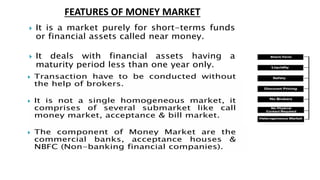

This document discusses different types of financial markets based on various classifications. It describes money markets, which deal in short-term securities with maturities less than one year, and capital markets, which trade long-term securities over one year. Money markets are highly organized and dominated by banks. Capital markets help mobilize savings, fuel economic growth, and provide investment opportunities. The document also covers primary and secondary markets, cash/spot versus forward/futures markets, and exchange-based versus over-the-counter markets. In conclusion, it states that financial markets play a crucial role in allocating resources, though they involve risk if not handled strategically.