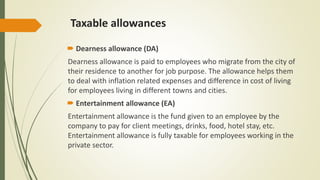

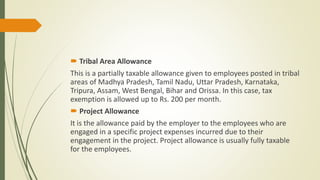

An allowance is additional compensation provided by an employer beyond a employee's regular salary. Allowances can be categorized as taxable, non-taxable, or partially taxable. Taxable allowances include dearness allowance, entertainment allowance, project allowance, and overtime allowance. Partially taxable allowances include house rent allowance, medical allowance, conveyance allowance, education allowances, and hostel expenditure allowance. Non-taxable allowances are those provided to government employees serving abroad, judges of the Supreme Court, and employees of the United Nations.