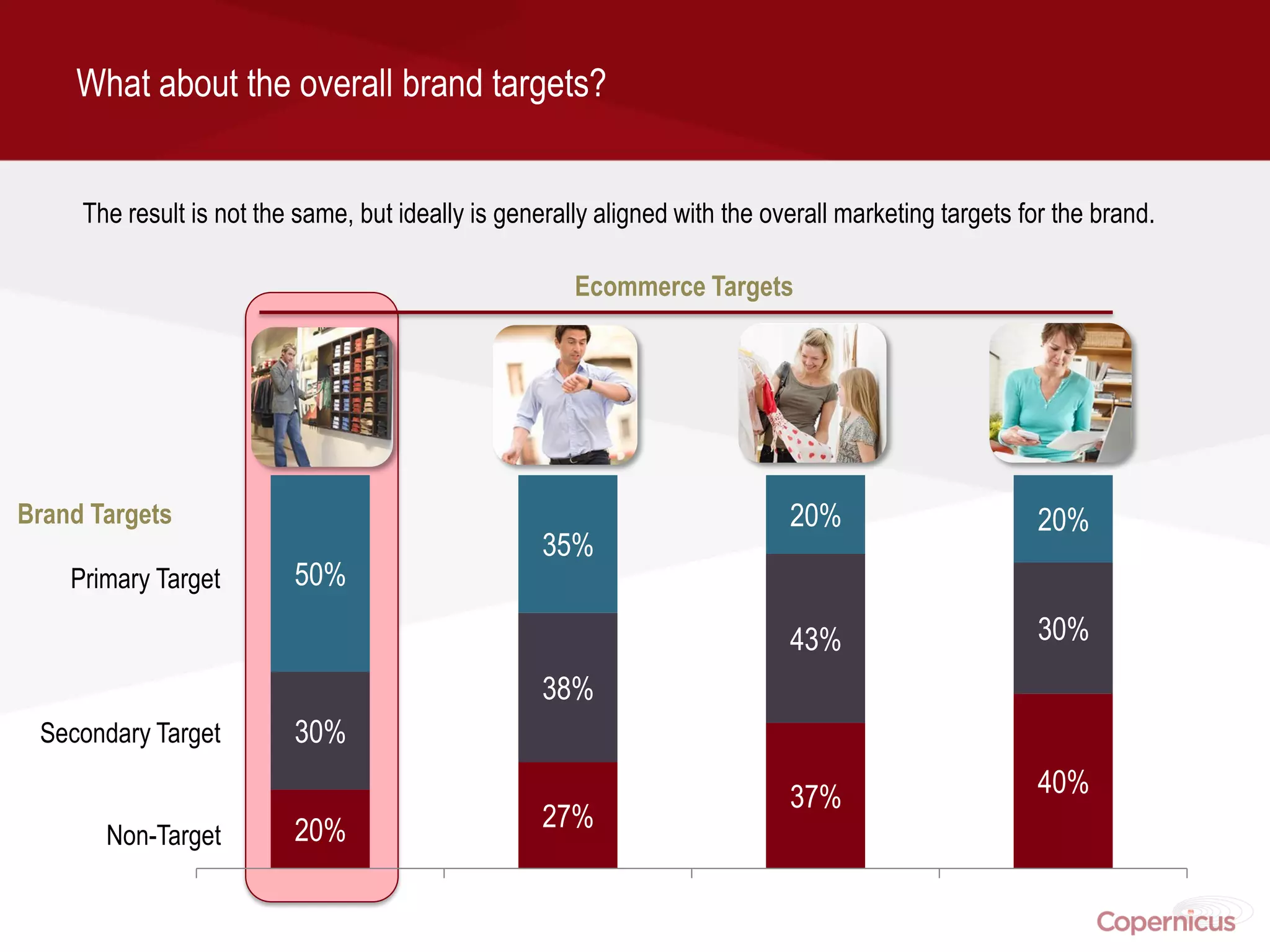

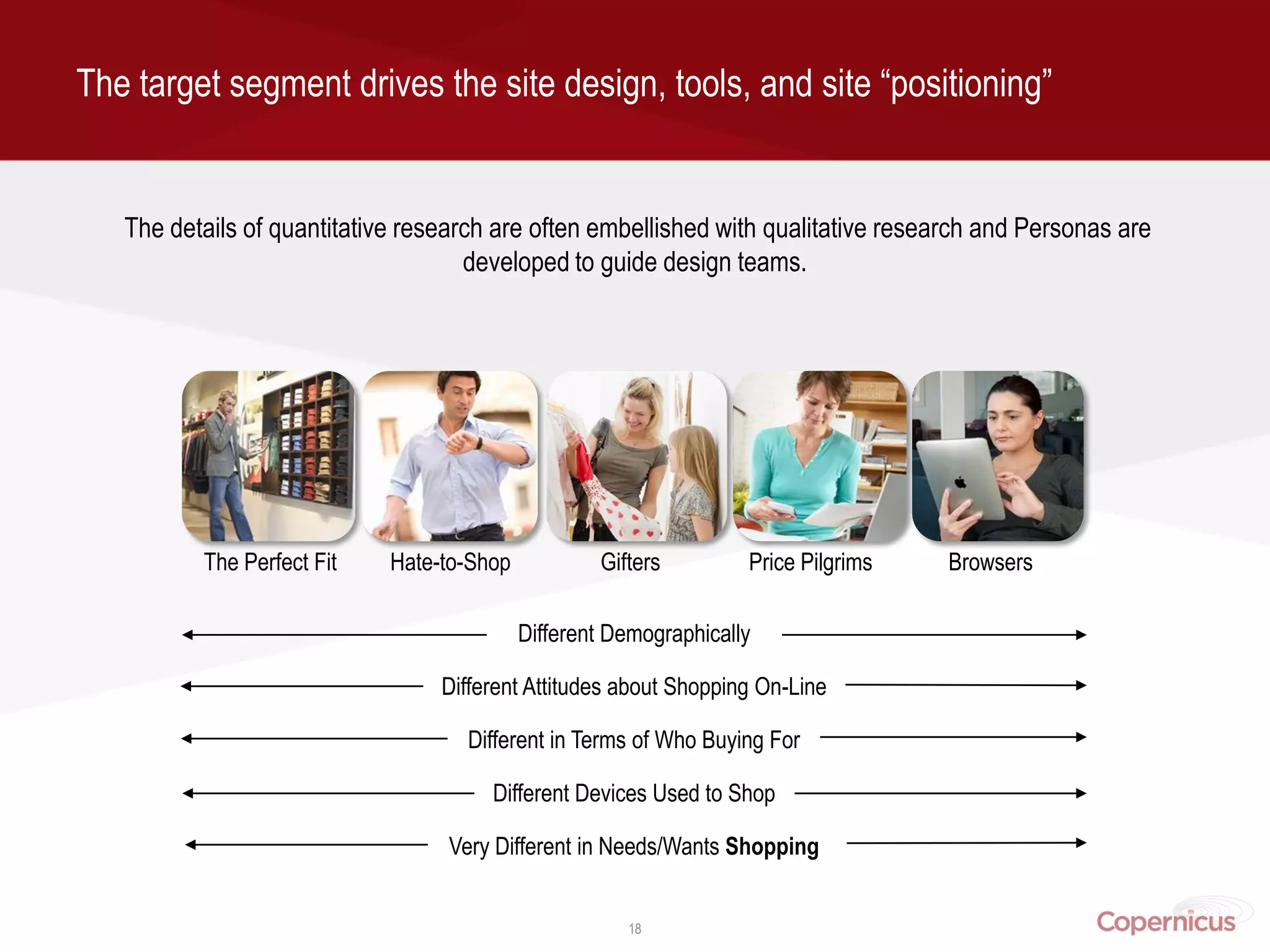

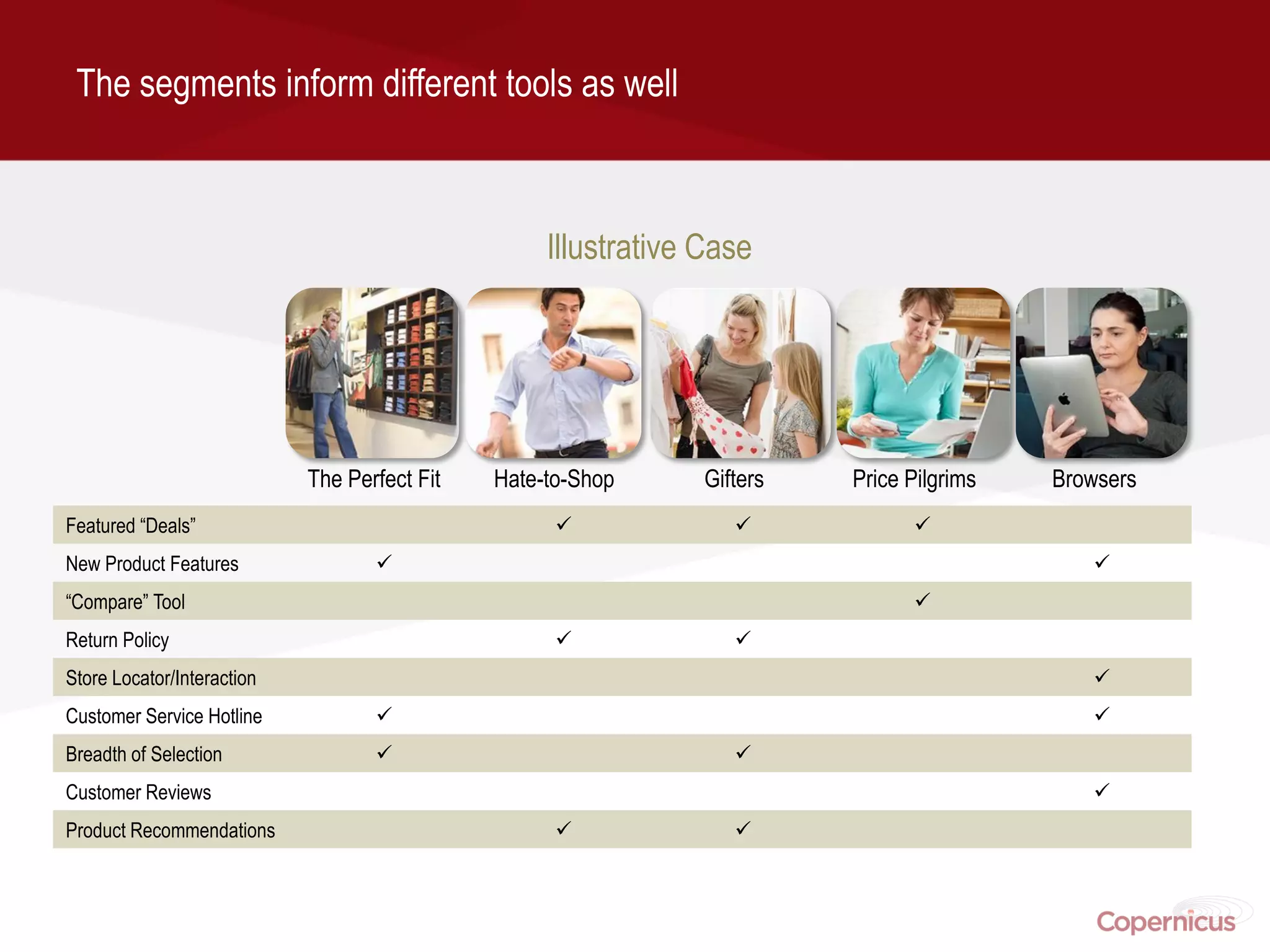

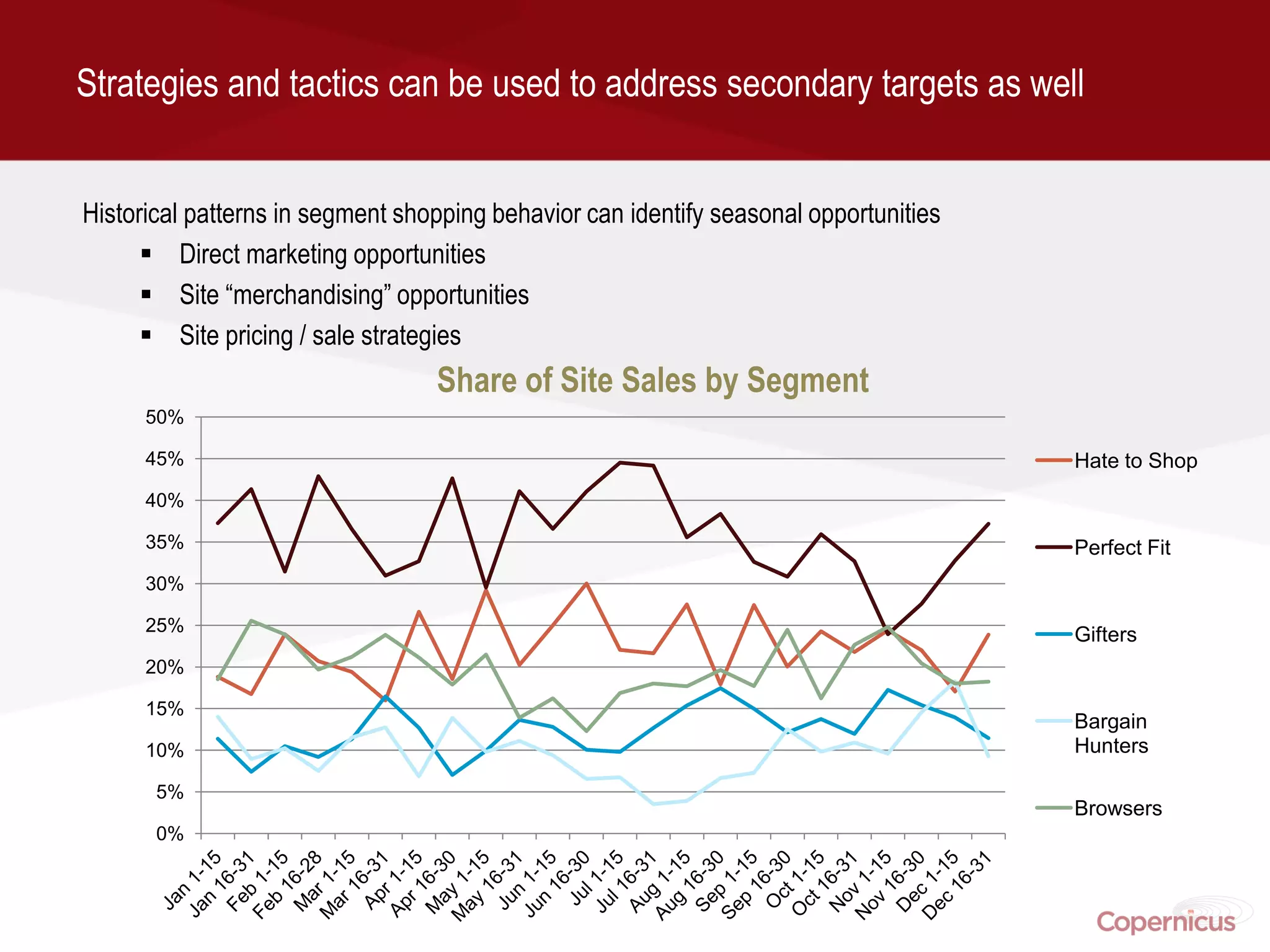

