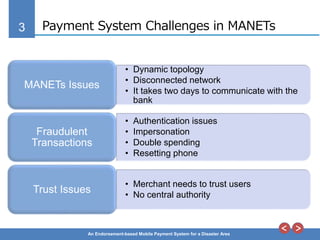

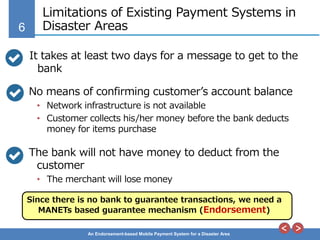

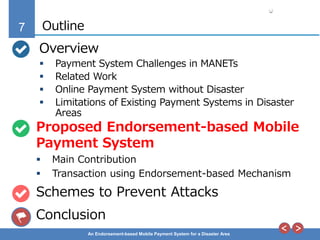

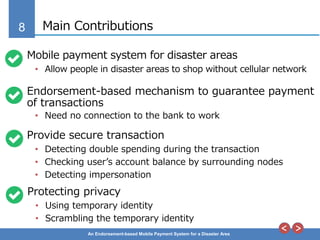

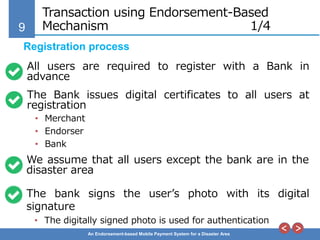

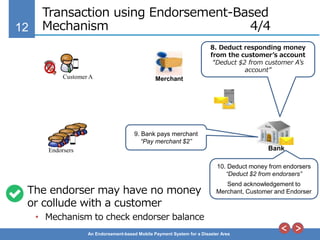

The document proposes an endorsement-based mobile payment system for disaster areas that does not require network infrastructure. In the proposed system, transactions are guaranteed through endorsements from surrounding nodes rather than connection to a bank. The system aims to address challenges like dynamic topology, double spending, and lack of central authority through an endorsement mechanism, event chains to validate transactions, and assigning endorsers to customers. The system is designed to enable secure mobile payments in disaster scenarios where traditional banking infrastructure is unavailable.

![4

An Endorsement-based Mobile Payment System for a Disaster Area

Related Work

Many researches have been conducted on payment

systems

Decentralized electronic cash with no central control [1]

Privacy of users [1]

Reducing computational overheads [2]

[1] S. Nakamoto, Bitcoin: A peer-to-peer electronic system, 2008.

[2] Z. Hu, and Y. Liu and X. Hu and J. Li: "Anonymous micropayments authentication (AMA) in mobile data

network", INFOCOM 2004.

Most of the existing payment systems require

communication infrastructure](https://image.slidesharecdn.com/aina2015-150324035850-conversion-gate01/85/An-Endorsement-Based-Mobile-Payment-System-for-A-Disaster-Area-4-320.jpg)

![24

An Endorsement-based Mobile Payment System for a Disaster Area

Babatunde Ojetunde, Naoki Shibata, Juntao Gao, and Minoru

Ito : An Endorsement Based Mobile Payment System for A

Disaster Area, in Proc. of The 29th IEEE International

Conference on Advanced Information Networking and

Applications (AINA-2015) , pp.482-489, Mar. 2015.

DOI:10.1109/AINA.2015.225

[ PDF ]](https://image.slidesharecdn.com/aina2015-150324035850-conversion-gate01/85/An-Endorsement-Based-Mobile-Payment-System-for-A-Disaster-Area-24-320.jpg)