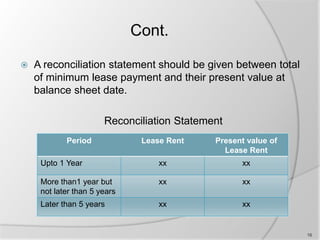

This document summarizes the key aspects of Accounting Standard (AS) 19 regarding the accounting treatment of leases. It defines leases and the different types of leases - operating and finance leases. For finance leases, it outlines that the asset and liability should be recorded on the lessee's balance sheet. For operating leases, the lease payments should be recorded as expenses. It also discusses the accounting treatment for sale and leaseback transactions, required disclosures for lessees and lessors, and the differences between AS 19 and IND AS 17 regarding leases.