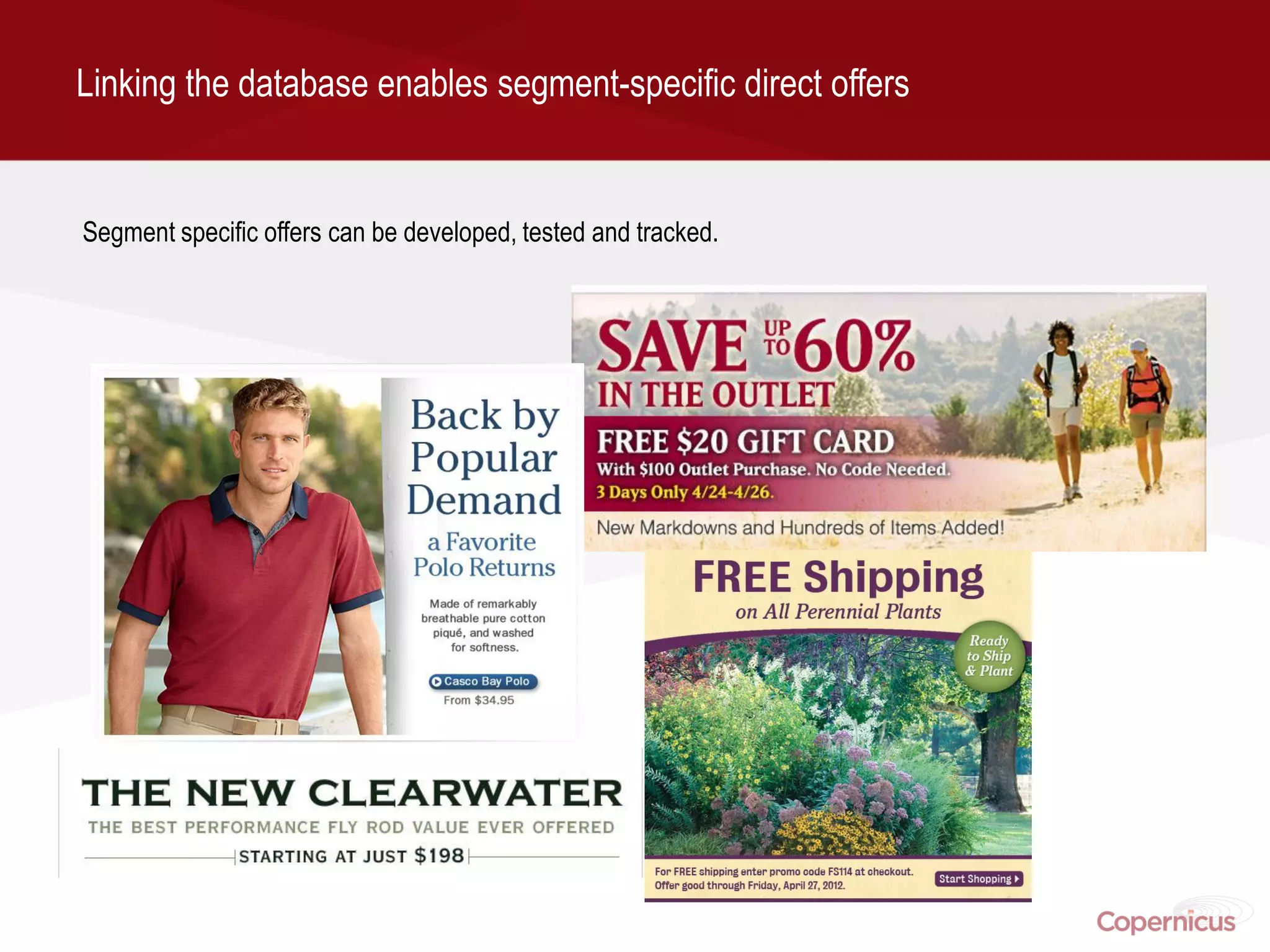

This document discusses using shopper typologies and segmentation to inform ecommerce strategies and website design. It recommends conducting surveys of website buyers to understand who they are demographically, their attitudes, shopping behaviors, and needs. The results can be used to identify the most important and profitable customer segments for the website. These key segments then drive decisions around the website tone, architecture, tools, content, and merchandising to best meet the needs of the primary target segments. Qualitative research with personas helps illustrate differences between segments to guide design. The overall goal is to align the website and digital strategy with the most valuable shopper types.