The document discusses key concepts in agribusiness management including:

1. The concept of agribusiness management covers scope, functions, tasks, organization, and marketing, financial, operations, and human resource management.

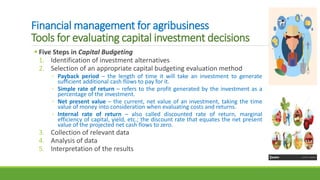

2. Financial management for agribusiness involves understanding financial statements, analyzing statements, and tools for evaluating operating and capital investment decisions.

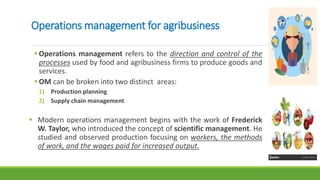

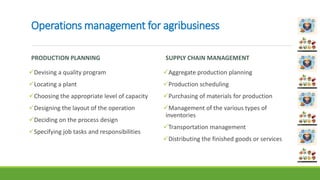

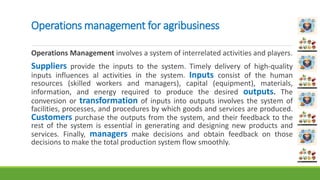

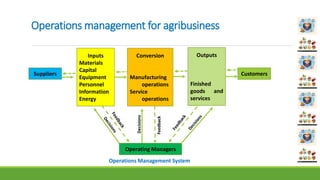

3. Operations management for agribusiness includes production planning and supply chain management functions.

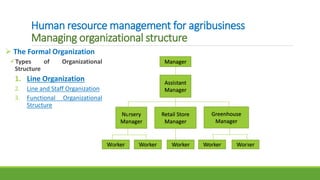

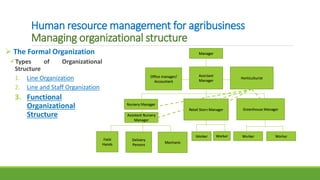

4. Human resource management covers managing organizational structure through principles of organization and different structural types.